Jing Daily’s Top Posts for the Week

In case you missed them the first time around, here are some of Jing Daily’s top posts for the week of October 3-7.

Chinese Artists Soar, Japanese & Korean Artists Sag, At Sotheby's Contemporary Asian Art Auction

Following the successful run of the second and final portion of the Ullens collection of Chinese contemporary art at Sotheby’s in Hong Kong this past weekend, the British auction giant’s Contemporary Asian Art auction on October 3 again saw energetic bidding by Chinese and other Asian collectors, finally achieving total sales of HK$227 million (US$29 million). Despite disappointing bidding for works by Japanese and Korean artists, Chinese buying pushed this auction to the highest total for a various-owner sale in this category for Sotheby’s Hong Kong. Driven primarily by Chinese demand for blue-chip works by top Chinese artists, the sale bested pre-sale estimates by HK$28 million (US$4 million).

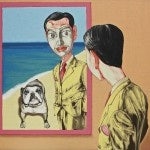

As expected, increasingly savvy Chinese buyers homed in on top-quality works by blue-chip Chinese artists. The top lot of the sale — Zhang Xiaogang’s “Bloodline: Big Family No.1″ — beat high estimates, going for HK$65.6 million (US$8.4 million), reaching the second-highest price for the artist at auction and achieving a record for Zhang’s trademark “Bloodline Series.” This puts “Big Family No. 1″ right behind Zhang’s earlier work “Forever Lasting Love” (1998), which sold for a record-breaking HK$79 million (US$10.1 million) at Sotheby’s Hong Kong this spring, more than double its high estimate.

Interview: Warrior Shoes Renovator Ye Shumeng#

Who would have expected Ye Shumeng (叶书萌), a design student from Helsinki, to become one of the greatest proponents of bringing back “Made in China” classics? What started out for Ye as a personal interest has ignited a movement in the world of Chinese-made sneakers, bringing vintage style into the international spotlight (and attracting new investment). Ye’s interest in Warrior (Huili 回力) shoes led to her documentation of the lingering presence of Warrior shoes in China over the last half century, often led by economical convenience or simply romantic nostalgia. The result was a godsend to the waning brand; not only did it catch the attention of foreign investors, intent on reviving the brand, but Warrior shoes quickly found their way into many international and domestic hipsters’ closets.

This time, Ye has proven to outdone herself once again. Her recent efforts at the Nouveau Riche pop-up store in Sanlitun have once again redefined the conceptual status quo of Chinese consumption.

In our interview with Ye, Jing Daily discussed the gradually changing views on Chinese brands in the West and got some of Ye’s perspective on the future of the Made-in-China fashion.

What's New Zealand Doing Wrong In China?#

Jing Daily wrote last year, New Zealand real estate agents looked to Chinese HNWIs to pick up the slack for anemic demand from local investors. With Western brands continuing their China expansion efforts, everyone from wine producers to lamb farmers in New Zealand has also looked to position their products in the Chinese luxury segment. But as Xinhua writes this week, New Zealand expectations and Chinese consumer education show a yawning gap, which provides an interesting case study in the way countries can and should market themselves in China. Is it always best to market products solely at the elite, or is a more mass-market approach a more sure-fire bet for long-term profit?

High Costs May Dampen Golden Week Tourism In Hong Kong?#

Hong Kong retailers have come to rely on an influx of mainland Chinese tourist-shoppers during Golden Week, the twice-yearly festival. As Jing Daily wrote last year, Golden Week has become a critical time for high-end brands, auction houses and wine merchants in the city, so retail observers around the world will likely be watching closely. According to estimates by the Hong Kong Tourism Board, about 700,000 mainland visitors are expected to spend in the city this week, an increase of 10 percent from the same period last year. As China Daily writes this week, however, higher accommodation costs may put a crimp on revenue this fall.

Hong Kong has been a major luxury destination for mainland visitors, but as a spokesperson from the Ministry of Commerce announced in June, the import luxury duty on the mainland will be cut by 2 percent to 15 percent. If this is true, it may elapse Hong Kong’s role as the luxury shopping center to mainland shoppers if they can buy luxury at a lower price at home. So it might be wiser for business people in Hong Kong to think creatively to attract visitors from mainland rather than scare them away by adding extra service premiums.

Sales Success At Second Ullens Auction In Hong Kong#

Sotheby’s saw spirited bidding for top-quality works today at the second installment of the Ullens Collection auctions in Hong Kong. Holding the sale in a packed house populated by dozens of mainland Chinese, alongside local buyers and dealers, Sotheby’s saw opening bids for some lots open far beyond their low estimates due to the sheer amount of bidders. At times, Jing Daily observed bid increments skyrocket from HK$2.2 million to HK$3.5 million to HK$4.5 million, generally for rare pieces like Ding Yi’s “Appearance of Crosses 2001.8 (triptych),” which eventually sold for HK$5.4 million (US$693,000), nearly four times its low estimate.

With phone bidding noticeably more energetic than at other recent auctions, buyers at the second Ullens auction were highly competitive for the renowned Belgian collector’s blue-chip works. While this auction had more second-tier works than the first installment, bidding for top artists like Liu Ye, Zeng Fanzhi and Wang Keping was at times ferocious. Liu Ye’s “Portrait of Qi Baishi” from 1996, estimated between HK$7-9 million, eventually sold for HK$12 million (US$1.5 million), while Yu Youhan’s “Chairman Mao Celebrating His Birthday” sold for an impressive HK$4.6 million, well above its pre-sale high estimate of HK$1.5 million.