Value Retail's nine villages in Europe and two in China are the holy grail for deal-seeking Chinese luxury shoppers, who are responsible for 25 percent of luxury spending around the globe. A startling 60 percent of Chinese visitors to the United Kingdom visit Value Retail's London location.

Founded in 1992, Value Retail says it prides itself on having its pulse on Chinese consumers' preferences, and offering an experience that shoppers can’t substitute online. It will shortly rebrand its 11 villages from Chic Outlet Shopping to The Bicester Village Shopping Collection.

Jing Daily sat down with the Founder and Chairman of Value Retail, Scott Malkin, to discuss the rebranding, the value of an offline experience in an increasingly online world, and the ever-evolving global Chinese consumer.

Value retail has nine villages in Europe and two in China. What proportion of sales comes from Chinese visitors?#

Last year it was half a billion dollars, and this year we are hoping to get to as much as one billion dollars. That number is the combination of Chinese visitors in Western Europe and those in the Shanghai and Suzhou villages.

Right now I would say that about 20-25 percent of our spending across the globe is coming from Chinese visitors. This year we will have over 40 million visiting our Villages in foot traffic.

Luxury brands are increasingly partnering with e-commerce stores in China. Will there still be a role for outlet malls in an increasingly digital market?#

Brands realize today they must be omnichannel — they must sell at all touch points in the retail infrastructure. But we are not retailing directly, so we don’t sell online. We are online to invite our guests and to communicate the right messages for the brands who are with us.

We must understand very well the way technology is influencing brands as they adapt, because being omnichannel already means that tomorrow will be different from today. Why is Amazon buying Whole Foods? Why is Alibaba buying grocery stores? It’s a combination of links to the customer at all levels —that’s the omnichannel part — access to customer data, and the way that the customer spends.

But we all want some experiences that are not technological. We want some that are human. That’s how we are programmed genetically, every one of us. The important question becomes which experiences are memorable? We are always thinking of ways to further diversify the guest experience in-Village and throughout the customer journey to ensure their time with us is enjoyable, exciting and offers something new every time they visit.

You connect with Chinese consumers both at home and abroad. What are the differences between who they are and how they shop in different villages?#

The guests are either visiting from China or returning to China and looking for gifts. The guest who is living in London, Munich, Milan, or Frankfurt is shopping more for personal consumption, probably buying fewer, maybe more sophisticated items, because when you're there you can evaluate the fit and the comfort. Clothing is less natural for gifts, which are mostly accessories.

Among Chinese guests living in China or internationally, the subtlety of fashion is understood. Chinese consumers are very mature now. It may be used to be about showing off a purchase, but now it’s about knowing what’s special and why. They are becoming more knowledgeable about international trends because of the research they’ve done online.

Many brands have found that Chinese millennials are driving much of their sales. What is the breakdown by age of Chinese consumers at Value Retail?#

Our core audience responds to the trends that are represented by millennial behavior, but our core audience is not millennials, for the very simple reason that our price points for these goods are very high. Millennial consumers typically don’t have the budget for these higher price points even though, because it’s surplus merchandise, we have outlet pricing.

A consumer who comes to us should leave loving the brand and being a full price consumer as well. The main thing we can do is introduce brands and create relationships. That’s the human part. It doesn’t happen online.

Our core consumer is 35-50 years old. She is building a meaningful wardrobe. She is not only looking for quick trends but enduring qualities, and for a relationship with a brand that is more permanent.

Why are you rebranding as Bicester Village?#

There are three components of The upcoming Bicester Village Shopping Collection. The first part is Bicester Village. Bicester is an identity that’s known around the world. It is very much the symbol of what we are doing everywhere. In fact, we say the Shanghai Village is the Bicester Village of Asia.

Then the second part — shopping. Because we are moving from outlet shopping to just shopping, we are delivering a shopping experience that’s very high quality. It happens to have outlet products as part of its appeal, but it’s not primarily about outlet shopping.

And then the collection has a network effect with the way word of mouth spreads about what’s interesting, new trends, how customers refer a product.

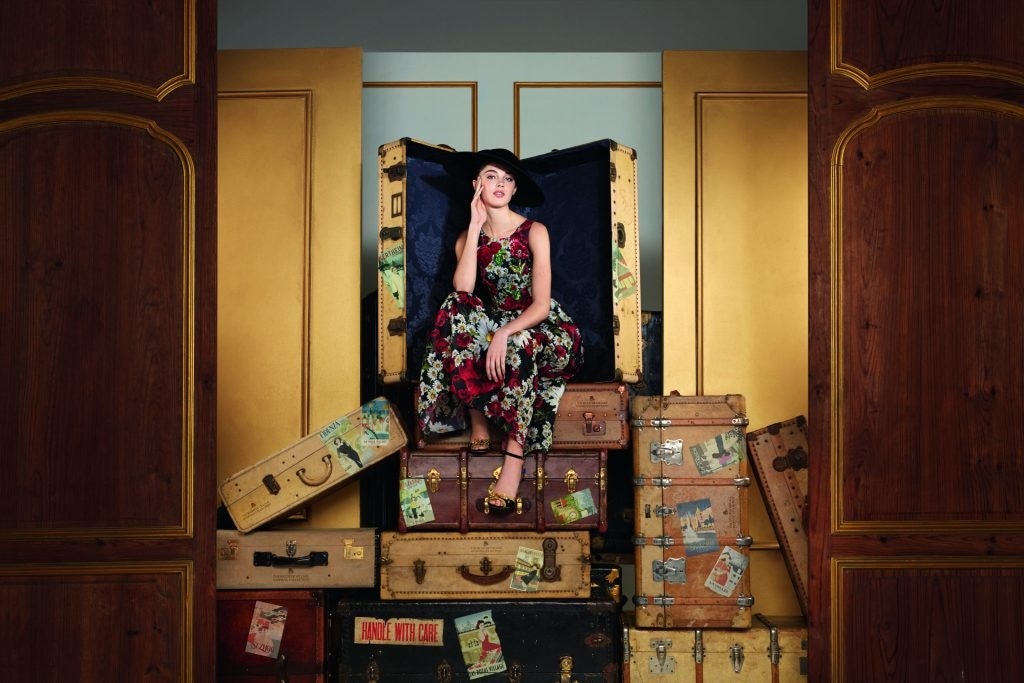

Our network is about a certain kind of traveler who we call the traveling luxury consumer. She is a global traveler, she is brand aware, very knowledgeable, and she is shopping for pleasure. As things become ever easier to enjoy online, we celebrate the fact that no matter how good the experience online can be, the satisfaction and enjoyment can never be the same as the great physical experience.