FleishmanHillard's new study examines the "Authenticity Gap" between consumers' expectations of a brand and what they perceive to receive. (FleishmanHillard)

China now has the world’s largest online retail market and online shopping now accounts for 10 percent of all retail in the country, but a recent study by American marketing agency FleishmanHillard finds that e-tailers still fall short when it comes to meeting consumers’ expectations. According to the firm, brands must address this gap if they are to succeed.

The study looks at perceived gaps between consumers’ expectations and what they receive from a company in regard to factors such as a company’s commitment to environmental protection, credible communication, and value. Twenty sector categories were examined, including luxury, internet service providers, and online shopping. Unlike consumers in the United States and Germany, Chinese respondents were reported to have an overall positive experience across all 20 categories.

While the Chinese online shopping overall experience was rated to be positive, its “value” factor was found to be lacking. Chinese consumers felt that online shopping fell 6.5 percent short of the value they desired according to the study’s metrics, but performed 2.4 percent more consistently than shoppers expected.

"Consumers want to know they will get the same quality service online as in the store, particularly with regards to imitations, payment security and the potential for the same product to cost less overseas,” said Rachel Catanach, FleishmanHillard’s Asia head for reputation management and Hong Kong managing director, in a press release.

The discrepancy between expected and delivered “value” isn’t unique to online shopping in China—as much as 70 percent of the 20 sectors surveyed were also guilty of the same flaw.

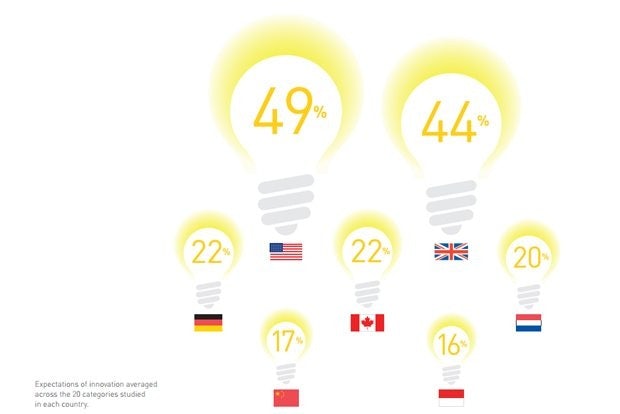

The study finds that globally, Chinese consumers are three times less likely to clamor for innovative products and services, but that number is increasing. Forty-nine percent of respondents from the United States listed “innovation” as the most important expectation of firms and companies, compared to 17 percent of Chinese consumers. Chinese consumers desiring innovation indicated that even high-tech products such as tablets and e-readers lack that creative edge.

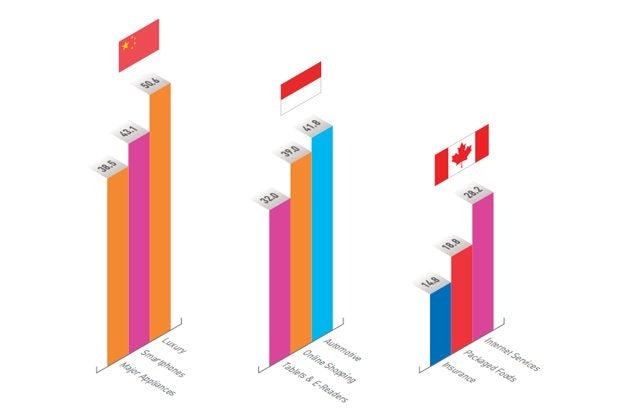

Chinese firms lead when it comes to what FleishmanHillard calls “momentum,” a measure of whether a brand is gaining or losing ground. The luxury industry in China was given a score of 50.6 for “momentum,” nearly twice that of any other industry in the Western world—the highest was 28.2 for internet services in Canada. One factor possibly contributing to China’s high “momentum” scores is that emerging markets have a lot of room for differentiation between brands, unlike the saturated Western markets. Greater access to global brands in emerging markets also contributes to greater levels of enthusiasm, helping boost that score.