Auction Series Pulls In Grand Total Of US$400 Million Over The Course Of Week#

We've kept a close eye on the Asian Art Auction series taking place at Sotheby's in Hong Kong this week, where strong bidding for top-quality contemporary and traditional art, watches, wine and jewelry brought in a grand total of HK$3.08 billion (US$400 million) -- a new record for Sotheby's Hong Kong and more than its spring and autumn 2009 auctions combined. What stands out about this week's series, aside from its record-breaking total, is the buying habits of Chinese buyers.

It's well accepted from an industry viewpoint that Hong Kong, and increasingly mainland, Chinese buyers are highly particular about the items they're buying but see no problem going far beyond estimates for important works of art or specific vintages of wine. The quality of items up for the hammer this week in Hong Kong underscored the importance that Sotheby's is placing on Hong Kong, not as a dumping ground but as a key, thriving auction market.

With mainland Chinese buyers piling into art as a status symbol and as a potentially lucrative alternative investment, intense competition and a diminishing supply of top Chinese antiques coming to market have sent records tumbling.

A yellow-ground famille-rose Qing vase fetched $32.4 million, the highest ever price for a Chinese porcelain piece at auction, a pair of floral medallion Qing bottle vases made $18 million while an imperial white jade seal from the Qianlong period fetched $16 million, a world record for white jade.

"What we saw was just that desperate, desperate hunger for objects of great quality," said Kevin Ching, the CEO of Sotheby's Asia in a Reuters interview. "It's a very delicate chemistry between the collectors' desires and the outstanding quality of the objects available. There was a growing realization that outstanding objects are in very short supply."

Half of the top lots were bought by mainland Chinese.

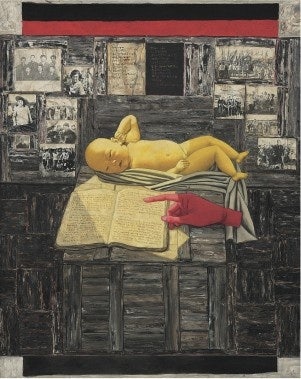

As we noted earlier this week, Monday's Contemporary Asian Art auction -- which saw a rare work by Zhang Xiaogang sell for nearly US$7, a new record for the artist -- racked up a grand total of US$27 million, comfortably above the pre-sale estimate of $19 million. Driven by high-quality works by artists like Liu Ye, Cai Guo-Qiang, and Yu Yaohan, Chinese collectors showed a preference for single-owner lots and even indicated a growing interest in contemporary photography, with a Zhang Huan photo going for US$142,000. As the Reuters article notes, 25% of the lots at the Contemporary Asian Art auction did not sell, but sell-through rates for Chinese artists was higher than Japanese or Korean artists, which reflects on the quality of Chinese lots on the block in Hong Kong.

As Kevin Ching of Sotheby's said today, the burgeoning interest in art collecting as a status symbol or financial hedge among China's newly wealthy -- and the creeping scarcity of high-quality pieces -- could see Hong Kong becoming a major market for Western art. Much in the same way that Japanese collectors plowed into Western impressionist or modern artists in the 1980s, Sotheby's expects Chinese collectors to do the same in the next decade. We've already seen some rumblings in this area, with Picasso's “Nude, Green Leaves and Bust” rumored to sell to a Chinese telephone bidder for US106.5 million in May, and a set of 10 Warhol "Mao" prints selling in Hong Kong for US$851,000 one month later.