Study On Retail And Consumer Products Sector In Asia Predicts Strong Growth In Fashion, Online Shopping, Luxury Markets#

Today, PricewaterhouseCoopers (PwC) released its 2011 Outlook for the Retail and Consumer Products Sector in Asia report, highlighting some of the top trends we should see in the food and general retail, fashion and apparel, online retailing, consumer goods, luxury brands, and consumer goods and electronics sectors in the coming year. While some of the report's findings -- such as the expected growth in fashion demand by consumers' "increasing appreciation for fashion" -- are unsurprising, others, such as the projection that online retailing may be "on the brink of staggering growth in China," are more compelling. As one would expect, China, as the world's second-largest economy and the fastest-growing consumer market, features heavily in this report, with PricewaterhouseCoopers bullish about the country's nascent online marketplace and red-hot luxury market.

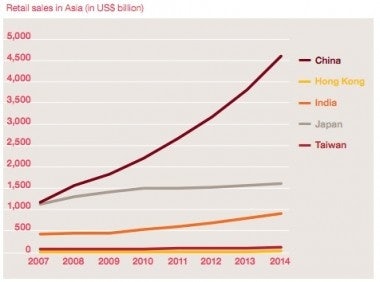

China's retail sales growth is expected to far outpace the other Asian economies profiled in the PwC report, with the country expected to post 14.6% retail growth next year and 12.4% growth in 2012. That leaves BRIC counterpart India in the dust, with India expected to show 3.9% retail sales growth next year and 5.6% in 2012. Developed Asian markets, specifically Australia and Japan, will fare less well, according to the report, with these countries' retail sales expected to grow only 0.2% and 0.8% next year, respectively. In number terms, retail sales in China are expected to reach US$2.2 trillion in 2011 -- more than double the level in 2006 -- and US$4.6 trillion by 2014.

With the Chinese retail market predicted to expand rapidly in the next five years, fashion retailers are among the most optimistic about their prospects both in mainland China and Hong Kong. While the estimated US$44 billion in market demand in 2010 buoyed luxury brands, it also bodes well for mass market retailers. Recently, the American fast-fashion chain Gap opened its first stores in Beijing and Shanghai, and Sweden's H&M opened well over 200 locations throughout China over the course of 2010. Other chains, such as Spain's Zara and Japan's UNI QLO, have also posted record growth in China this year. According to PwC's findings, they can expect more of the same through 2014, when market demand in China should reach US$91 billion. Hong Kong should continue to benefit from mainland Chinese consumer demand as well, with PwC noting in the report, "Hong Kong...will continue to be an important clothing market for international brands, many of which use the territory as a base to introduce their wares to visitors from the mainland."

Perhaps the most important finding in PwC's new study is that online commerce "represents the next major area for retail growth in Asia." Although this isn't exactly a secret, as online retail platforms like Taobao have thrived in China for years, according to the report, with improving technology and changing consumer spending habits, China "seems set to skyrocket." Christophe Bezu of Adidas, remarking on the potential effect of online retail growth driven primarily by younger, tech-savvy Chinese, said, "China is shaping its own local brands, its own local tastes, and when you have 500 million Chinese internet consumers, it's clear that they will change consumption patterns." Qualifying that statement, Bezu added that Adidas opened its online shop on Taobao this August "with incredible results," and that the company expects "that this will be a profitable channel [helping Adidas to] reach a critical mass of consumers." However, Bezu noted, the vastly different online retail models in China, South Korea and Japan make the company's online presence in Asia "quite complex."

Essentially, the online retail market in China is at a crossroads: it's grown so fast that retailers are struggling to catch up, but at the same time the sector remains underdeveloped, hampered by issues of transaction security and credit-card use. While Taobao's Alipay service sidesteps much of these problems, credit card payment has increased much more slowly in popularity, as credit card company charge a 5-10% transaction fee that consumers in China have so far been reluctant to pay.

In the luxury market, PwC's report -- like other recent reports by McKinsey, Bain and others -- expects continued growth in China over the next five years, as brands expand into emerging second- and third-tier markets. However, the report is quick to point out one important qualifying factor: while the opportunities are "enormous," there is presently "a dearth of high-end retail space, few well-trained sales staff and rising competition." Also, times look to be tough for emerging Chinese luxury brands like Trands, NE-TIGER or Qeelin that are trying to get a deeper foothold in their home market, as established Western brands commit more resources to China expansion and consumers continue to be enticed by their "exclusive, foreign provenance." The report notes that Gucci has earmarked 60% of its expansion budget to China. It'll be very difficult for local brands to match this.