Key Takeaways:#

Second-hand luxury sales should become incrementally relevant in a post-COVID-19 world in which buying with purpose and issues of circularity will take on a bigger role.

The trend is part of the third wave of change which will affect the luxury sector, after the COVID-19 shock and the economic consequences, with climate change and sustainability understandably bound to dominate luxury conversations.

Is this bound to remain a Western trend? How should brands ride the wave? Why are consumers really interested? Many questions will find answers in the years ahead but here are some thoughts.

Put your money where your mouth is#

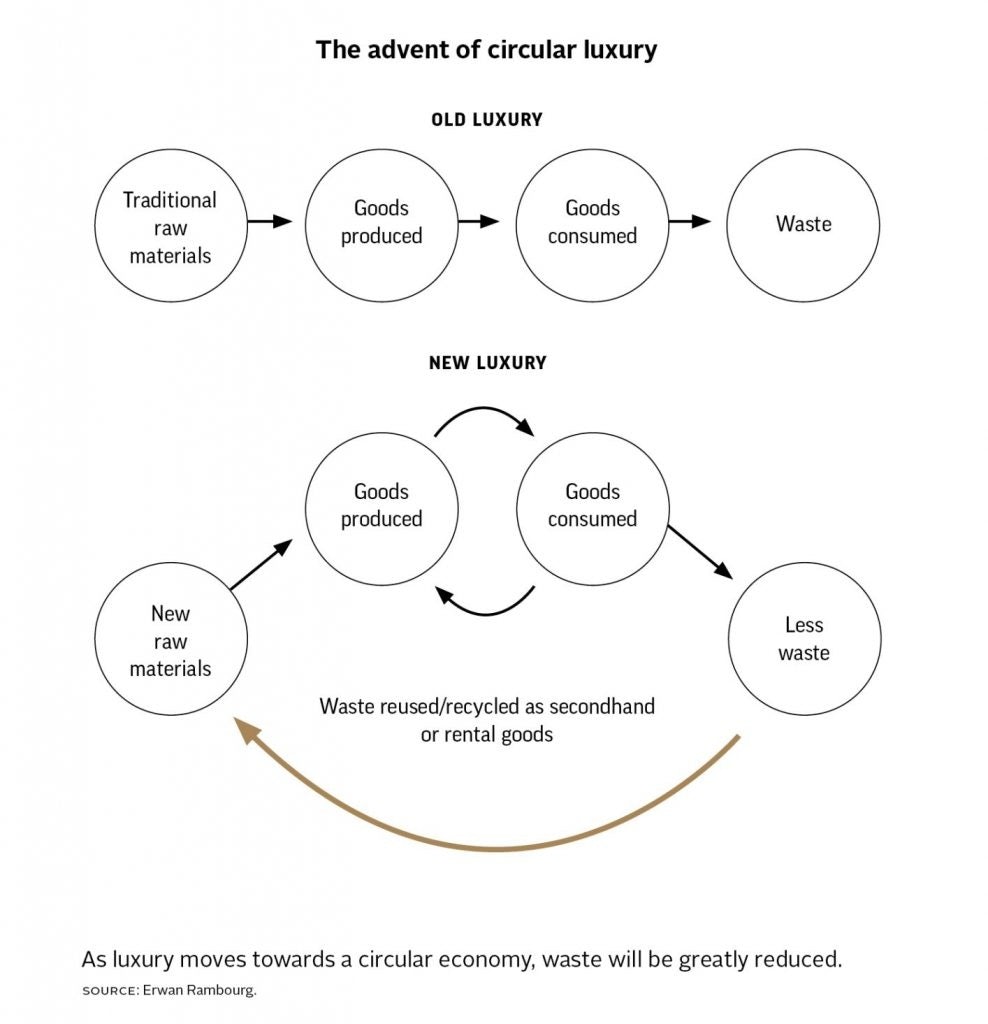

At the end of the last chapter of my book Future Luxe called “Disrupting Luxury: The Decade Ahead,” I write about the rise of rental and second-hand goods. While I find the first business model to be intricate and somewhat limited in potential, I believe the future of second-hand purchases in luxury is big and bright. It is indeed, in my mind, an attractive alternative to purchasing fast fashion brands while contributing to a circular economy that ultimately produces less waste.

In my first Luxe Decade column called the Third Wave, I had described how after the COVID-19 pandemic and the ensuing economic implications, the world would focus on a much graver, broader threat, that of climate change, as well as other environmental, social, and governance issues. These are issues that François-Henri Pinault, the chairman and CEO of Kering — and the kind writer of the foreword of my book — has had close to his heart for years. Indeed, Kering has been recognized for its focus on sustainability issues, is known for developing “EP&Ls” for its brands, and has a very active voice in their Chief Sustainability Officer, Marie-Claire Daveu. This week the Kering Group took a stake (and a board seat) in Vestiaire Collective, putting the focus once more on this up-and-coming segment of the luxury market and the attention is unlikely to wane any time soon.

This could become a global phenomenon#

In 2011, e-commerce entrepreneur Julie Wainwright founded The RealReal. The company, listed as of June 2019, employs experts to authenticate second-hand luxury products that are sold on consignment. It is the US poster child for the principle of “re-commerce” of luxury. Rebag is a New York–based website that launched in 2014 as a platform to buy and sell designer handbags. And in a somewhat extreme take on second-hand, there was a burgeoning market pre-COVID-19 for used makeup among millennial consumers in Japan.

Many other companies started up on the principle of second-hand ownership, taking a sort of vintage approach to luxury. Vestiaire Collective is 12 years old and has 11 million members, who buy and sell authenticated luxury fashion items. Similar companies include Material World, thredUP, Poshmark, and Depop. In hard luxury, Watchfinder & Co. was founded in 2002 as an online second-hand watch retailer and was purchased by the Richemont group in 2018.

Most of these concepts are Western or Japanese but for now a very limited proportion of sales are made to Chinese consumers. This could change in the years ahead for three reasons. First, Chinese luxury consumers are mostly first-time purchasers of luxury items, so they often would prefer the latest and greatest products that will enable them to shine in society. As they evolve to becoming repeat purchasers, buying something from previous collections will likely be okay. Secondly, many American and some European consumers are quite value conscious. That will come in China eventually as well. Third, because many consumers in Asia are first-time purchasers, environmental or circularity issues are not the main priority in a first purchase as it is more about fitting in but that, again, is just a question of time. Are consumers buying second-hand because it’s cheap or because it feeds into circularity and makes them feel responsible or look good? I believe it is a bit of both, but it’s hard to tell if only asking those consumers as they will likely focus on the latter.

Where to and with who?#

In a recent fascinating study, BCG assessed that second hand-sales of apparel, footwear, and accessories accounted for USD30bn to USD40bn in sales and should grow on average 15 percent to 20 percent per annum over the next five years. To paraphrase what Federico Marchetti, the visionary former CEO of the Yoox Net-a-Porter Group, said recently at a conference: the future twenty years ago was online sales, the future today is sustainability. Besides, I believe that second-hand sales are a very powerful means to recruit consumers who may otherwise not have been shopping at your brand and who may eventually trade up to purchase the latest collections at full-price.

Who should manage second-hand for a brand? Here, it’s a bit like for online sales. There is a pragmatic, “Italian” way to run second-hand, which is to find trusted partners, which Kering seems to have adopted. And there is a dogmatic, “French” way to run luxury, which is to control everything you can from production to distribution (think Louis Vuitton or Hermès) and that could imply that eventually you deal with second-hand sales yourself. I don’t know if one is better than the other, I just think the trend is nascent and promising.

Erwan Rambourg has been a top-ranked analyst covering the luxury and sporting goods sectors. After eight years as a Marketing Manager in the luxury industry, notably for LVMH and Richemont, he is now a Managing Director and Global Head of Consumer & Retail equity research. He is also the author of Future Luxe: What’s Ahead for the Business of Luxury (2020) and The Bling Dynasty: Why the Reign of Chinese Luxury Shoppers Has Only Just Begun (2014).