Key Takeaways#

- China is set to hit a milestone as the first country in history to carry out most of its retail sales online instead of through physical retail stores. This puts added pressure on retailers to entice shoppers back in person post-pandemic, but means they must push the boundaries of brick-and-mortar.

- Consumers' growing expectations means that now all of a brand’s digital media should be completely shoppable supported by technologies like AR, and AI which will create an even better buying experience in stores.

- Finally, retail is now considered a journey, whether metaphysical or geographical. This will see stores becoming fully-realized independent lifestyle destinations as a way to strengthen their differentiation. Livestreaming too is a necessary way to engage your luxury community.

Since 2020 began, most brick-and-mortar stores have spent more time closed than open. Now, China is set to hit a milestone as the first country in history to carry out most of its retail sales online instead of through physical retail stores. So now, the question retailers need to ask is: What is the point of a store post-pandemic?

Curbside pick-ups, available e-commerce, and increased delivery speeds have offered unimaginable convenience and choice — not to mention safety — to shoppers during the pandemic. It's being predicted that one in every four purchases will be made online by 2024, when e-commerce sales will hit 3.9 trillion, according to the media investment company Group M.

Although three of four sales will still be in person, COVID-19 has shown us that a retail store isn't necessary. During 2020 — but even before — many companies were forced to recalibrate their business models, reduce footprints, and rethink the roles of their stores in today's omnichannel landscape. Many companies are now moving away from physical retail to digital-first or digital-only platforms, incorporating automated offerings and we have even seen the advent of augmented-reality stores.

But China is still the anomaly. Countless brands from Boucheron to Tom Ford have opened stores in China during the pandemic. But how can they keep sophisticated consumers across various tiers interested and engaged? Bain & Company has suggested that more stores will start operating as “showrooms or hubs for order pick-ups or click-and-collect services, with increasing levels of automation.”

The likes of Chanel and Tommy Hilfiger have upped their digital game post pandemic. Much of this innovation has been through the introduction of smart fitting rooms which recognise items though RFID tracking and can enable orders on e-commerce sites and recommend new products.

Rent now is no longer a cost of distribution. Doug Stephens, the founder of the retail consultancy Retail Prophet, explained how that is the cost of customer acquisition. “[Before the pandemic,] brands that understand this [in-store value] were investing disproportionately in creating outstanding experiential playgrounds with which to acquire new customers,” he stated.

Whether it’s embedding the store experience with sustainable interventions (such as L'occitane's sustainable pop-up), reimagining your store as a livestream studio (which many brands attempted during the pandemic), or even the unlikely act of handing out products through a hole in the wall while wearing a bear claw, there are several lively ways brands can reinvigorate their store formats in 2021 and beyond.

Now, as the retail world braces itself once again to take tentative steps towards reopening post-pandemic, Jing Daily asks what the role of stores might be in our ‘new normal’ and how that will play out in China.

The store as media#

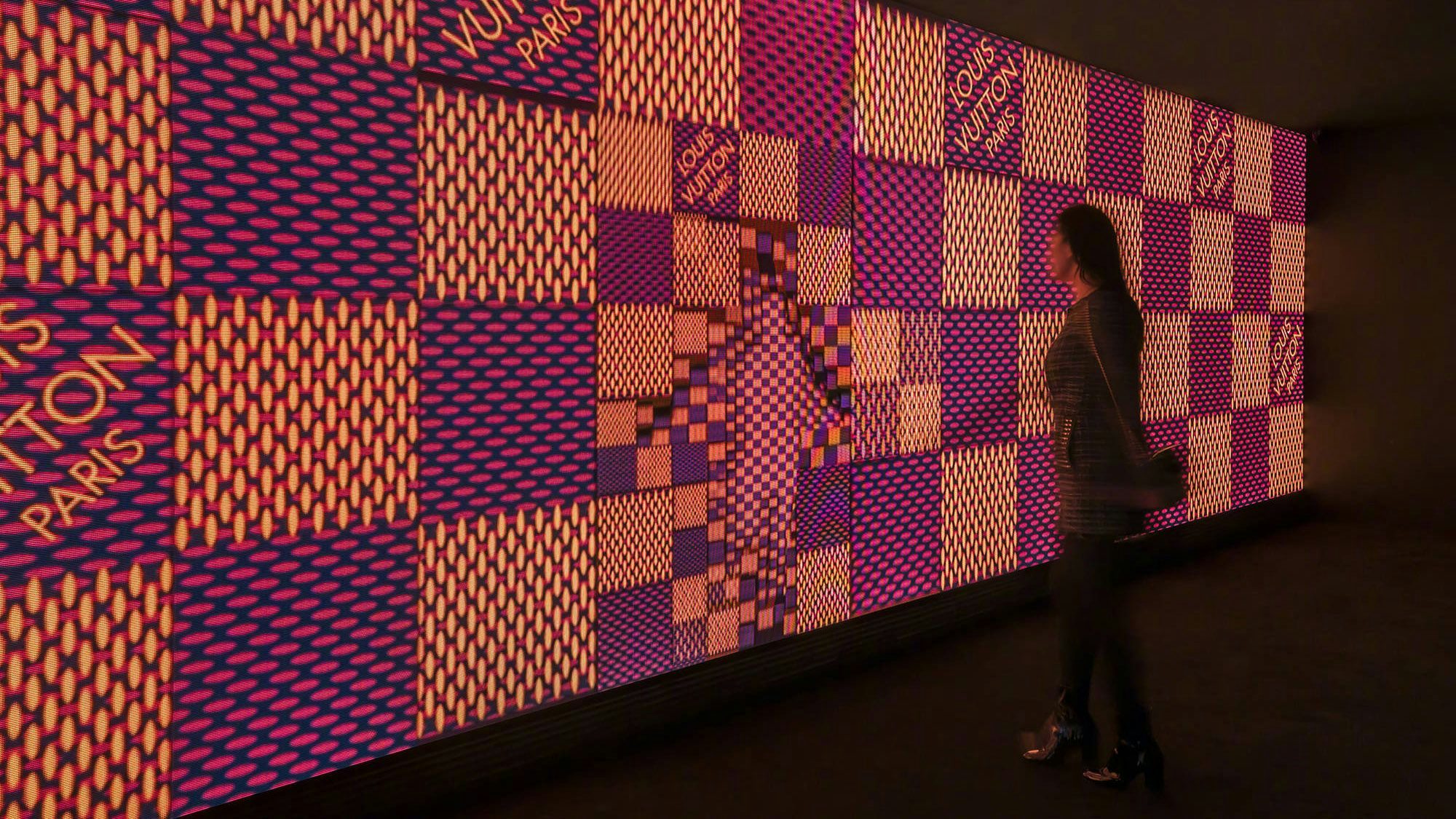

First, Stephens thinks that omnichannel is a dead concept, particularly in the Asian market. In fact, what's happening in retail today is far more profound, and the way he prefers to think of what we're seeing is that, essentially, all forms of media have become the store. And, conversely, physical stores are evolving to become “powerful and measurable media channels.”

“As consumers, our base expectation is rapidly becoming that media, across all channels and devices, is no longer simply a call-out to go to the point of purchase... We are no longer consciously 'going online' to shop, [as] we live in a constant semi-digital state,” Stephens explained, adding that physical stores are transitioning into “media channels so brands can engage customers with physical content, drawing them into the brand ecosystem.”

That means consumers' growing expectations are now that all of a brand’s digital media should be “completely shoppable.” Stephens continued by saying that the cost of digital media will continue to skyrocket post-pandemic, making it “untenable for many brands to even use as a means of customer acquisition.” In effect, digital media must be held to a higher standard to be effective.

“We can expect to see media across channels and devices become far more shoppable and supported with technologies like livestreaming, AR, and AI, while working to create an even better buying experience than a customer used to enjoy in a store,” explained Stephens, offering Nike stores as an example. The goal is to create “highly experiential stores, fully-shoppable digital media, and excellent technology that connects every customer touchpoint.”

As a consequence of this monumental shift, Stephens said physical stores will be measured on three key figures — “four-wall sales, online sales from inside a store's catchment area, and the store's media value (the number of consumers that visit the store multiplied by a base dollar value per consumer impression, modified by the store's net promoter score.)” For Stephens, these three figures form the essential equation for valuing the productivity of a physical store.

Retail as a nomadic journey#

With consumer purchasing power on the rise and attention spans getting shorter, the pressure is on brands to keep customers coming back for more — especially in China, where consumers are spoiled by a bevy of online choices. That can play out in two ways, says Gregory Cole, the director of CDGL Strategic Communications.

The first technique is to immerse consumers in the brand’s lifestyle proposition. It creates a positive way to “refresh” consumers’ understanding and appreciation of the brand but makes more sense in cities with mature consumer bases. “Traditionally, we’ve seen this approach from shopping malls, using their architecture as part of the experience, like their atriums as community spaces for hosting events such as fashion shows, talks, etc.”

Much like the Starbucks “third-space” flagship in Shanghai, Cole expects to see more luxury brands enhancing their boutiques to become “fully-realized independent lifestyle destinations as a way to strengthen their differentiation.”

The second twist is immersing the brand in its consumers’ lifestyles via nomadic retail, pop-ups, or mini shopping mall stores across the country. Cole noted that these initiatives would increase shopping convenience and brand relevance with local consumers who are just discovering the brand. Otherwise, those consumers would have had to travel to Shanghai, Beijing, or Guangzhou to reach a brand’s nearest store.

“An interesting aspect of this nomadic retail is that cities across China have strong local cultures and traditions,” he added. “Instead of replicating the same store concept around the country, brands will stand a better chance of resonating with consumers by reflecting local culture, and more importantly by transforming regularly to match the accelerating consumer journey that we are seeing.”

The store as a temporary creative cohort#

Opening doors is especially challenging for emerging brands given the vast commercial overheads; being stocked by destinations like Selfridges or Lane Crawford can raise seasonal inventory difficulties. Muaz Notiar, Co-founder of Revstance, states his philosophy is based on temporary installations with a clear ROI.

In a move away from permanence, designers can control their parallel visions of the prestigious multi-brand retailer that still brings people into the brand story. “Working with a specific retailer becomes quite difficult. So now we see a designer asking, why do I need to do that? I’d rather a temporary installation for say two months in a specific location,” Notiar stated.

And, what is different post-pandemic is how, in this shrunken timeframe, “before even six months, it was considered a pop-up” with scenarios based on connecting like-minded designers that “follow similar brand themes and basing pop-ups on these values.”

According to Notiar, "That is one of the trigger points we see in the back end. We are experimenting with what would drive a specific person to a location. And, how do you line up the Rubix cube to make the journey worth it? Creating cohorts means overlapping customer pools, and that allows individuals to know that, when they go, it is a broader experience. So it is worth making that journey.”

Retail as a customer interaction or community event#

How the store interacts with the consumer is another key metric for brands to determine and measure. Of course, the level to which brands want to engage will depend on the brand position. But it will be wide-ranging, either with fully-automated experiences with technology or human salespeople. The former can work for convenience retailers. But what about luxury, which is said to hinge on the personal touch and face-to-face sales?

Stephens thinks it might lie in a hybrid of the two. “Higher touch brands and luxury retailers will focus on automating low-value tasks and using technology to empower their staff and stores to deliver exceptional experiences,” he said.

He also added that, beyond customer acquisition, these stores also act as “brand clubhouses, building community among new customers.”Natural beauty brand L’Occitane en Provence’s sustainability concept store in Hong Kong has the dual-appeal of being green and also cultivating a community through rewards and interactive activities.

For Stephens, other iterations of this trend will be powering retail. “Sustainability, across the entire consumer journey, will become table-stakes for all brands. Energy-efficient stores, electrified delivery vehicles, circular manufacturing processes, supply chain resilience, and sustainably constructed goods will be de rigueur, particularly among luxury brands.”

This spring, when Bain & Company surveyed 4,700 consumers in China, they found that customers were now more likely to use livestreams and short-form videos as research and purchasing tools than they were before the outbreak. Luxury brands cannot afford to miss this boat in China. We saw the medium's value during the pandemic after shops transformed into broadcast studios. As such, in-store livestreaming is sure to further embed brands in consumer psyches.

In China, the need for physical stores remains. But the in-store experience has always been sacrificed by the proliferation of digital innovation. As citizens have shown by forming lines around the block, they still crave the physicality of ‘going to the store.’ But now, the reason why is less obvious.

That puts even more pressure on stores and their luxury owners to keep evolving. They will need to excite and entice safely but also ensure quality and have differentiation through assorted products. But this change can be seen as an opportunity to rethink stores for this post-pandemic moment while ensuring shoppers do not experience life without them. Whatever the reason for their existence, they must be justified.