What happened?

The social media video app, owned by China’s tech giant ByteDance, just announced plans to speed up its small store global expansion into 12 new countries, including Brazil, Australia, Italy, France, Spain and New Zealand.

TikTok’s e-commerce engine earned a total of 208 billion (1.41 trillion RMB) in 2022, rising 76 percent from the previous year. More than 30,000 influencers and 60,000 stores have broadcast over 2.7 million hours of commercial content promoting their wares, garnering 1.3 billion user interactions, according to TikTok’s year-end report. The report also reveals that the Gross Merchandise Value (GMV) of its international cross-border business grew 136 percent last year, with the social media app setting a new GMV goal of 23 billion for 2023.

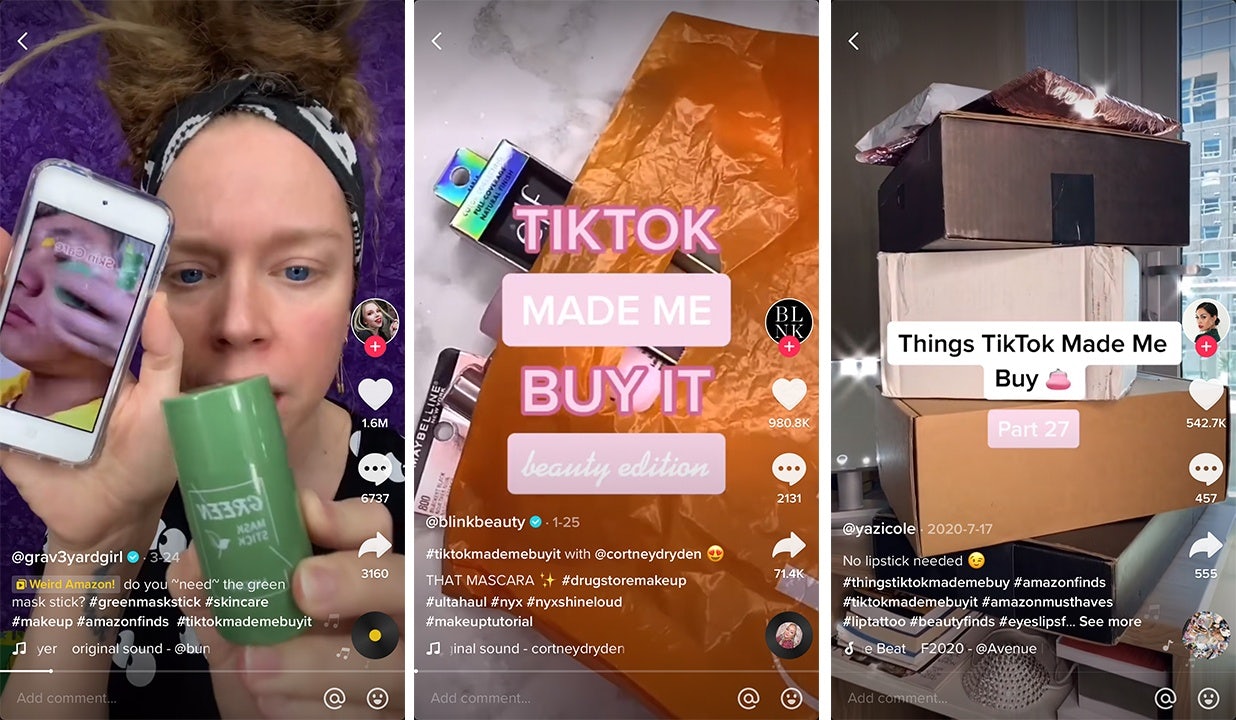

The Jing Take Known for its viral user-generated short videos and livestreams, the app

already boasts enormous global traffic and a user base of over 1 billion. But apart from user-generated videos, its rapidly growing e-commerce arm has already made inroads in the UK and Asia. This newly announced expansion, billed to start after Lunar New Year, is likely to further supercharge growth and boost cross-border sales.

As 12 more economies will be brought into TikTok’s sales ecosystem, this presents an opportunity for brands to connect with younger consumers in a fresh, fast and engaging way. Will this development echo the explosive trajectory of the globally popular Shein, the controversial low-cost, hyper-fast fashion company based in China? Perhaps most so in high population countries such as Brazil (214.3 million), where TikTok attrition is high and e-commerce has not yet plateaued.

This is not all without contention however, especially in the US. Chinese umbrella company ByteDance owns China’s popular video app Douyin as well as its global counterpart TikTok. As the apps quickly became the preferred social media for Gen Z, there’s been heated debate in the US over TikTok’s popularity — with Donald Trump being one of the most vocal opponents during his presidency. Concerns over mysterious algorithms and the relationship of the parent company with the Chinese government have led to bans by some American organizations (both private and governmental) due to national security risks.

This is unlikely to threaten TikTok’s global dominance anytime soon however; it amassed 1 billion users in just five years, a faster rate than Facebook, Instagram and YouTube, and its growing e-commerce arm is likely to continue capturing the attention of Gen Z and beyond. Since Gen Z will soon drive luxury retail, brands must carefully eye this new development if they don’t want to fall behind the times.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.