China has a sleep problem. Mintel research reveals that 59 percent of Chinese urbanites say it is difficult to get to sleep. Emotional stress is keeping many locals (especially among the younger generations) awake at night. COVID-19 has of course made this worse. Indeed, Nielsen IQ reported that consumers in the country ranked sleep as a critically important priority. It is a recent phenomenon that has awakened the significant market potential of the sleeping dollar in the luxury space. According to iiMedia Research, the sleep economy here is expected to exceed 157.1 billion (one trillion RMB) by 2030.

Luxury groups are waking up to the size of this market opportunity. The Australian bedmaker A.H. Beard has close to 50 shops in China with plans to double this. Tony Pearson, CEO of the company, is optimistic about its prospects in the mainland. “As the Chinese market matures, consumers are growing more aware of the importance of sleep, sleep health, and the role the sleep surface plays.” This market sentiment is shared by the British bedmaker Savoir Beds, which makes fewer than 1,000 handcrafted beds a year. With doors located in Guangzhou, Shanghai, and Qingdao, the business is planning to open a showroom in Beijing in the next 12-18 months.

Rising awareness of the importance of a healthier lifestyle is motivating consumers to either change or upgrade their sleeping experience. This is part of the holistic wellness trend that is accelerating in China. There is a considerable opportunity here: a 2021 YouGov and IKEA survey found that just 53 percent of Chinese respondents say their home meets their needs for sleeping. The movement extends beyond the bedroom to categories from foods and beverages to fitness and nutrition apps. Technology, too, has its part to play: 89 percent of domestic consumers agree that wearable devices make it easier to understand their physical condition through data.

The rise of China’s sleep economy is an opportunity for luxury players to promote physical and mental wellbeing through their products and services. For example, Rosewood Hotels & Resorts launched Alchemy of Sleep, a collection of immersive retreats that offered sleep-inducing treatments. Rosewood Guangzhou provides guests with a program that features massages incorporating sound-healing and traditional Chinese herbs.

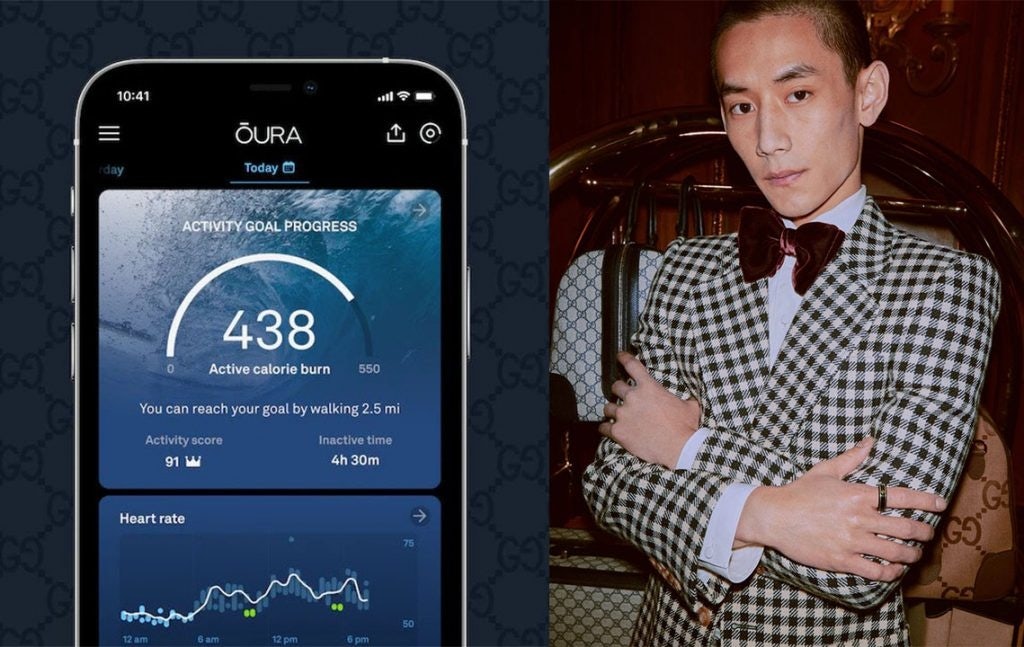

Innovation will play a critical role and "dream" brand collaborations that combine style with sleep tech have the potential to disrupt existing ecosystems. For example, a collaboration between Gucci and Oura, a Finnish health technology outfit, introduced a ring (Gucci x Oura) that monitors a range of activities, sleep included. The New York Times reported that the ring’s second series is set to be launched this autumn on the house’s website and at select Gucci stores worldwide.

The fact that the future of China’s sleep economy is also intertwined with longer-term demographic trends means it is simply too big for labels to ignore. As Tony Pearson observes, “I believe the rapid aging of the Chinese population will drive awareness of sleep and the role it plays in health.” Though strategies need to be aligned if they are to ensure a sustainable value, sleepwalking past this moment is not an option for the luxury industry. It’s time for brands to wake up to the reality of a burgeoning sleep economy in China.

Key Takeaways#

- A significant percentage of Chinese urbanites struggle with sleep issues, exacerbated by emotional stress and the COVID-19 pandemic, spotlighting the growing importance of sleep as a luxury market opportunity.

- Luxury brands and bedmakers, like A.H. Beard and Savoir Beds, are expanding their presence in China, aligning with the increasing consumer demand for premium sleep solutions and wellness-oriented products.

- The holistic wellness trend in China, encompassing everything from diet to fitness apps, underscores a broad consumer shift towards healthier lifestyles, further fueling the sleep economy.

- Innovative collaborations and products, such as the Gucci x Oura sleep-monitoring ring, highlight the luxury sector's potential to merge fashion with sleep technology to cater to health-conscious consumers.

- Given China's demographic shifts and rising health awareness, the sleep economy presents a considerable and untapped market for luxury brands, necessitating strategic engagement to capture this emerging consumer interest.

Glyn Atwal is an associate professor at Burgundy School of Business (France). He is co-author of Luxury Brands in China and India (Palgrave Macmillan).