Even before Ganni’s debut in China, the Danish brand was already well-known in the market. Young consumers learned about the quirky, chic label from western bloggers and started purchasing it from overseas websites or daigou. Despite its popularity — which dates back to 2017 — the Copenhagen-based label only launched its Xiaohongshu account and debuted on Tmall in 2021. By the end of this year, it will open its first retail store in Shenzhen.

This cautious strategy reflects the complexity of the Chinese market with its linguistic, cultural, and currency barriers, which has put Nordic labels off from committing to the mainland. Nynne Kunde, founder of the eponymous brand, told Jing Daily, “We are used to marketing the brand to the small countries in Northern Europe. It’s hard to understand and come up with a strategy that will work in the huge country that is China. Although we live in a globalized world, there are lots of cultural differences between countries.”

Additional complications lie in the way too, according to Kevin Rozario, a luxury journalist who attended Copenhagen Fashion Week last week. He suggested, “After COVID-19, strategies are all about rebuilding presences in existing European markets and opening new ones. Luxury brands like Nynne are more likely to look to the US for international expansion than to China.” On the ground, he also found that many Scandi brands and the Swedish exhibition organizer at CIFF concurred with this view.

However, for locals looking for niche brands to express more individuality, the aesthetics of these often logo-less Scandi brands meet that need. According to investment bank Everbright Securities, the size of China’s contemporary luxury market including niche designers reached 18.4 billion (124 billion RMB) in 2020. Given this, Scandinavian fashion might be missing out on a multi-billion-dollar opportunity.

Here, Jing Daily investigates how Nordic brands are faring in China and why domestic venture capitalists are eyeing up these labels.

China’s love affair with Scandi fashion#

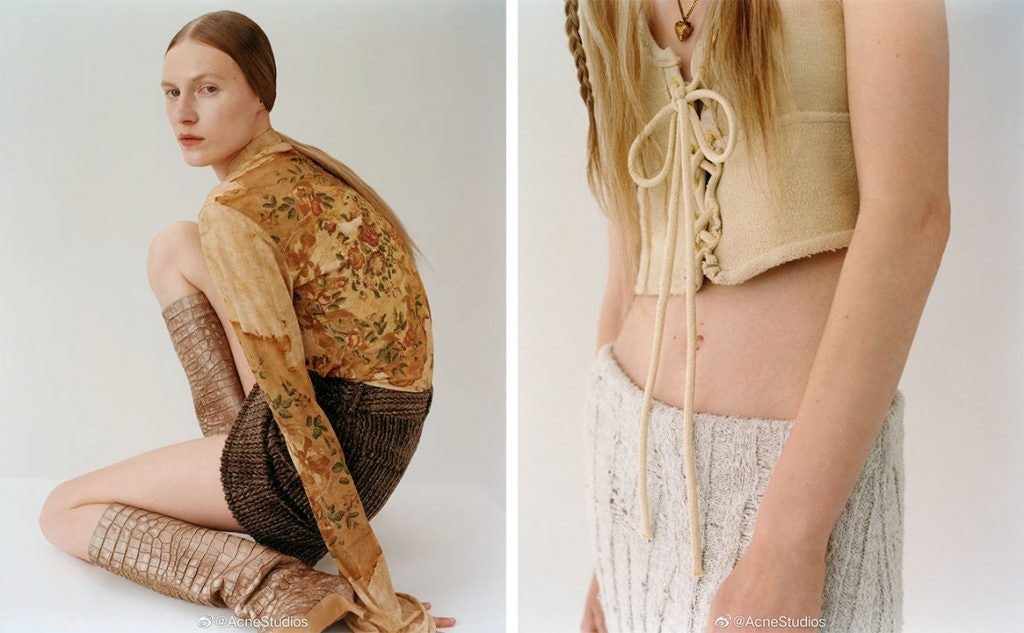

The Scandi or Nordic style wave (北欧风) initially exploded in China a decade ago. In the early days, Nordic interior design rose to prominence thanks to its functionality and contemporary look; in 2013, the sales of Ikea China exceeded 929 million (6.3 billion RMB) and more than 45 million consumers visited its stores. The style then expanded into more categories in China, including fashion: see the rise of Acne Studios, Ganni, and Nynne.

Lifestyle trends such as Denmark’s Hygge (creating a warm atmosphere) have also caught on as Chinese residents’ living standards improve and they seek more psychological fulfillment. Aslada Gu, director of product and innovation at Gusto Luxe, noted, “We can see that a growing number of top-tier cities’ residents are pursuing a slow lifestyle.” She believes Scandi style’s popularity lies in the fact that it’s Instagram-friendly and photogenic.

Citizens also associate its clean silhouettes and modernity with high-quality design and good taste. Andrea Baldo, CEO of Ganni agreed, adding: “When it comes to designing for the Chinese consumer, creating design-led, quality products that have a luxury play has been key for us.”

Is it too late for Scandi brands to win in China?#

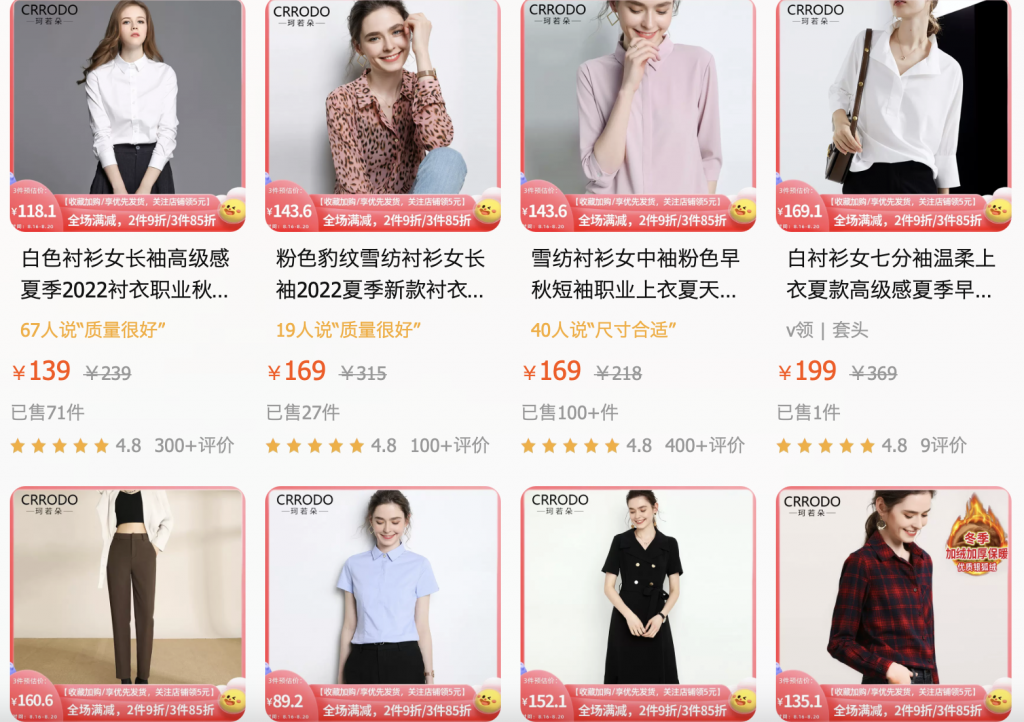

Nordic designers’ late-built official presence in Mainland China has impacted their potential in the market. The labels are currently facing fierce competition from homegrown names such as Mona and Toohot, who have jumped on the Scandi-chic trend. “It is easy to imitate a style. The challenge faced by Scandinavian brands is that their generic style has been offered by domestic rivals at a lower price point,” Gu points out. When searching the keywords “北欧风” on Taobao, thousands of results appear from the likes of Yuxi and Crrodo. Many are priced under 15 (100 RMB).

Although Ganni, Holzweiler, and Nynne are positioned as affordable luxury, young consumers with limited budgets — who favor the style over say, brand loyalty — are likely to opt for cheaper versions. “Only a niche target of elite, high earning white-collar types and fashionistas who appreciate authenticity, quality, and craftsmanship will become these brands’ loyal shoppers,” Gu continued.

This means building brand awareness is key to capitalizing on the local market — an opportunity missed by Copenhagen Fashion Week and its line-up this season which skipped out on Chinese press. However, organic exposure and growth can be a challenge. To reach targeted consumers, Scandinavian fashion houses need to collaborate with the right homegrown influencers who are consistently communicating Nordic aesthetics.

“Our first step was to build brand presence on local platforms like RED, Weibo and Tmall,” stated Ganni’s Baldo. The company has also collaborated with local KOLs including @削梨Sherry, @菜菜bops, and @sasha.mei and plans to hold events on the mainland later this year.

Why are venture capitalists investing in Scandi-chic?#

Despite the aforementioned challenges and fierce competition, local venture capitalists are bullish on the future potential of Scandi-chic brands. Only a few days before Copenhagen Fashion Week, investment firm Sequoia Capital China acquired a majority stake in contemporary Norwegian fashion house Holzweiler.

The CEO of the business, Andreas Holzweiler, shared with Jing Daily: “Our partnership with Sequoia will allow us to expand our direct-to-consumer business physically and digitally; store launches are planned globally in important markets such as China and we will launch our Tmall store later this year.” The aim is to surpass 102 million (691 million RMB) annually in sales; this year’s turnover is expected to be around 50 million (339 million RMB).

At the same time, rumors have circulated that several Chinese conglomerates are interested in buying Ganni from LVMH’s private equity L Catterton. So why are domestic venture capitals eyeing emerging Nordic labels?

Angelica Cheung, Vogue China’s ex-Editor in Chief and a venture partner at Sequoia Capital China, was quoted saying: “We believe they have a huge opportunity to expand to other parts of the world, especially at a time when audiences value nature, the outdoors, and human connection more than ever before.”

It’s true that the lengthy COVID pandemic — which has locked people at home for months — has drastically changed dressing habits. Wearing relatively clean and comfortable silhouettes made with high-quality fabrics has become mainstream, and a growing awareness of climate change in first-tier cities has shifted people’s attention towards green consumption.

Brands themselves are positive too. Nynne’s Kunde noted, “The Chinese market is showing more interest every day in a more conscious and quality way of consuming, and that is why we think it is one to watch.” Though the sustainability favored by many Nordic labels is an added value for Chinese consumers, it’s not a key factor in making a final purchase decision.

Amid the roadblocks, there are still opportunities in China for Scandi-chic fashion houses. However, they will need to beef up their brand awareness and localization strategies to better compete with the local competition and carve out their own, lucrative spot in the market. More than just fashion, the Scandi-chic trend is a way of living that spans interior to clothing. Appealing to shoppers who desire this kind of lifestyle (and its values) will be crucial to generating final sales.