France Holds 48.8% Market Share Of Imported Wine Market#

France, the long-time dominant force in China's imported wine market, will see its iron grip on the industry slowly slip in the years ahead, as major exporters like Italy, Australia, the US, Spain and Chile chip away at the market and more adventurous Chinese drinkers start to look beyond the usual French red. That's the latest finding from the "China High-End Red Wine Report" recently issued by Fortune Character magazine (财富品质), which this week announced that the already red-hot market will only continue growing, albeit at a more mellow pace. As researcher Yang Min (杨敏) said this week at the press conference, China's wine industry maintained an average growth of 70 percent, with the share of imported wine accounting for around 25 percent of the total market. According to Yang, with imports expected to keep growing at a steady pace, imported wine should make up about 40 percent of the total domestic wine market in China within the next five years.

As chief researcher Zhou Ting (周婷) said, increasing diversification and more (and more regular) wine consumption among China's middle class should see France's domination of the high-end red wine market in China slip. Said Zhou, the trend in China is moving towards label and style diversification, with New World wines showing strong gains, adding that the premium that Chinese consumers currently put on major French winemakers will likely fade within the next three to five years.

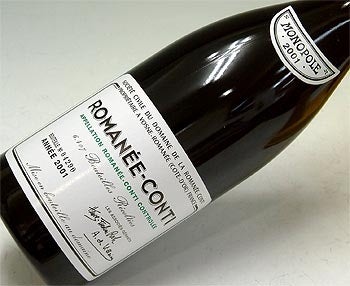

According to Fortune Character's report, 43 percent of China's wealthiest wine drinkers consume red wine more than twice a week, with 13 percent consuming it more than five times per week. Breaking down the study's findings further, the wealthiest respondents in the study said they felt quality is guaranteed for wine priced above 500 yuan (US$79), adding that this is their conception of the boundary between "high-end" and "common" red wine. In terms of buying criteria, respondents listed label, year, and word-of-mouth as key drivers, with 33 percent saying they still buy premium wine at high-end wine stores and 16 percent saying they purchase wine directly from sources overseas. As for preferred wineries, the survey listed the top ten as Château Lafite Rothschild, Château Latour, Château Cheval Blanc, Pétrus, Domaine de la Romanée-Conti, Château Mouton Rothschild, Château Ausone, Opus One, Almaviva, and Penfolds.

Perhaps recognizing the importance of increasing the scope of Chinese drinkers' understanding of the diversity of French wine-growing regions (and counterbalancing reputation concerns caused by the proliferation of counterfeit Lafite), France has invested heavily in efforts to introduce Chinese wine "newbies" to its sparkling wines, whites and rosés. As Jing Daily wrote earlier this month, the French Agriculture Ministry recently announced plans to launch a three-year campaign aimed at introducing Chinese wine drinkers to 400 types of wine from 12 regions all over France, among them Alsace, Beaujolais, Corse, Jura and Savoie, Languedoc Roussillon, Provence, Sud-Ouest, the Loire Valley (Jing Daily coverage) and Cotes du Rhone.