Trust In Product Authenticity, Quality, And Origin Are Underpinning Motives For Overseas Shopping#

As Beijing continues its campaign against official public luxury spending, passing new edicts on luxury advertising and generally pushing for national frugality, Chinese shoppers are still heading up and out to spend on high-end toys further afield. As Jing Daily previously noted, according to one survey Chinese consumers spent a relatively spare US$830 million on luxury items domestically during the recent Lunar New Year holiday, a 53 percent drop from last year’s spending spree, but a whopping $8.5 billion overseas, an 18 percent increase year-on-year.

As the Financial Times notes this week, a recent executive summary by FT China Confidential on outbound Chinese shoppers highlights particularities about this free-spending contingent that -- while not exactly new -- are certainly important. According to the FT, “China’s middle class affinity with overseas travel is set to burgeon in 2013, with the wealthiest 26% of outbound tourists spending an average of RMB43,770 (US$7,032) on each trip – for a total spend of $160bn.”

The top international destinations for Chinese tourists in the next 12 months are unsurprisingly led by France, followed by the United Kingdom, Italy, Germany, Hong Kong, Japan, the US, Singapore, South Korea, and Switzerland. In France, Chanel, Dior and Louis Vuitton reign as the top three most popular brands among Chinese shoppers, whereas in the US, Gucci replaces Louis Vuitton as third most popular.

For cosmetics and perfume, Estée Lauder takes first in the top ten purchased brands by outbound Chinese tourists, followed by Lancôme and Chanel.

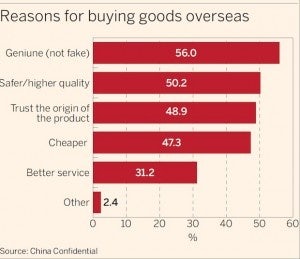

What is most interesting to us, however, is the incentives that are luring Chinese shoppers away from the homeland and into foreign markets. While price considerations have typically been considered the key driver of overseas luxury spending, as Chinese consumers have long been burdened by stiff import taxes on luxury items, the FT study finds that trust in product authenticity, quality, and origin are underpinning motives for overseas shopping, trumping price and service. If these statistics prove to be true, then luxury brands in China may want to divert their energies towards further promoting authenticity and origin within the China market as well, enticing more shoppers to stay closer to home despite higher prices.