What happened

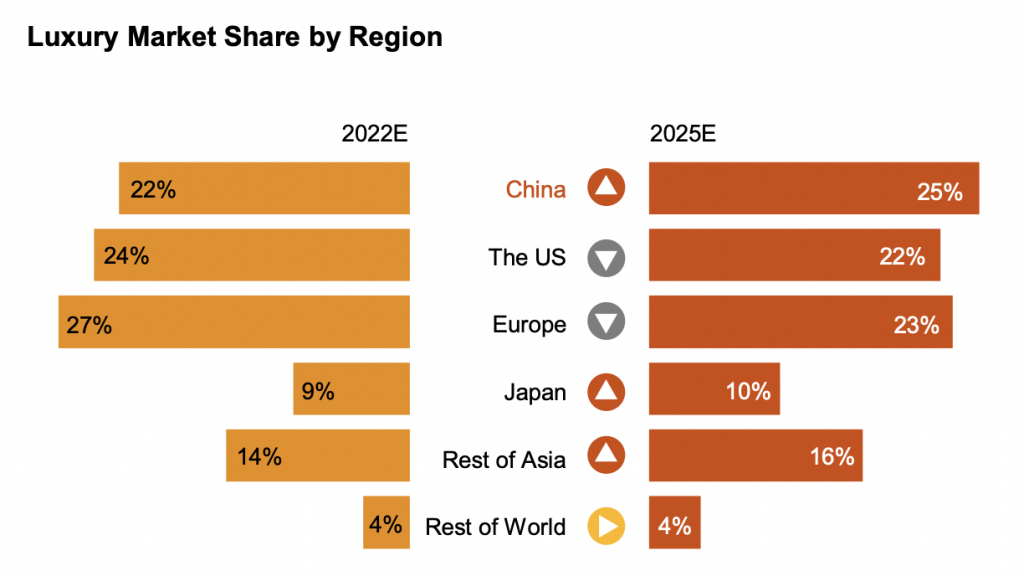

Tourism is right on track and the global luxury market is steadily recovering, says PwC. According to a report released by the consulting firm this month, the US and Europe spearheaded luxury consumption in 2022 — helping the industry surpass pre-pandemic levels — while the Asia-Pacific region was impacted by prolonged lockdowns.

However, it’s estimated that by 2025, China’s luxury market will reach 119 billion (816 billion RMB) and account for a market share of about 25 percent, due to “the higher internet penetration, social media exposure and increasing consumption power of young generations.”

PwC identifies several factors that could influence the country’s luxury sector: high-net-wealth individuals, who prefer “exclusivity, scarcity, value preservation, and mystery”; circularity, resale, and rental models; as well as metaverse initiatives that reinvent the customer journey.

The Jing Take

As China continues to be a driver of global luxury growth, brands need to look at what makes the market tick: namely, high-net-worth individuals and shoppers born after the 1990s. The former, defined by PwC as having a net worth of about 1.4 million (10 million RMB), make up just 0.3 percent of China’s population but 42 percent of luxury sales. These individuals prefer to invest in value-preserving products, such as haute couture, watches and jewelry, and are motivated by scarcity and cultural capital.

Meanwhile, those born in the 1990s account for 46 percent of China’s luxury market. Driven by self-reward and individualism, these shoppers are interested in avant-garde designs and extreme novelty, particularly when it comes to apparel and footwear as they signify personality attributes. Post-90s consumers also expect brands to incorporate more Chinese cultural elements into their products; hence, the pandemic saw more brands launch global limited-edition products around Chinese festivals, roll out creative pop-ups around the country, and craft China tailor-made items.

Additionally, there are various “pandemic-enhanced opportunities” that could propel luxury growth in the coming years, notes PwC. For starters, the luxury market penetration rate in lower-tier cities is growing. Global companies have already begun to cash in on tier-3 cities, including Sanya, a tourist destination and duty-free hotspot on Hainan, as well as Qinhuangdao, where Valentino and Louis Vuitton hosted takeovers of its Aranya neighborhood. Hainan is particularly important for accelerating brand expansion as it plans to become fully duty-free by 2025, meaning brands no longer need to work with duty-free licensees.

By contrast, Hong Kong’s luxury landscape has changed dramatically over the past three years. Not only did the city lose its reputation as the world’s largest export market for Swiss watches and the most expensive commercial rental location, but it also lost many luxury brand stores. With the price differential between Hong Kong and the mainland shrinking and Hainan’s duty-free economy expected to boom, the special autonomous region has lost its edge; in fact, 55 percent of the world’s new luxury brand stores opened in mainland China in 2021.

While Hong Kong remains an attractive shopping destination, it will take a makeover — in the form of opening new premium flagship stores, unique products, and being on the forefront of international trends, says PwC — for it to rebound as a prime luxury location.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.