Every year, navigating the China market is a complicated game of snakes and ladders. One minute you’re ahead, up even; the next you’re down, embroiled in a controversy or worse still, find yourself cancelled. Very few houses emerged entirely unscathed this year. From miscalculated ambassadorial appointments to campaign missteps, no name is truly ever safe in China: 2021 was no exception. In fact, 2021 was less about winning and more about surviving on the mainland. Here Jing Daily finds the few global and local names that did just that, as well as the ones who failed.

The Winners:#

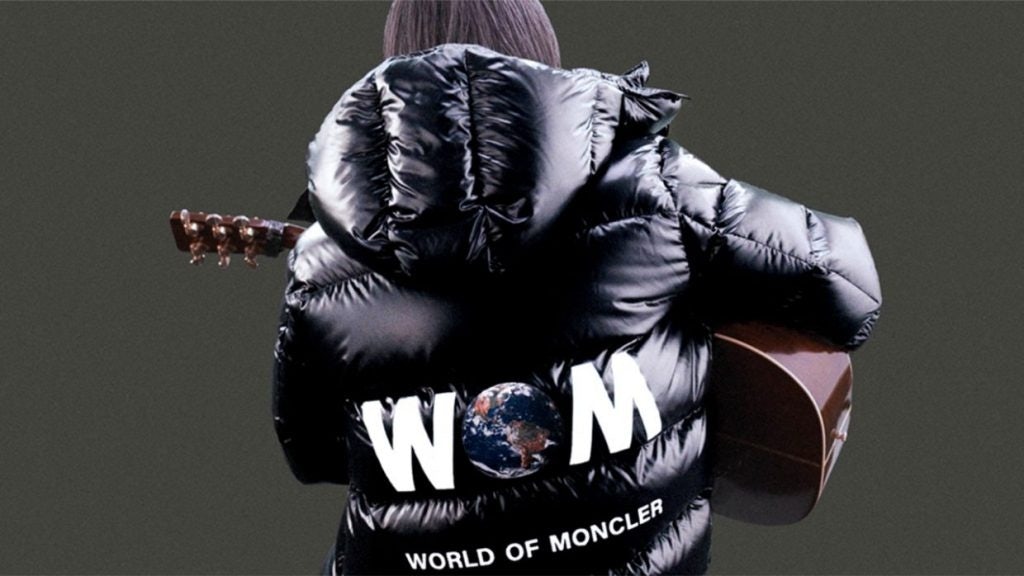

Moncler#

The Italian house has marked itself out as an agile luxury player which is becoming a clear leader in the China market. It managed not only to avoid controversy this year, but also roll out some key initiatives and dynamic retail experiences which ensured Moncler’s Asia sales soared by 53 percent in Q1 2021. By region, the house saw its Asia sales soar by 53 percent, largely thanks to mainland China and South Korea. Now, with brand desirability at a high, it earned a top-five ranking on the Lyst Index — a quarterly ranking of fashion’s hottest brands and products — every quarter since 2020, and Lyst highlighted Moncler’s Genius Project as a key driver of this appeal.

In July, 7 MONCLER FRGMT HIROSHI FUJIWARA 2021 collection dropped on the brand’s WeChat Mini Program ahead of its offline release. This drop model prioritized digital channels, catering to Chinese online shoppers while also fueled social buzz. Moncler closed the year by opening a flagship store featuring immersive retail spaces at Sino-Ocean Taikoo Li in Chengdu. By differentiating merchandising approaches at its two boutiques in Chengdu, Moncler mapped out a varied strategy for its regional market. Discerning luxury players like Moncler have learned that one strategy does not fit all Chinese consumers.

Tiffany#

2021 was a decent year for LVMH's newest house, Tiffany. China’s local shoppers already see Tiffany & Co. as a “go-to” jewelry store, second only to Cartier. Endorsement deals with celebrities like South Korean star Rosé, Jackson Yee, and Olympic skier Gu Ailing, only cements this. Innovative campaigns included color-swapping, the “not your mother’s Tiffany” slogan, and the inclusion of the ultimate power couple (Beyoncé and Jay-Z) continued to disrupt the US jeweler’s marketing strategy.

The Return To Tiffany collab, featuring Supreme’s iconic box logo in Tiffany’s signature Robin Egg Blue was one of the year’s biggest hyped partnerships. Smaller wins came in the form of Yan Wo (or edible bird’s nests) at The Mid-Autumn Festival and signature Robin Egg blue cat bowls to leverage China’s booming pet market. During 2020’s Christmas holidays, the jewelry brand experienced an over-50-percent sales growth in the local market while online sales soared more than 80 percent. Will this year be the same?

Shushu/Tong#

Shanghai-based designer brand Shushu/Tong’s feminine-yet-avant-garde approach is certainly making waves in China. A Spring 2021 campaign starred global supermodel Ju Xiao Wen and was shot by photographer Zeng Wu. Additionally, the brand — particularly popular with Gen Z consumers who use clothing to make personal statements —collaborated with local retailer LABELHOOD to launch a pop-up store furnished with floral wallpaper that echoed prints from the new collection. It also launched a collaboration with Estée Lauder, exposing the cosmetics house to a younger generation of shoppers. Earlier in the year, Jing Daily asked the question: Can Shushu/Tong go global? Perhaps 2022 is the time.

The losers:#

H&M#

Put simply, there were many losers this year — whether they were self-inflicted or not. But for the Swedish conglomerate H&M, it was a very tough year. Alongside other international fashion companies — Burberry, Nike, and others — the fast fashion giant voiced its concerns about cotton sourced from the Xinjiang region in China; H&M in particular suffered a startling quick nationalistic backlash. But it didn't end there. At the beginning of June, it got caught in crossfires again when it infuriated Chinese customers after officials announced that they had banned several of the brand’s products over safety concerns.

Canada Goose#

The winter apparel brand came under fire after refusing to refund a customer in Shanghai for a damaged parka, stating that all products sold at its retail stores in the mainland are non-refundable. This raised a bigger question: Why does Canada Goose not allow refunds in China? On top of finding it difficult to return items, citizens also called out the brand for “double standards,” noting that online purchases in global markets are eligible for refunds within 30 days of purchase instead of just seven. Despite its reliance on the market, this latest controversy adds on to a growing list of offenses there: just three months ago, the Toronto-based giant was slapped with a $71,000 fine for false advertising. While many luxury brands eventually bounce back in China after controversy, the timing isn’t great for Canada Goose.

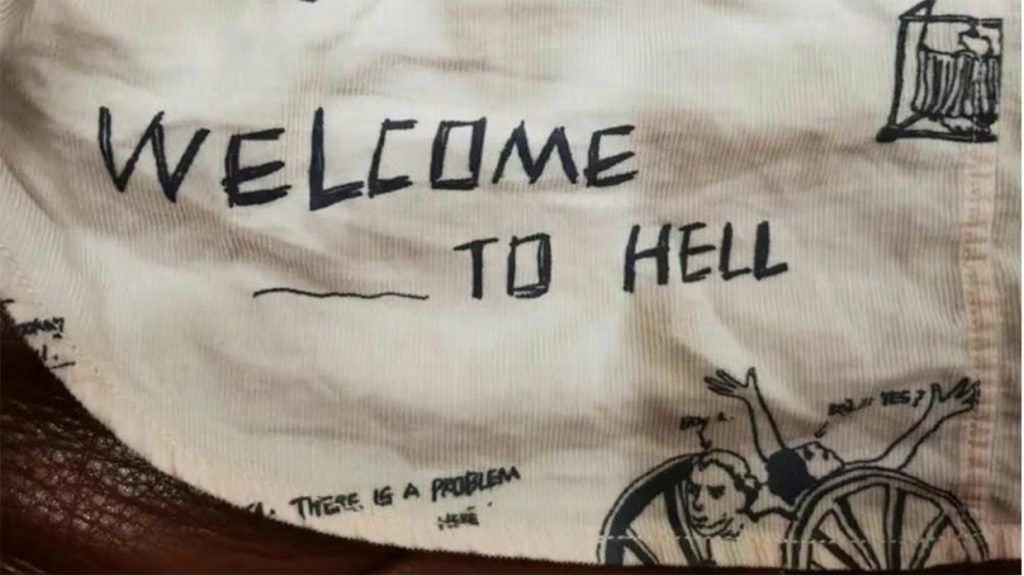

JNBY#

Earlier this year, photos of the Chinese fashion group JNBY’s children’s clothing spread online and sparked controversy over the weekend as the retailer stood accused of creating disturbing designs for its kid’s clothing line. Desing phrases included, “Welcome to Hell,” “Let me touch you,” and other messages related to violence, heresy, racialism, and sexual innuendo, quickly attracted attention on the internet, and the hashtag #JNBYrespondedtoinappropriateprintsonchildclothingline hit nearly 300 million views. Authorities in Hangzhou, where the company is based, ordered JNBY to pull its controversial children’s clothing off shelves and formed a team to investigate. Although the brand has issued apologies for its inappropriate designs, they were rejected by infuriated netizens.