Luxury Buyers' Changing Purchasing Habits Cause Record Number of Store Closings in China#

The latest report by the investment research company Bernstein revealed that from 2016 to 2017, China closed more luxury stores than any other country in the world. The driving force behind this large-scale store closing, according to the consulting firm Bain & Company, is the Chinese luxury shoppers, whose purchasing behaviors have been constantly shaped by the country's fast-growing e-commerce industry.

The convenient and increasingly rich online shopping experience created by China's major e-commerce platforms, such as Alibaba Group and JD.com, have been perceived by Chinese luxury consumers as an alternative to buying goods at the offline retail stores, the Bain & Company's recent report on global Chinese luxury shoppers said.

More than 50 percent of surveyed consumers said they increased their online spending on luxury goods via domestic sites last year. Customers from the second and third-tier cities, in particular, welcomed the luxury goods offerings on domestic e-commerce sites as they have limited access to the retail stores, the report said.

Outlet Malls Can Survive Thanks to Middle-Class Luxury Consumers' Pragmatic Approach#

In regards to the opportunity in China's luxury brick-and-mortar sector, Bain & Company advised looking at the country's middle-class luxury customers and how their approach to luxury shopping is different than the ultra-wealthy population.

Chinese middle-class shoppers are known for their pragmatism, meaning they are much more price- and value-conscious compared to the wealthier ones. Their pragmatic approach to luxury shopping has made them more interested in visiting outlet stores, where "out of season" luxury goods are typically sold at a reduced rate thanks to a variety of reasons.

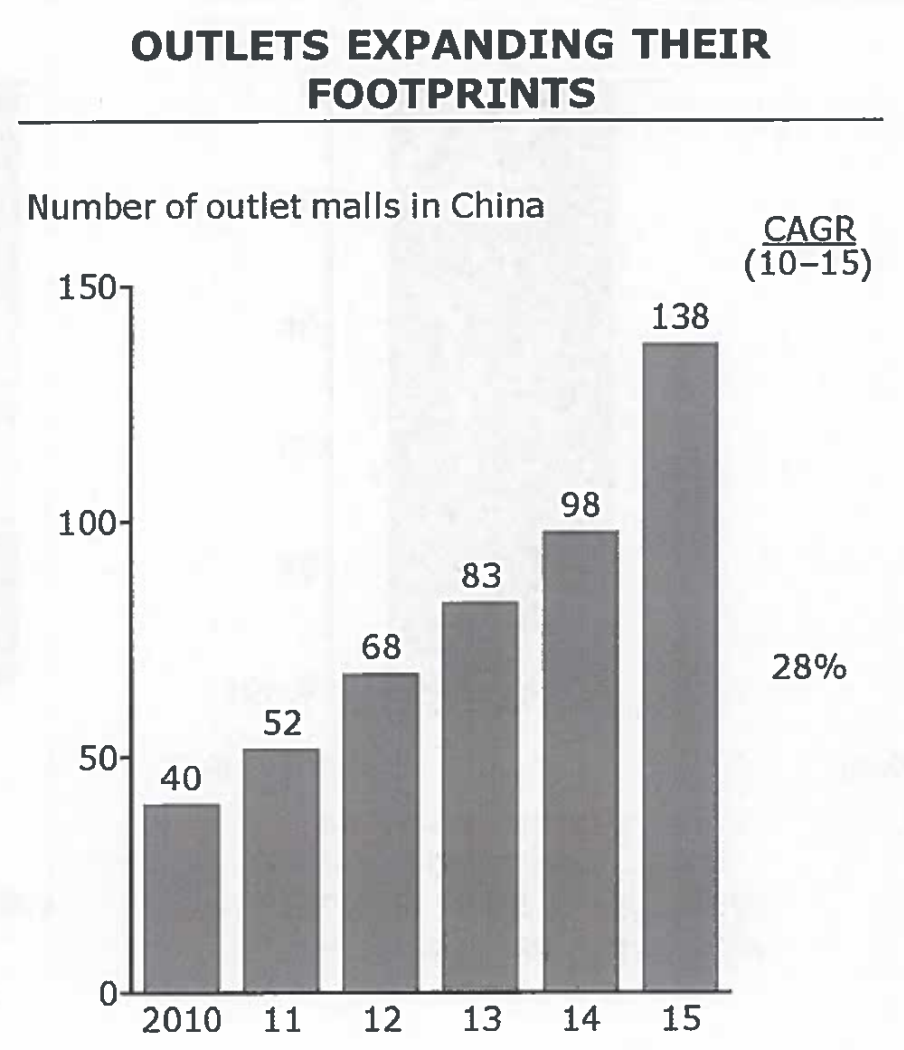

When asked if they will increase their luxury spending in outlet malls next year, 66 percent of respondents surveyed by Bain & Company gave an affirmative answer. Luxury brands in China have already taken note of this trend. There were 138 new outlet malls opened in China in 2015, about a 41 percent increase from the year before.

“[The opening of outlet malls] can compensate for the struggling of full-price retail business, and restock the vast retail networks of stores brands have been opening,” wrote the report. However, the consulting firm also warned against the overexpansion of outlet malls by luxury brands, as it could “cannibalize the full-price stores,” which is likely to have long-term damage to the value of brands.