Key Takeaways:#

Xiaohongshu/Little Red Book, the social media app famous for displaying ostentatious lifestyles, has recently updated its guidelines as a way to restrain its users from overtly showing off their wealth.

Years of development on social media has proven that bragging content does entertain a certain number of fans while encouraging them to spend.

In 2020 and early 2021, Douyin punished thousands of accounts for flaunting wealth in short videos on its portal, removing over 2,800 posts and punishing around 4,000 accounts.

Xiaohongshu/Little Red Book, the e-commerce app famous for displaying ostentatious lifestyles, has recently updated its guidelines as a way to restrain its users from overtly showing off their wealth. Meanwhile, the platform will set a limit to luxury ad exposure and sponsored content. With China instilling a new policy to reduce online wealth-bragging behavior, social platforms that feature lavish lifestyle content might need to rethink their content objectives.

In May, China’s Cyberspace Administration announced a series of policies meant to manage the country’s online environment. The agency vowed to clean up virtual “wealth flaunting” via strict and specific measures, such as blacklist filtering, rigorous content checks, and flagged content categorization. Additionally, online publishers will need to have government-approved credentials before publishing on a wide range of subjects.

Luxury brands will need to know how the administration is tagging wealth-flaunting content amid its cleanup campaign. As per the regulations, blogs, livestreaming, articles, and videos displaying opulent or kitsch lifestyles on social media will be defined as "flexing" content. For example, simply showing the POS receipts of ultra-expensive luxuries without any appropriate context is a no-no. Also, fake rich lifestyle content is banned because it “misleads netizens and harasses regular marketing activities in a tacky way.” Moreover, luxury-sponsored content on livestreams and short-form video portals can easily blend with wealth-flaunting influencer behavior. The policy requires platforms to keep watch and filter such content themselves regularly.

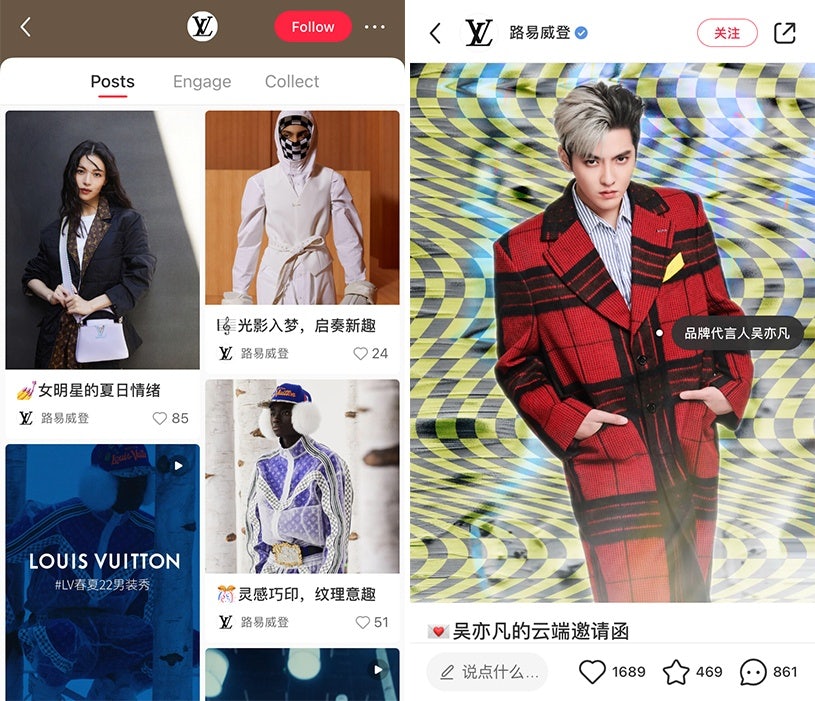

The extravagant lifestyles of influencers on social media like Xiaohongshu and Douyin have attracted many followers who depend on such venues for luxury education. Social media channels are a practical solution for most luxury brands wanting to reach Chinese luxury consumers. Louis Vuitton, for instance, opened its first Chinese social media account on Xionghongshu — not e-commerce giants Tmall.com or JD.com — to gain more web traffic. Most of the platform's users are Gen Zers and millennials, who have more purchasing power and influence than their older generations. Instead of buying tangible bags, shoes, and garments at stores, many young digital natives use social media to reach higher levels of self-satisfaction and gain more social currency.

Years of development on social media has proven that bragging content does entertain a certain number of fans while encouraging them to spend. But China's new policy focuses on delineating the boundary between sharing and bragging or guidance versus trickery. Since the government wants to see its people faring well on social media, the crackdown isn't an attempt to cripple e-commerce growth. According to the director of China’s Cyberspace Administration, they will be supervising content that endangers mental health, breaks with common social practices, preaches wealth hatred, and promotes money worship.

Xiaohongshu listed several types of content that fall into the banned categories. “Those videos deliberately displaying large amounts of luxury bags and promoting ‘money worship’ will be banned," said He Tong, who is in charge of the project operation at Xiaohongshu. "And content featuring negative signals or private flexing information will also be filtered. In all, luxury co-op content helping others to live a better life could get good publicity on Xiaohongshu.”

In 2020 and early 2021, similar actions were taken by Douyin, which punished thousands of accounts for flaunting wealth in short videos on its portal. According to ByteDance (Douyin and TikTok’s mother company), it had removed over 2,800 such posts and punished around 4,000 accounts. Videos promoting “fake elite lifestyles” and those ridiculing “lower class” people have been banned permanently.

“It’s not practical to apply one general standard to all content,” said Michael Chang, the digital marketing director at a local fashion agency in Beijing. “The content creation is personal sometimes. What we need to do is to educate followers on what is cool about luxuries and build a cyber-community that transmits knowledge, positive information, useful tips, and a healthy lifestyle.”

So, is social media still the ideal solution for luxury brands that want to connect with Chinese customers? The traditional use of social media is outdated in China. While many brands found themselves marketing through the local social media ecosystem, simply posting pictures of luxury items and collaborating with celebrities is no longer good enough. Under China's new anti-flaunting stance, luxury brands will have to find new ways of presenting themselves within the fundamental laws of social media: sharing candidly and keeping it real.