Investment Funds Specializing In Diamonds, Wine, Art Catching On Among Wealthy Chinese#

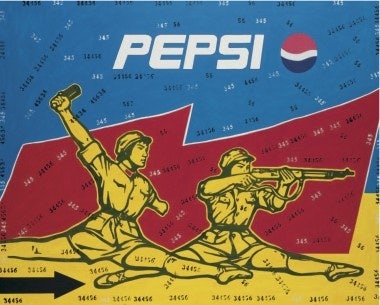

Wang Guangyi's "Great Criticism Series - Pepsi" sold for HK$1.16 million this spring in Hong Kong

Late last year, Jing Daily covered the growing potential of art funds in China, where more aspiring collectors are turning to investment funds as a more affordable way to get into the country's booming art market. As we pointed out at the time, art funds have long been around in Western countries, though in the wake of the global economic crisis of 2008 funds overloaded with European or American artists to the exclusion of Asian artists saw decidedly mixed results. In response to growing demand from new collectors -- who have plowed into the Chinese auction market so quickly that "super-collector" Liu Yiqian recently said he'll "know less than one-fifth of the players in this area in the next five years" -- Jing Daily added:

We’ve already seen investment funds focusing on everything from education to real estate appearing in China, but art investment funds really haven’t materialized yet. However, it’s just a matter of time before they do, and we would assume they’d be well-connected with ascendant mainland Chinese auction houses like Poly and China Guardian.

As it turns out, it's not just art funds that investors, spooked by inflation and often ambivalent towards the Chinese stock market, are looking to. This week, China Daily looks at the growing number of investment funds specializing in wine, diamonds and even musical instruments that are appearing in China. These so-called "passion funds" -- "investment vehicles that offer significant long-term returns from luxury collectibles such as art, fine wine, diamonds, rare musical instruments and mint condition comic books" -- at times met with a cool response in years past, but now they're once again catching on.

From China Daily:

Market volatility and severe declines have reduced the attractiveness of many other investment options, such as equities, bonds and hedge funds, so it's not surprising that investors are increasingly attracted to passion funds, said Enrique E. Liberman, president of The Art Fund Association based in New York.

"More money from Asia is going into such funds. We've heard of a rare fancy colored diamond fund targeting China. The fine wine funds are going there too," he added.

High net worth investors no longer see such investments as an indulgence in expensive hobbies. Rather, the funds allow them to diversify investment portfolios based on more traditional assets and hedge against inflation.

Hong Kong has become a key wine auction market for Sotheby's and Christie's

While interest in niche "passion funds" specializing in rare books or musical instruments might be there, it's really in the art and wine segments that these funds are likely to find success in China. As the article points out, the emergence of Chinese collectors and investors on the art scene and in the global wine auction market has had dramatic effects on the rising prices for top Chinese contemporary art (particularly for "blue-chip" artists) and sought-after wines.

Strong demand from Asia in general and China specifically is expected to drive the Liv-ex Fine Wine 100 Index to a 21 percent increase this year, likely making investors in wine investment funds very happy indeed. With auction houses breaking records left and right at this spring's auctions in Hong Kong and mainland China, we can expect even more funds to try to diversify their holdings to include more top historical Chinese contemporary artists. As the article concludes:

Most Chinese millionaires, whose average age is 39, tend to keep a low profile. Their luxury possessions include watches, Chinese classical art and an average of three cars. Many are also drawn to art.

With China surpassing the UK as the second-largest auction house and gallery market and becoming a very important purchasing power, and with Chinese auction houses making record sales, "we see that there is an opportunity for art funds in China", said Daniela Sanchez, art advisory and investor relations associate at Fine Art Fund Group Ltd.

Although art as an investment class is still new in China, some early participants recognized the immense potential of the market: Noah Holdings Ltd, Beautiful Asset (Beijing) Management Ltd Co and Shanghai-based Terry Art Fund Management.

...

As the value of Chinese art continues to rise exponentially, funds investing in this asset class will need to raise increasingly large amounts of money to have an impact in the market.

What would be considered a large fund by US and European standards, perhaps exceeding $250 million, could become more commonplace, said Michael Plummer, a principal at ArtVest Partners LLC, an investment advisory firm.