What happened

Today, Ralph Lauren Corp. reported better-than-expected earnings for its third quarter of FY2020, which ended on Dec. 28 before the coronavirus outbreak hit.

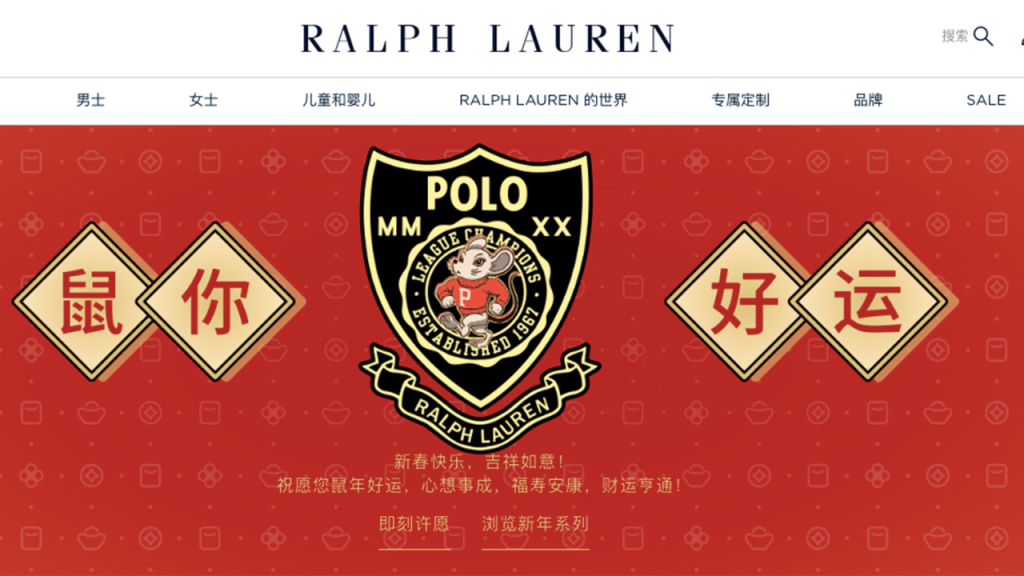

Asia shows strong momentum in reported net revenue at 5.4 percent growth, surpassing growth in Europe (3 percent) and North America (0.2 percent) but with more potential yet to be uncovered. “Asia is still in the earlier stages of growth since we’re only a little over two years on Tmall and JD.com and just launched our China site a year ago,” said Ralph Lauren Corp.’s spokesperson, Katie Ioanilli, to Jing Daily.

Net income for the third quarter rose to $334.1 million from $120 million from the previous year. Adjusted earnings of $2.86 per share came in well ahead of the $2.45 projected analysis. The company’s shares soared 11.3 percent by midday in New York.

"We continue to make strong progress on our Next Great Chapter plan amid a volatile backdrop, with third-quarter results ahead of our overall expectations,” said Patrice Louvet, Ralph Lauren’s president and CEO, in an earnings release. In addition to Ralph Lauren brands, the company also houses Club Monaco and Chaps, the latter of which mirrors Polo Ralph Lauren’s preppy American style.

Ralph Lauren Corp.’s five key strategies under Louvet include:

- Win Over a New Generation of Consumers

- Energize Core Products and Accelerate Under-Developed Categories

- Drive Targeted Expansion in Our Regions and Channels

- Lead With Digital

- Operate With Discipline to Fuel Growth

In line with the above directions, the company has certainly kept itself busy in China in the last quarter. It launched Buy Online-Ship From Store fulfillment in China as well as a WeChat Mini-Program for Singles' Day last November.

The Jing Take

Approaching the 10th anniversary of its first store in China, Ralph Lauren has been giving more attention to the Asian market as sales at home remain stagnant. The future looked bright as of last December, but what’s happened in the last month with the coronavirus puts the company’s financial future up in the air.

The company has listed “epidemic diseases” in its last annual report, but it’s unclear whether they are prepared for this one since around one-third of Ralph Lauren products were reported as sourced from China for the fiscal year ended on March 30, 2019. The same report tells investors that they “do not own or operate any manufacturing facilities and depend exclusively on independent third parties for the manufacture of our products,” and that epidemic diseases could result in “closed factories, reduced workforces, scarcity of raw materials, and scrutiny or embargoing of goods produced in infected areas.” While this might sound like a futuristic nightmare, it has recently become a real-life issue.

Now that the majority of China is stuck at home, consumers might turn to online commerce for a fix. But if the manufacturing cannot keep up, what’s the difference between a digital store and empty physical stores?

The Jing Take reports on a leading piece of news while presenting our editorial team’s analysis of its key implications for the luxury industry. In this recurring column, we analyze everything from product drops and mergers to heated debates that sprout up on Chinese social media.