Lamborghini, Lafite, Louis Vuitton Seeing Sustained Demand Among Chinese Elite#

Shanghai Auto Show: Lamborghini Gallardo LP 550-2 Tricolore (Image: CarNewsChina.com )

After a couple of years of doing the heavy lifting, this year China won't be the only country fueling growth in the global luxury business. According to a newly released report by Bain & Co., stronger first quarter momentum in the US and Europe -- along with steadily increasing growth in China -- as well as emerging markets like Russia, Brazil and the Middle East, should see the luxury industry grow eight percent this year to US$270 billion. The study goes on to note that the rapid increase in the number of wealthy Chinese should see even more new store openings, but points out one very important trend that Jing Daily has previously profiled: mainland Chinese luxury consumers are getting much more sophisticated and demanding.

At the same time that major luxury brands need to figure out how better to appeal to these more discriminating shoppers in an increasingly crowded high-end market, these brands (and the market researchers who follow them) also want to figure out what exactly it is that drives purchasing behavior in China. However, this week a somewhat tongue-in-cheek article from the Beijing News claims to have cracked the case. What do seemingly disparate brands like Lamborghini, Louis Vuitton, Lafite, Lotus, Louis XIII, Loewe, and Lanvin have in common? The letter L.

While the article doesn't get into what could have caused China's seeming love affair with all things "L for Luxury," it could have something to do with the early entry (and quick dominance) of Louis Vuitton in the mainland China market. As Jing Daily has previously noted, the cult of Louis Vuitton is continuously expanding among China's aspirational class, with the French luxury spending the last several years delving into comparatively untapped second- and third-tier cities. In a recent Bain & Co. luxury survey, 46 percent of Chinese respondents ranked Louis Vuitton as their most desired luxury brand, making it, by Bain's estimation, tops in China.

Fellow "L" brand Lamborghini recently chose the Shanghai International Auto Show for the worldwide debut of its new Gallardo LP 550-2 Tricolore. With only 150 available globally -- and wealthy Chinese car owners mad for limited-edition models -- Lamborghini received several orders for the 5 million yuan (US$770,000) supercars right there on the auto show floor. As Lamborghini executives remarked, the company is optimistic that China will soon surpass the U.S. to become Lamborghini's largest single market. As Jing Daily has previously written, Lamborghini is pulling out all the stops to compete with rivals who are more established in China, particularly Ferrari and Porsche, and last year announced it would introduce eight more models to the China market. Let's just hope more of these eye-wateringly expensive cars that the company plans to sell in China don't end up destroyed by sledgehammer-wielding men on the street.

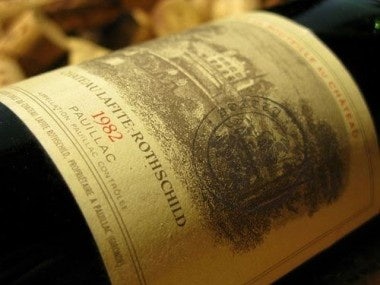

Chinese buyers have had a long-time love affair with 1982 Chateau Lafite

Among premium wine brands in China (first in Hong Kong and now in the mainland), Bordeaux winemaker Chateau Lafite has long reigned supreme. Last year, a Chinese buyer tossed down a whopping US$715,000 for three bottles of 1869 Lafite at auction in Hong Kong at a sale in which a set of three bottles sold for $232,000. All this for a wine that retails for anywhere from $5,000-6,500 in Europe. As we wrote in the wake of the jaw-dropping Hong Kong auction:

Anybody who follows the wine industry in China is well aware of the explosion in demand for Bordeaux, and more specifically Château Lafite among Chinese collectors, businesspeople, and budding wine aficionados. The strong demand for Bordeaux in China has not only seen prices for top bottles skyrocket at auctions in Hong Kong or at wine stores throughout the mainland, it’s sent shockwaves through the global wine market, particularly for Château Lafite.

The "L" phenomenon isn't limited only to these "super-brands," however. To name a few, brands like Lancôme, La Mer, Longines and Lacoste have also seen considerable success among mainland Chinese consumers. So is it just a coincidence? Probably. But even if it's not a simple coincidence, it could be a fad. As Chinese consumers become more brand-savvy and sophisticated, competition in the China market will no longer just be about "names," but will fall back on the things important to consumers in other, more mature markets: quality, value, brand experience, customer service, and pedigree.