What happened

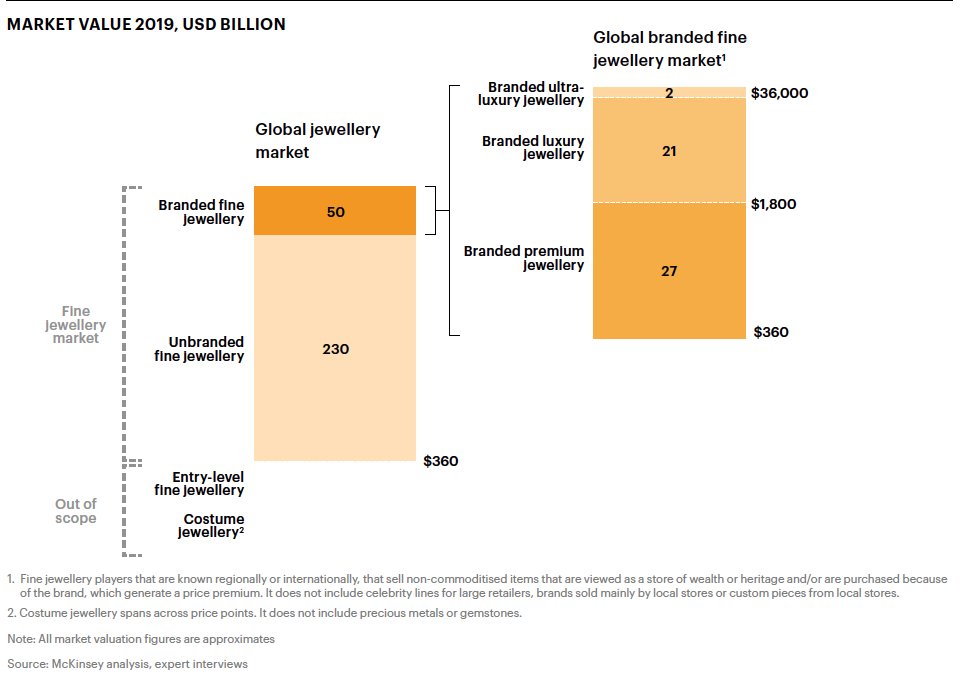

China, India, Japan, and the US have become the world’s major platinum jewelry markets, thanks to brands and consumers’ commitment to the metal due to market development activities by PGI. However, branding is a substantial yet underrepresented market opportunity in jewelry. This finding was affirmed by “State of Fashion: Watches and Jewelry,” co-released by Business of Fashion and McKinsey & Company this June. The study forecasted that the global fine jewelry market would become more branded in the coming years, and branded fine jewelry would grow at compound annual growth rates (CAGR) of 8 to 12 percent between 2019 to 2025, with price points around six times higher than unbranded products.

Still, only 18 percent of global fine jewelry is branded and this number is even lower in China at 15 percent. Hence, Platinum Guild International (PGI®) remains steadfast in promoting the use of branded collection strategy to consolidate platinum’s equity as a premium, high-quality metal that represents love, meaning and authenticity.

Branded collections are an effective strategy to build resonance with young consumers, both in the bridal and non-bridal categories, thereby driving jewelry category’s growth.

The Jing Take

Instead of selling pieces based on weight — the traditional sales strategy among Indian and Chinese jewelry retailers — branded jewelry is sold via piece-based pricing. Given that the value of these jewelry pieces has risen much higher than just the cost of the metal, branding is becoming a significant margin driver that can provide retailers with competitive edge.

Fundamentally, branded collections are about imbuing products with perceived intangible values in the mind of consumers. This approach necessitates a consumer-first mindset, in both design and storytelling to create a meaningful proposition that is important to the target consumer segment.

But even before the brand narrative, design is important for consumers and therefore is fundamental for jewelry makers. In recent years, PGI has been exploring new technologies and developing new alloys with partners, including hard platinum and heat-treatable alloys that allow for more refined contours, better polish & shape retention, and higher scratch resistance. These innovations have enabled greater design possibilities for platinum to capture a more competitive market position.

Branded collection has proven to be a powerful tool to ensure platinum will stay relevant within evolving consumer needs. It should even capture new growth opportunities such as the self-purchase segment in the US and young consumers in Japan markets, not to mention the emerging men’s jewelry segment in India and China.

With branded jewelry expected to lead the growth of the fine jewelry market, branded collections will continue to play a significant role in the platinum jewelry global market strategy.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.