Restructuring Effort Aimed At Giving Shanghai Jahwa Competitive Advantage#

Shanghai Jahwa

Recently, the Shanghai Jahwa Group (上海家化集团), parent company of cosmetics maker Shanghai Jahwa United Co., announced plans to transfer a 9 percent stake, worth around 5 billion yuan (US$765 million), to the Shanghai Chengtou Corporation (上海城投, 4.5 percent) and Shanghai Jiushi Corporation (上海久事, 4.5 percent) under the supervision of the State-owned Assets Supervision and Administration Commission (SASAC).

Shanghai Jahwa United Co. is engaged in R&D, manufacture and distribution of daily-use chemical products, mainly focusing on personal cleaning and care products, cosmetics, household cleaning products and perfumes.

Shanghai Choutou specializes in investment, construction and management of urban infrastructure. Shanghai Jiushi is an investment enterprise that has participated in a number of infrastructure projects in Shanghai. Both of these companies are state-owned enterprises controlled by the Shanghai municipal government.

Shanghai Jahwa United has 423 million total outstanding shares, of which 161.5 million shares (38.18 percent ) are held by its parent company, the Shanghai Jahwa Group. After the transfer is completed, the Shanghai Jahwa Group will hold 29.18 percent stake of the listed company. In the meantime, Shanghai Chengtou and Shanghai Jiushi will each hold a 4.5 percent stake in the listed company. Once the transfer is completed, the deal will be the largest M&A case in China's daily-use chemical industry, according to Investor.com.

In all, the Shanghai Jahwa Group has 18 wholly owned and secondarily controlled companies, accounting for nearly 7 billion yuan (US$1.07 billion) in total assets. At the end of last year, Shanghai Jahwa United announced plans to reform its state-owned assets. At the beginning of this year, Ge Wenyao, the chairman of Shanghai Jahwa United, announced plans to transfer all of the state-owned equity in the company within a matter of months.

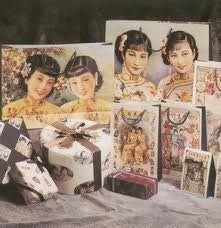

Shanghai VIVE

The main reason for the Shanghai Jahwa Group's restructuring effort is to boost the domestic Chinese fashion industry, compete with foreign fashion giants, and to avoid being acquired by foreign competitors. With the quality of Chinese daily care products gradually improving, and more Chinese consumers willing to buy domestically produced brands, Shanghai Jahwa is confident about its prospects in the daily chemical industry -- an area that has long been dominated by foreign brands.

According to the development goal reported by Shanghai Jahwa to the Shanghai municipal government, the Shanghai Jahwa Group ultimately plans to position itself as a comprehensive fashion group focusing not only on cosmetics and consumer products, but also branching into areas such as watches, jewelry, apparel and boutique hotels. Last year, Jing Daily reported on Shanghai Jahwa's foray into the luxury cosmetics market with its high-end Shanghai VIVE line, which marked the company's first attempt to shift from manufacturer to brand operator:

Shanghai VIVE aims to tap into the lucrative middle-class, 30+ female market through a combination of “branding power” and quality. Designed to emulate the extravagance and elegance of 1930s Shanghai, the Shanghai VIVE line marks the latest attempt by a domestic Chinese company to make the shift from low-cost, low-profit manufacturer to high-end brand operator.

For Shanghai Jahwa, whether its restructuring effort will streamline its operations and help it better compete with powerful brands like Estee Lauder will remain to be seen. However, in a very fickle business environment like the cosmetics market, in order to more quickly respond to market changes, spinning off the restrictions of the institutional system may just give the company the competitive advantage it needs.