This post originally appeared on Luxury Daily

By 2020, Chinese social media use is estimated to hit 647 million active users, making a presence on local platforms essential for luxury brands aiming to speak to China's affluent and aspirational consumers.

According to Fashionbi’s latest trend report, China’s social media use has reconfigured how consumers in the Chinese market shop, with most opting for social commerce facilitated through platforms such as Weibo and WeChat. Developing a localized voice is a vital strategy for brands looking to make headway with consumers located outside the West, and in China, without social media it is nearly impossible to build awareness or conversions.

"Asia and China, in particular, represent high interest for the fashion and luxury brands and we know that the customers there are even more empowered by technology and the key cities have very advanced digital citizens compared to the United States or Europe," said Yana Bushmeleva, chief operating officer at Fashionbi, Milan.

"If the brand wants to sell the collections to the locals or to the tourists during the abroad trips the brand should not only spread the message about these collections but also serve the customers," she said. "The social networks in Asia are more advanced and are used not only for 'reading' and 'searching' but also for 'paying,' as the result many Western retailers started to implement WeChat payments at their bricks-and-mortar stores."

Seriously social#

The top 10 Chinese social media can be divided into five categories: multifunctional applications, messaging, forums, short video and live streaming networks. Most popular are China’s multifunctional applications which include WeChat and Weibo.

WeChat and Weibo, which have 938 million and 340 million active monthly users, respectively, are most commonly used by Western luxury brands looking to enter and interact with Chinese consumers.

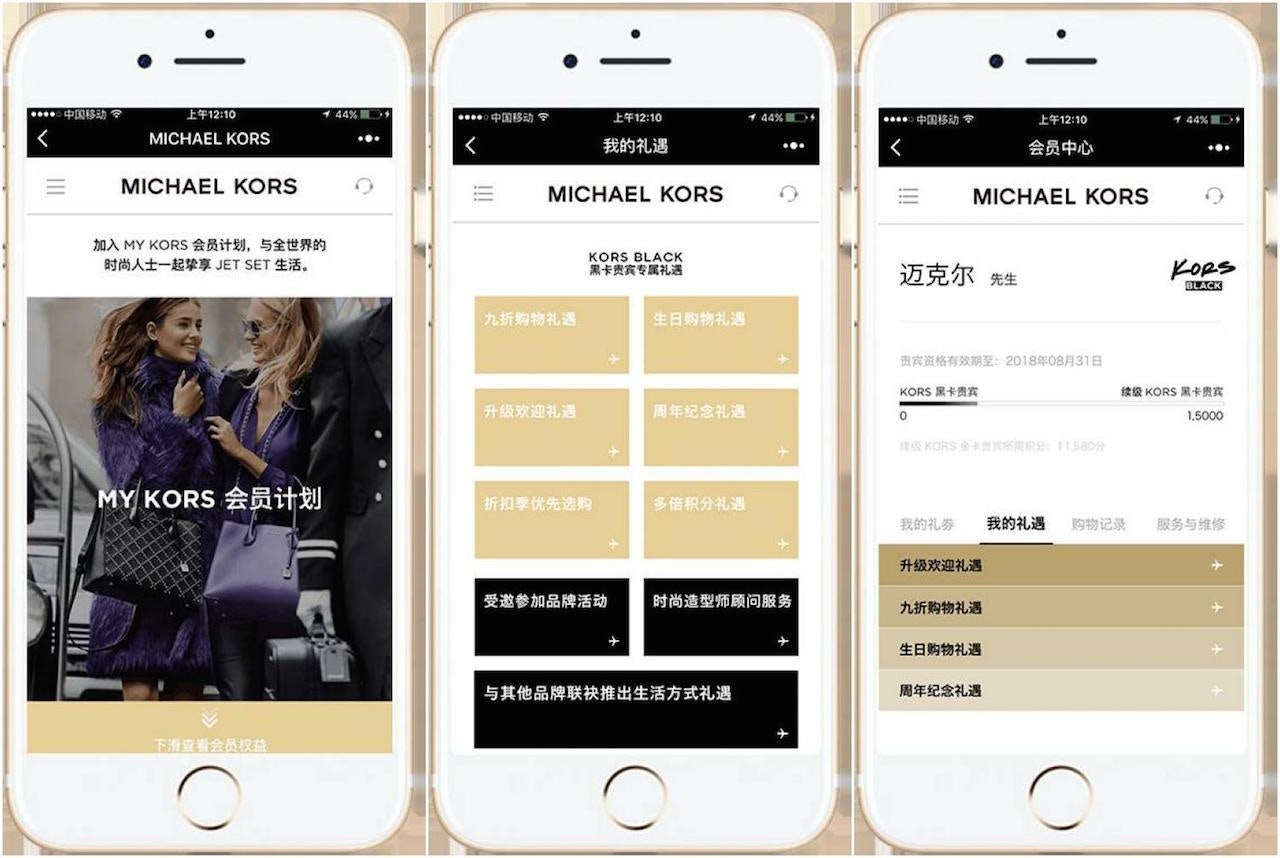

As the most-popular Chinese social media network, WeChat has attracted a number of high-profile luxury brands. This attraction is related to WeChat’s commerce capabilities and the availability of mobile payment solutions.

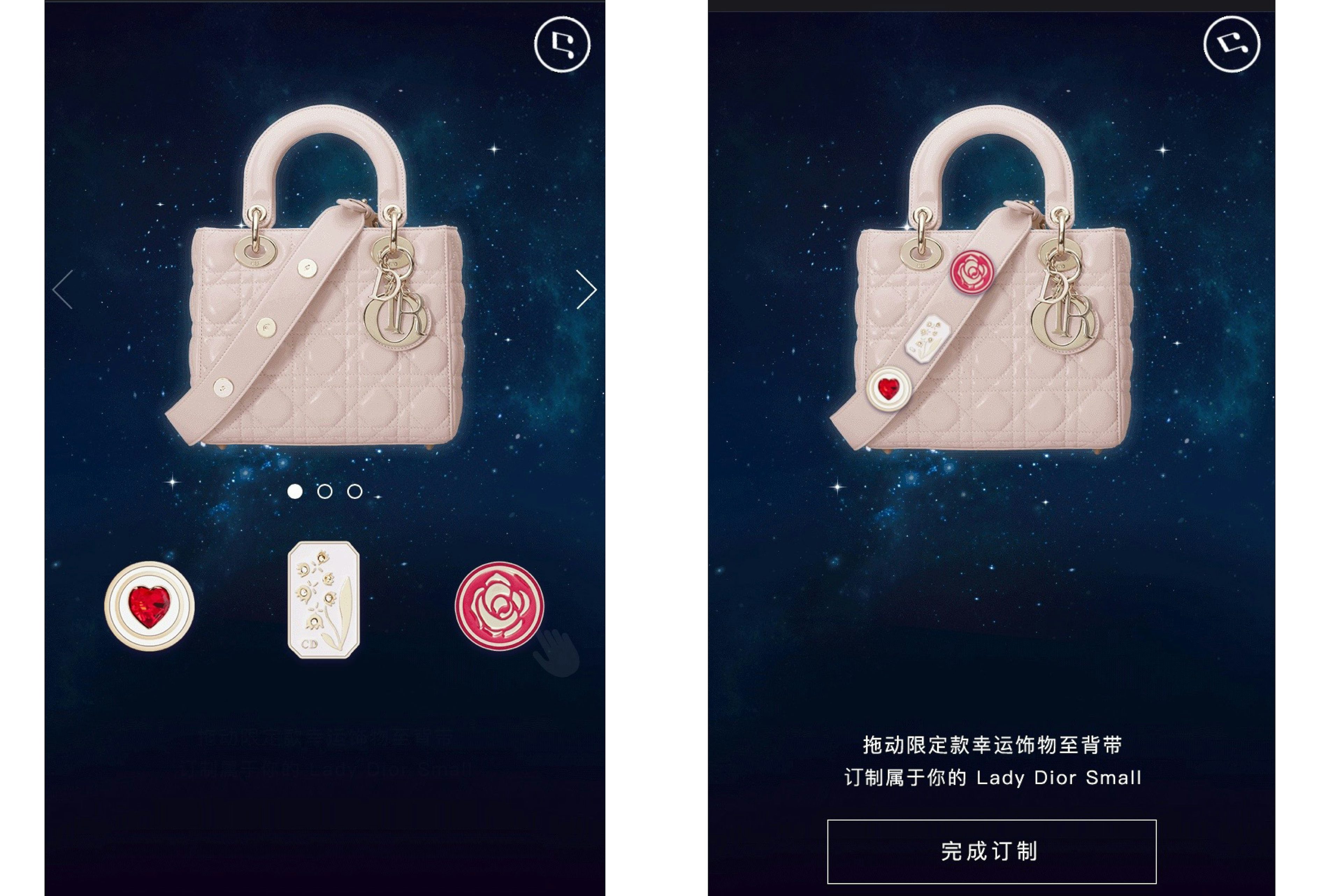

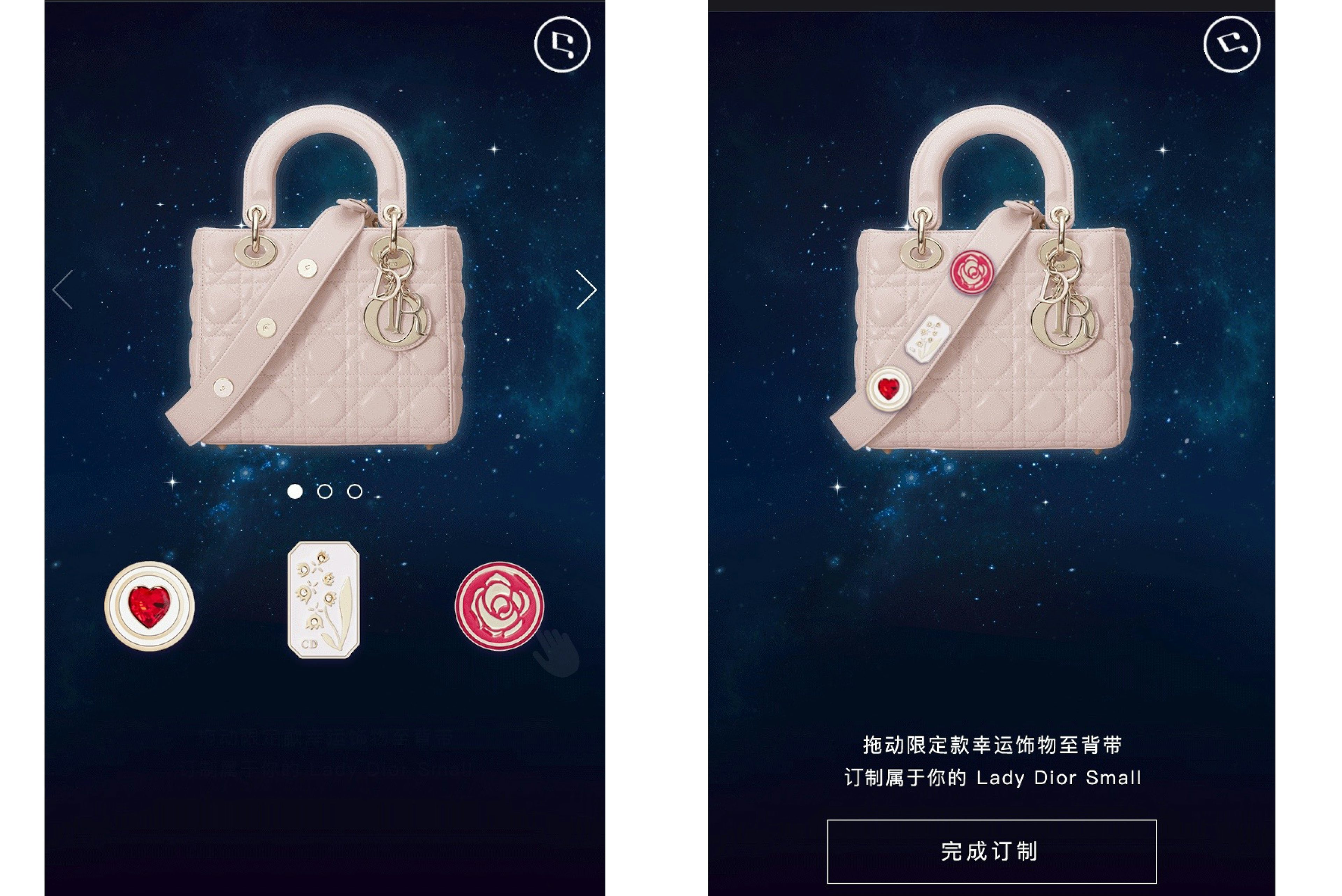

In 2016, for example, French atelier Christian Dior tried its hand at social selling by offering its followers on WeChat the opportunity to purchase a limited-edition handbag directly through a post.

While not alone in its WeChat efforts, Dior became the first luxury house to sell a high-end handbag through the app, showing its potential for direct-to-consumer sales.

Since then, standard WeChat campaigns have evolved from QR code-accessed content, such as games, visuals and video to fully functional online stores that live within the multifunctional app.

WeChat’s place in the Chinese consumer's path to purchase has also been enhanced by the platform’s introduction of Mini apps. Accessed through a brand’s homepage, WeChat mini apps boost mobile commerce functionality using geolocation to heighten user experience.

Exclusive to San Francisco International Airport, LVMH-owned travel retailer DFS Group, for example, launched a mini purchasing program powered by WeChat in September.

Accessed through WeChat’s Discovery function, users will find the DFS menu where they can preview and pre-order more than 300 products across luxury categories. Since the mini program is location-based, the platform will push tailored products specific to the location.

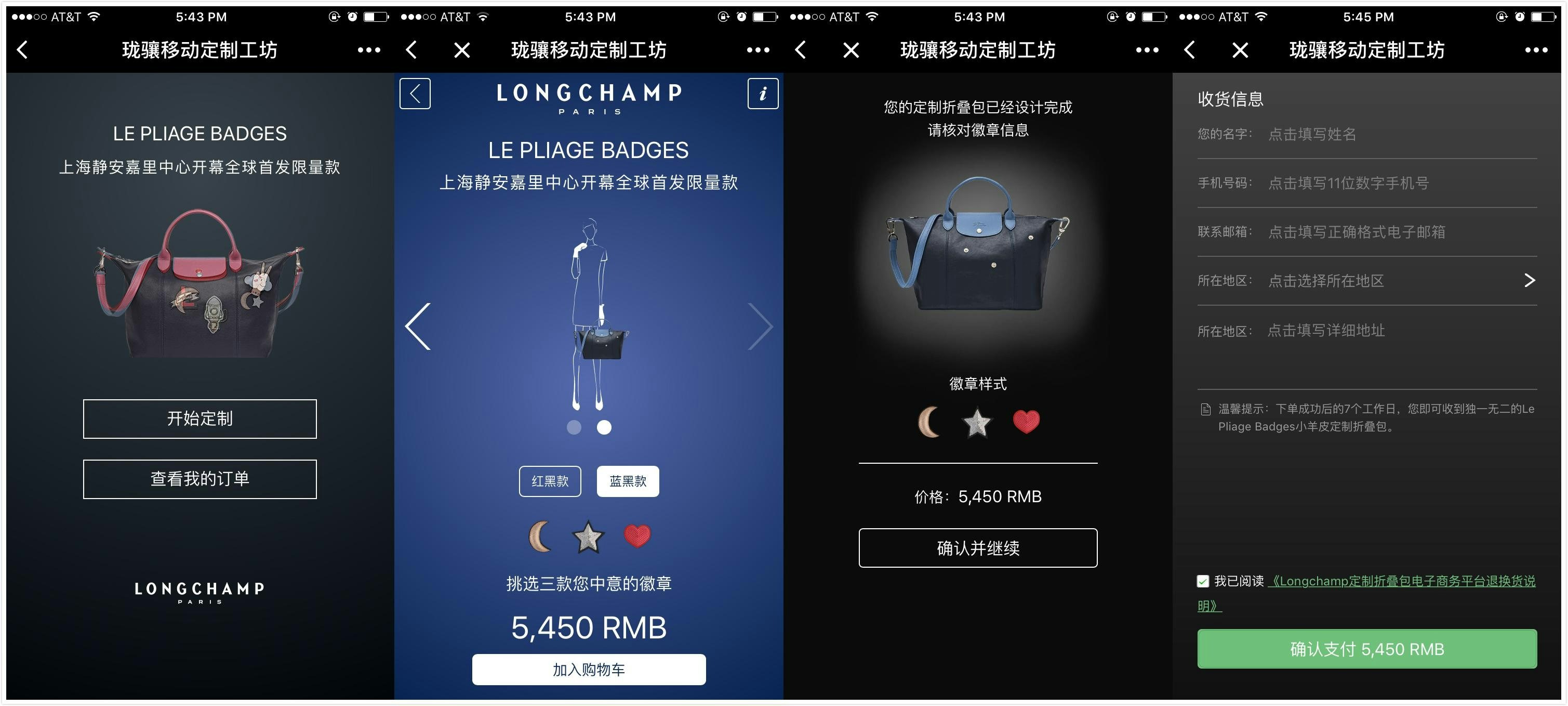

Similarly, French accessories maker Longchamp uses a WeChat mini app to help users locate its stores on a map. A function also allows Longchamp fans to post photographs with the brand’s accessories on the map.

Another WeChat mini app lets consumers personalize Longchamp’s Le Pliage handbag. The badges and color options are exclusive to WeChat.

Recently, WeChat launched WeChat Moment ads, similar to the sponsored posts seen on Facebook and Instagram. WeChat Moment ads include text, imagery and short videos that guide users to either a brand’s official account or a specific promoted landing page.

China’s Weibo functions a bit differently than WeChat and could be compared to Twitter due to its character limit, unlimited posting and timeline format.

Unlike WeChat, Weibo does not enable mobile commerce on its platform. Instead users are redirected to an official Web site or online store.

Often, brands without local commerce or Web sites in China send Weibo users to a third-party retailer, such as Alibaba’s Tmall, to close a potential transaction.This is more popular with mass brands than luxury labels who have been wary of partnering with online sellers in China.

Though Weibo does not orchestrate purchases directly, the social network does have a mobile payment solution, based on Alipay. Weibo Wallet’s goal is to make ecommerce more seamless for consumers and can currently be used to pay utility bills, buy games and movie tickets, among other purchases.

KOL communities#

A primary difference between the two platforms, and likely Weibo’s strongest asset, is the amount of Chinese key opinion leaders (KOLs) who have active accounts on the platform.

For example, actress/singer Angelababy, a Christian Dior ambassador, has 82 million followers while fashion blogger, Gogoboi, who has worked with Givenchy, counts a community of 7 million.

KOLs have massive social media followings with global reach, and their communities are responding to sponsored posts and brand collaborations through ecommerce. In China especially, the Luxury Conversation has noted in its “KOLs in China -- From Publishers to Ecommerce” report that this trend is exploding with influencers helping brands to sell products directly rather than a simple branded content post.

The popularity of KOLs and the high rate of social media users has resulted in a “fan economy,” meaning that consumers who see an influencer’s post are more likely to purchase the product or buy from the brand promoted.

"Since the number of users and accounts on the Chinese networks is very high, the competition for the people's attention is strong," Fashionbi's Ms. Bushmeleva said. "Therefore it's even more important to target the concrete message to the concrete audience

"Being present on Asian social networks doesn't mean translate Facebook posts from English to Mandarin, but having a proper content strategy and work with the local audience and influencers," she said. "It's an international trend to personalize the content, instead of broadcasting the same message to all potential and actual clients of the brand."