What happened

China’s first public multi-channel network company, Ruhnn Holding Limited, released its fourth quarter and full-year results on Wednesday, ending March 31, 2020. The company reported a 4% year-over-year drop to 228.2 million yuan ($32.2 million) in Q4.

“We capped off a year of strong overall operational and financial performance for the full fiscal year 2020, despite the impact of COVID-19 pandemic in China during the fourth quarter, a historically slower seasonal quarter for our business,” said Sun Lei, founder, director and chief executive officer of Ruhnn. The full year saw a 19% growth in the company's revenue to 1,295 million ($183 million).

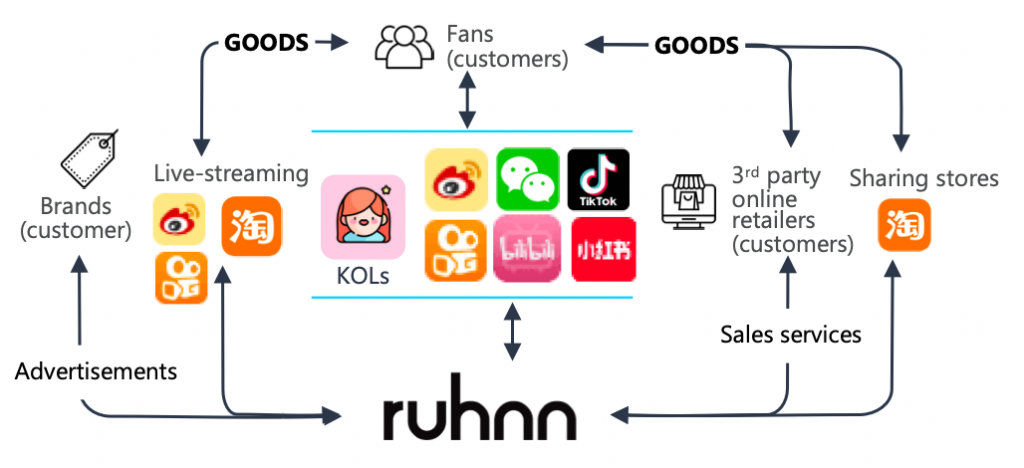

Ruhnn, which controls 4.9% of the market share in China’s influencer economy, according to US market research firm Frost & Sullivan, also said it’s on the right track to an “asset light model” that mainly involves KOL marketing for brands, as opposed to operating KOLs’ online stores. In Ruhnn’s terms, the former model is called “platform” and the latter called “full-service.”

Founded in 2016, in Hangzhou, China, Ruhnn Holding has boasted its connection with top KOL Zhang Dayi (@张大奕Eve), who now serves as the chief marketing officer. The company’s stock price soared by 7.14% by midday in New York to $3.90 a share. The initial public offering price was $12.5 a share when it went public on the Nasdaq last April.

Jing Take#

Ruhnn’s transition from e-commerce to relying on brands and fans will relieve a lot of financial pressure on itself, as the revenue dependency on top KOL Zhang Dayi began to attract an increasing amount of doubts from investors and Chinese media.

With its current 19 online stores under Ruhnn’s KOLs, the company is investing in a complete supply chain behind every KOL they sign, as if they’re running an online fast fashion company. Pivoting to a platform model, however, would mean that the pressure is diluted with the various monetization channels and they can instead charge the brands, the fans, and online retailers, as its latest investor presentation stated.

“The full-service model still accounts for the majority of the total net revenue, but if we look further from the growth profit perspective, revenue in the platform model increased 24% in 2019, to 35% in the fiscal year 2020, and we expect it to increase further to 40 percent in 2021,” said Jacky Wang, Ruhnn’s chief financial officer, in the call.

Traffic is what drives the influencer economy, and going ahead, Ruhnn needs to be careful with its potential legal risk around the cash cow. Previously, many MCNs have been troubled by fake followers, either with or without their knowledge. It’s become such a prominent problem in the influencer economy that the Chinese government is going after it, as Jing Daily previously covered. It can not only tank the reputation of KOLs and the company behind them, but also drive away brands that expect sales from the traffic.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.