Just a few months ago, it looked like the American jewelry mainstay Tiffany & Co. could be in store for a tough end to what’s been an already very challenging year for luxury. The brand’s much-publicized acquisition by LVMH, first announced in late 2019, appeared to fall through in September when the French luxury group sought to break off the deal, kicking off a series of intense negotiations until LVMH ultimately said it would go ahead with the purchase at $131.50 per share. ($3.50 less than previously agreed, valuing the acquisition at $15.8 billion.)

For all of the drama that surrounded the deal, the motivations that drove LVMH to purchase Tiffany in the first place were driven in no small part by the Chinese market. The purchase would allow LVMH to beef up its impressive brand portfolio with a company favored by middle-class and younger consumers, while also expanding its accessible jewelry and timepiece offerings — giving it some competitive advantage against rival Richemont, which is more focused on hard luxury. As Nikkei Asia reported, “For LVMH, buying Tiffany would bolster its watches and jewelry segment, which now generates less than 10% of its total revenue — far less than the likes of the rival Richemont group, whose brands include Cartier.”

As 2020 comes to a close, Asia’s relatively strong consumer recovery — and China’s in particular — is seen as a major factor in LVMH’s decision to complete the deal. The timing of the acquisition couldn’t come at a better time for Tiffany, which is looking to cement its position inside China as its consumers are spending far more domestically with international travel sharply curtailed.

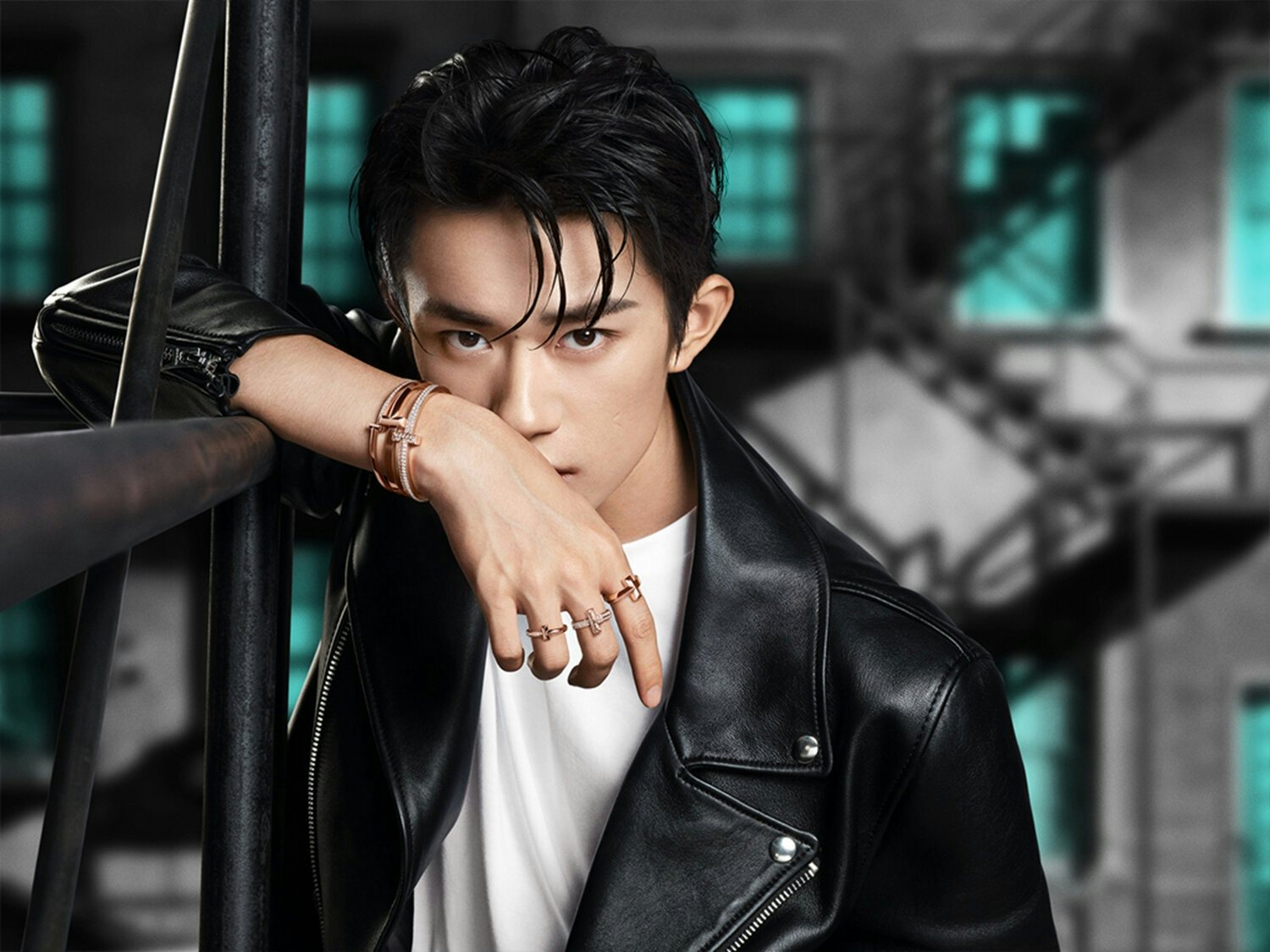

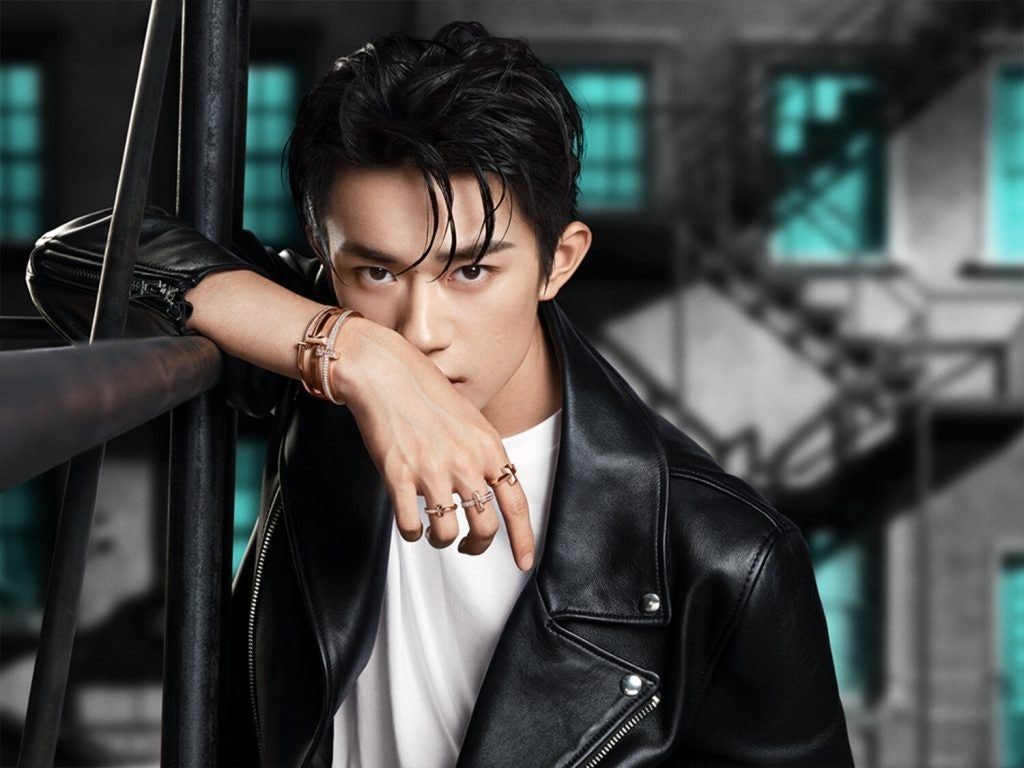

Following years of expansion in the market, both online and offline, what is most interesting about Tiffany’s latest moves in China is the brand’s decision to go all-in on Gen Z, perhaps with the understanding that the brand is already well-known by millennial and older shoppers. This summer, Tiffany announced that it had appointed 19-year-old actor and singer Jackson Yee as the brand ambassador for its Tiffany T collection, giving the brand new visibility among Yee’s vast young fanbase.

Whether it came down to the choice of Yee as a face of the brand, continued domestic shopping, good luck, or smart marketing, Tiffany has certainly fared well in China in recent months. This week, the company reported third-quarter net earnings of $119 million, up from $78.4 million in the same period one year ago, with sales reaching $1.01 billion, down a bit year-on-year but surpassing analysts’ estimates of $972.5 million.

According to Jing Daily, the contrast in Tiffany’s fortunes across markets was obvious, with comparable store sales in constant currency terms leaping 36% in the Asia Pacific region (minus Japan, which recorded a 5% decline), compared to a 14% drop in the Americas and 9% in Europe. As Tiffany CEO Alessandro Bogliolo noted, “Sales in mainland China continued to grow dramatically in the third quarter increasing by over 70%, with comparable sales nearly doubling in that period as compared to the prior year.”

The question now is whether a post-acquisition Tiffany can maintain this momentum into 2021. With Yee and all of his attention-drawing power, the brand has significant potential to leverage content-commerce strategies that can attract millennial and Gen Z shoppers.

But simply having Yee hawk the Tiffany T collection in ads and on his social media accounts won’t be enough. A young male celebrity arms race has been heating up all year, with Bulgari hiring content-commerce stalwart Kris Wu as brand ambassador and Cartier bringing on Hua Chenyu for a campaign earlier this year. As 2021 approaches, it will be interesting to see how Tiffany fits into the broader LVMH strategy for China, which, as CCI has previously noted, expertly weaves together multiple content-commerce strands.