Physical retail stores have taken a hit over the past several years as online retailers, such as Tmall and JD.com, have lured consumers away from crowded malls and shopping centers. While brands and brick-and-mortar retailers have scrambled to appeal to consumers and maintain foot traffic in their stores, some have found more success than others as they embrace technology.

Online shopping may be changing the physical retail landscape, but one part of the industry seems to remain resilient – outlet malls. Due to their ability to adapt to the latest digital trends in China, outlet malls are thriving.

It may seem contradictory for a physical mall to venture into online retail, especially the e-commerce space, as the current e-tail market is already so crowded. But as consumers browsing in stores often search online prices from their phone already, retailers might as well to cater to their needs.

Florentia Village, the luxury outlet owned by Italian retail giant RDM Group with six locations in China, continues to make breakthroughs on different digital fronts, but with a specific purpose – to convert online traffic to in-store foot traffic.

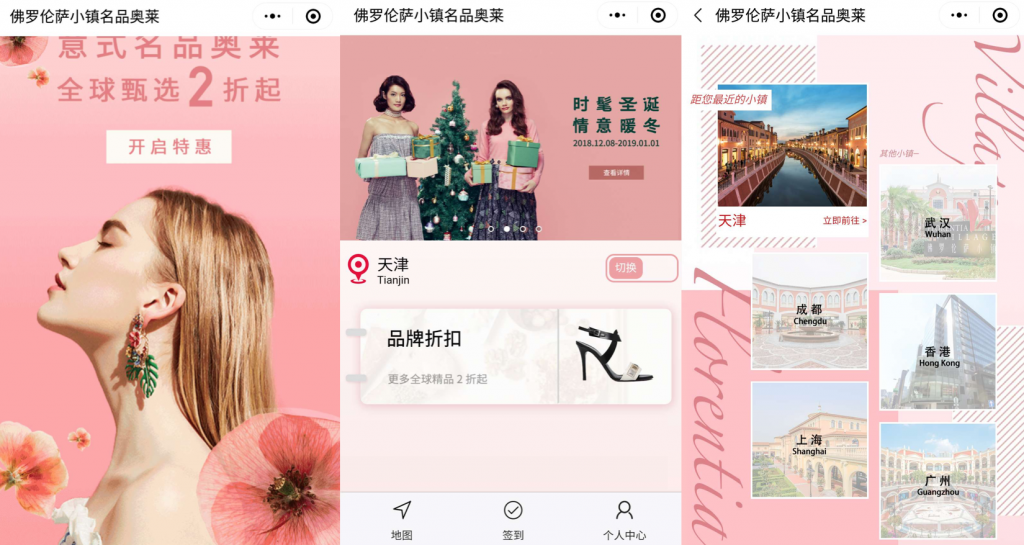

Seven months after establishing its e-commerce platform in February 2018, the outlet mall chain launched its official WeChat mini-program to further enhance the connection between its physical outlets and digital channels. The mini-program is organized with a list of each individual location, and within each location it provides information on the current store sales, events, an interactive map, and personal membership program. A highlight of it is the rewards program – every time a user checks in through the program, they can earn reward points to redeem gifts; they can also purchase gift cards to share with their friends on WeChat.

According to Florentia Village, the mini-program has generated a lot of virtual attention: attracting more than 1 million page views and nearly 100,000 likes within three months. More importantly, the digital traffic has converted to in-store foot traffic – in the first month after the launch, the mini-program attracted more than 240,000 online visits and converted nearly 20 percent of online users to offline shoppers.

The outlet is also prepared to charm consumers with special offline events that will further convince online users to make a physical visit. For example, last year, the outlet hosted “Salute Coach 75 years of heritage” event. The personalized Coach+ Florentia Village experience included a product story seminar, leather craftsmanship workshop, VIP gift offers, tailored Italian cuisine, and exclusive wine tasting.

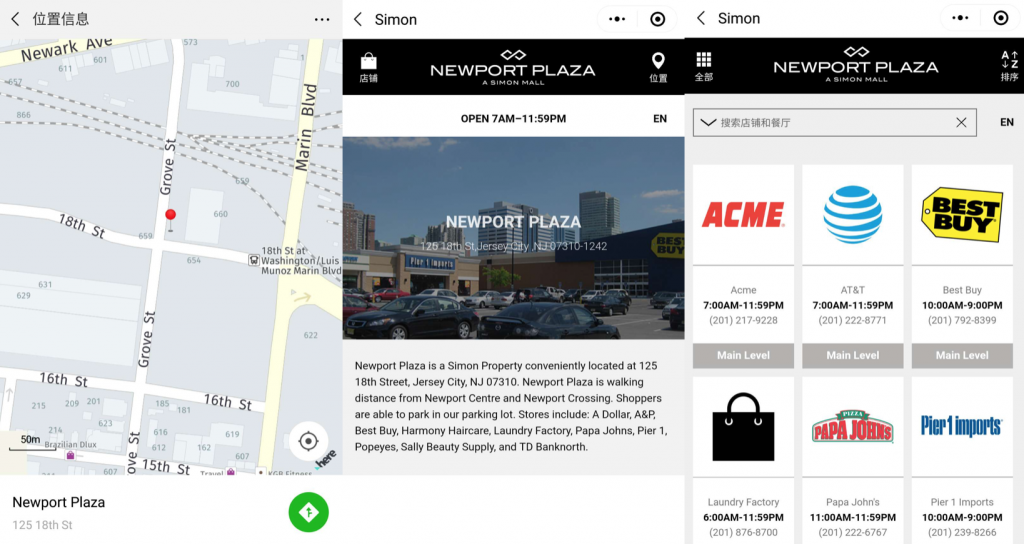

Beyond outlet malls in China like Florentia Village, overseas ones, many of which rely on Chinese travelers, have created digital channels knowing that customers would enjoy the same digital experience in China as abroad. For example, Simon Property Group, an American retail company that owns major outlet malls in popular U.S. travel destinations, has a WeChat mini-program that lists all its properties and includes maps to direct visitors to their locations. Even though the content is lacking, it’s a good start to serve as a guidebook for Chinese tourists.

Outlet business in China can demonstrate great resilience to global trade risks and macroeconomic trends, as it focuses on domestic consumption of the Chinese middle class, whose purchasing power continues to fuel the global luxury industry. According to independent market research by China Insights Consultancy, outlet sales in China are expected to grow at 25 percent annually over the next five years from 2018, and reach approximately 93 billion (RMB 640 billion) by 2030, outpacing even the U.S. market and becoming the world’s largest outlet mall market by revenue.

The digitalization of outlet malls has demonstrated yet again the importance of crafting an equally satisfying online experience to match the in-store customer experience. It’s a trend that has become a must to attract savvy Chinese consumers.