Engaging Key Opinion Leaders (KOLs) is perhaps the most effective way for beauty brands to market to digitally-savvy Chinese consumers. In February, traditionally peak season for beauty products thanks to holidays like Spring Festival and Valentine’s Day, many brands tapped KOLs to enhance their digital visibility among consumers. However, the effect of these KOL collaborations, whether paid or organic, fared quite differently among brands, according to a report by the KOL marketing agency PARKLU.

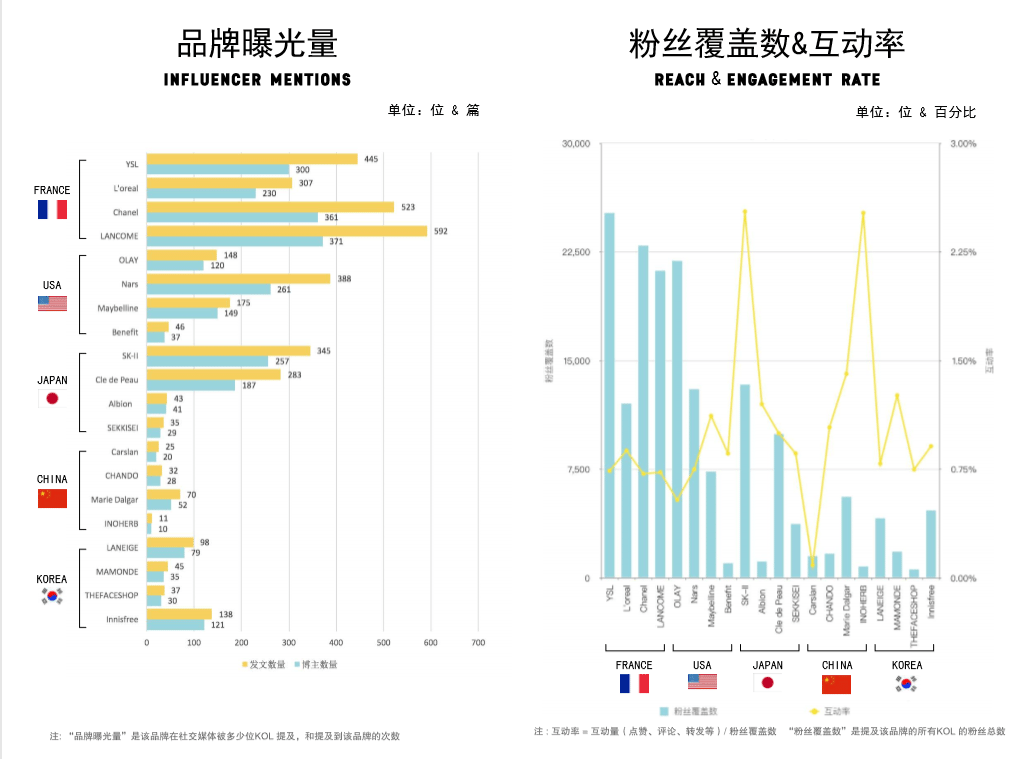

The more influencer mentions do not always lead to higher engagement with an online audience. The most striking finding from the report is that more mentions by Chinese KOLs on social media do not necessarily lead to higher engagement with online consumers. As illustrated by the chart above, four representative brands from France, namely YSL, L’Oréal, Chanel, and Lancôme, received a total of 1,262 online bloggers’ mentions in 1,867 articles. In comparison, their Chinese counterparts, which consists of Carslan, CHANDO, Marie Dalgar, and INOHERB, were mentioned in just 138 articles by 110 bloggers.

The French brands saw an average engagement rate of 0.75 percent, falling short of the Chinese brands, which (except for Carslan) all scored over 0.75 percent. The Chinese herbal beauty brand INOHERB, for instance, had only 11 posts by 10 bloggers in February, but had an engagement rate of approximately 2.5 percent.

“Influencer mentions can be interpreted as the interest (paid and organic) from influencers. Engagement rates can be interpreted as the organic interest of the influencers' followers,” said Elijah Whaley, chief marketing officer (CMO) of PARKLU. “Engagement rates can be one of the best indicators of general awareness, sentiment, and interest among influencers' followers, and by extension, the general public.”

One explanation for why more interest was generated by influencers for these Chinese brands is that they were reaching a smaller, more targeted audience with information that was not available everywhere else. But a more thorough understanding requires deeper analysis, as engagement can correlate to many factors like general sentiment, product launches, special marketing campaign tactics, and the likes, Whaley added. “The real secrets to [diverse] general sentiment are hidden in the influencers posts’ comments,” he said.

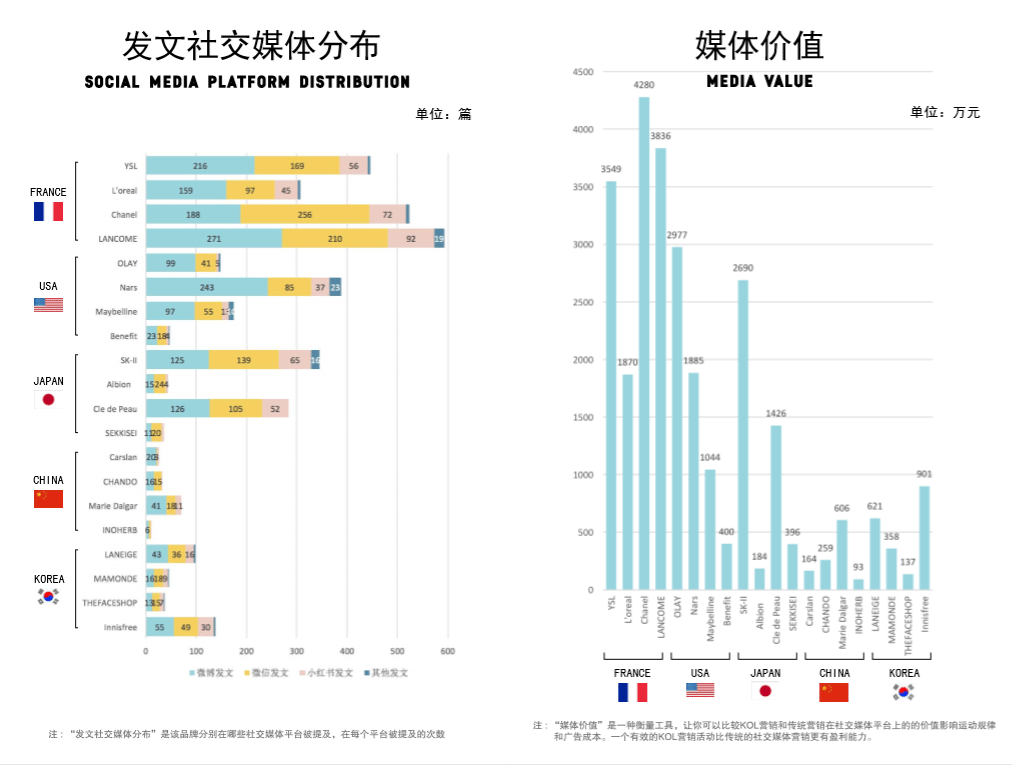

In addition, the report reveals the social media platform distribution of influencer mentions about beauty brands. Weibo and WeChat are still the prime locations for KOLs to promote beauty products in China. RED, a cross-border social commerce app, is quietly catching up thanks to recent collaborations with high-profile celebrities like Fan Bingbing and Lin Yun. PARKLU recommends beauty brands pay more attention to this platform.

The report also offers a comparative analysis of the media value of each brand. This metric allows brands to compare the value of influencer generated impressions and engagement to traditional social media ad impressions and engagement costs. Currently, owing to the high level of organic mentions by influencers, Chanel is leading the list, followed by Lancôme, YSL, OLAY, and SK-II. The same report also indicates a declining influence of Korean beauty brands in China, which is being outpaced by Japanese premier skincare makers like SK-II and Clé de Peau.