Worried About A Slow Spring? Don't Forget That Summer Is The Largest Spending Period For Chinese Tourists#

Chinese tourists shopping in Paris. (zoetnet/Flickr)

It’s not surprising that global luxury brand managers have started paying closer attention to the spendy Chinese travelers hitting their retail doors in Europe and America.

After all, China's tourists outspent the perennial global leaders from Germany in 2012, dropping a total of US$102 billion on overseas trips compared to just US$84 billion by their German counterparts. Couple this with the fact that Chinese are now the #1 purchasers of luxury goods worldwide, with more than 60 percent of this spending occurring outside of China.

Amid the noise in industry publications about Chinese New Year and October’s Golden Week, however, some China-watchers may have overlooked the two most important trends of the recent boom in Chinese tourism: summer is the strongest season for Chinese tourist arrivals in key U.S. gateway cities, while spring is the slowest.

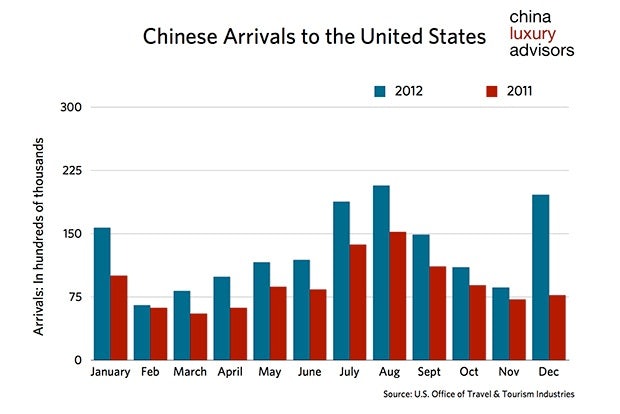

Consider the data. If you look at Chinese arrivals to the United States, which reached 1.4 million in 2012, the top month for arrivals from China is August, followed by December and July. In fact, the summer quarter (June, July, and August) was the top season for Chinese tourist arrivals to the U.S. in both 2012 and 2011, with 33 percent and 34 percent of all Chinese tourist arrivals respectively.

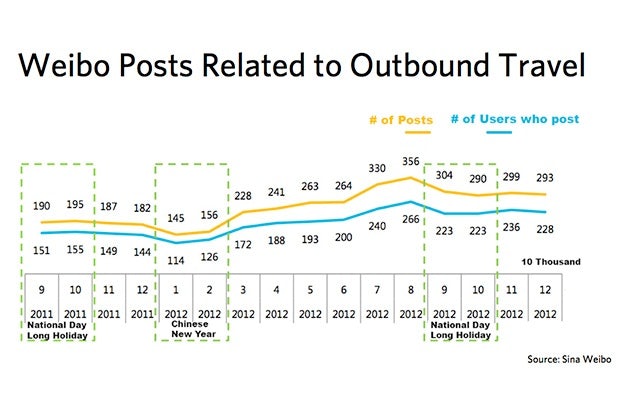

For further proof, we analyzed overall conversation activity related to international travel on Sina Corp’s Weibo.com, the dominant Chinese social media platform. The two peak months of posting volume for 2012 were July and August, followed closely by September and November.

This adds critical context to the recent rush of breathless news stories about a slowdown in spending by Chinese tourists during March, which is what we would expect from normal seasonal patterns. A look at the underlying annual trends indicates that a slow spring is nothing to worry about, even if this spring has been a bit slower than normal.

The spring quarter is always the slowest season for Chinese tourism. Every year. And the good news is that we are rapidly approaching the busiest travel period for Chinese tourists.

Chinese New Year 2012 display at Bergdorf Goodman. (Variouscolors.wordpress.com)

When formulating Chinese tourist engagement strategies and allocating budgets, the first elements most marketers consider are typically Chinese New Year activities and promotions. Retailers around the world have fallen over each other to produce limited-edition products related to the Chinese zodiac, Chinese decorations and window displays, Chinese cultural activities and special promotions, campaigns, and parties to celebrate the New Year.

While much of this effort is sensibly aimed to bolster brand awareness and goodwill, and strengthen connections with Chinese customers, brand managers would be better off driving revenue during the key summer season.

The best returns on investment will come from activities that focus on summer travel to Europe and North America. We will be watching closely to see if summer tourism arrivals from China revert to their late-2012 trend, after the bigger-than-usual downturn related to the Chinese leadership handover in March and the ongoing crackdown on luxury spending by Chinese government officials.

What does all this mean for retailers, tourist attractions, and hospitality providers?

- When determining your Chinese tourist strategy, do not simply consider Chinese New Year and October Holiday. Chinese tourists are traveling all year, and especially during the summer and Western winter holiday periods.

- Chinese tourists typically plan three months in advance. Act now to make sure you don’t miss the upcoming July and August peak season.

- Chinese tourists are not a monolithic demographic. They’re tour groups, individuals, young, old, travel pros, travel newbies, affluent, middle class. Do not assume they are all the same. Take time to understand your existing customer base and your relative strengths with each of these customer segments.

Remember: summer––not Chinese New Year or October Golden Week––is the busiest travel period for Chinese tourists and a must-win opportunity for retailers and hospitality providers in global gateway cities.

Sage Brennan#

is co-founder of China Luxury Advisors, a boutique consultancy that helps luxury brands and retailers to develop China-related strategies, ranging from market entry to social media to attracting, converting, and retaining Chinese tourists. Sage first visited China in 1987, and has worked in China as a researcher, investor, entrepreneur, journalist, and advisor, with a specialization in digital, mobile, and strategy. Follow China Luxury Advisors on Facebook or Twitter.