In “Headlines from China,” we share the biggest news stories about the luxury industry in China that have yet to make it into the English language. In this week’s edition, we discuss:

- Olay’s Ambassador Controversy Startles China’s Tax Authority

- Brands Taste Initial Success Over Livestreaming via WeChat Mini-Program

- Taikoo Li Owner, Swire Properties, Reports 55% Decrease in 2019 Group Profit

Olay’s Ambassador Controversy Startles China’s Tax Authority#

—#

National Business Daily#

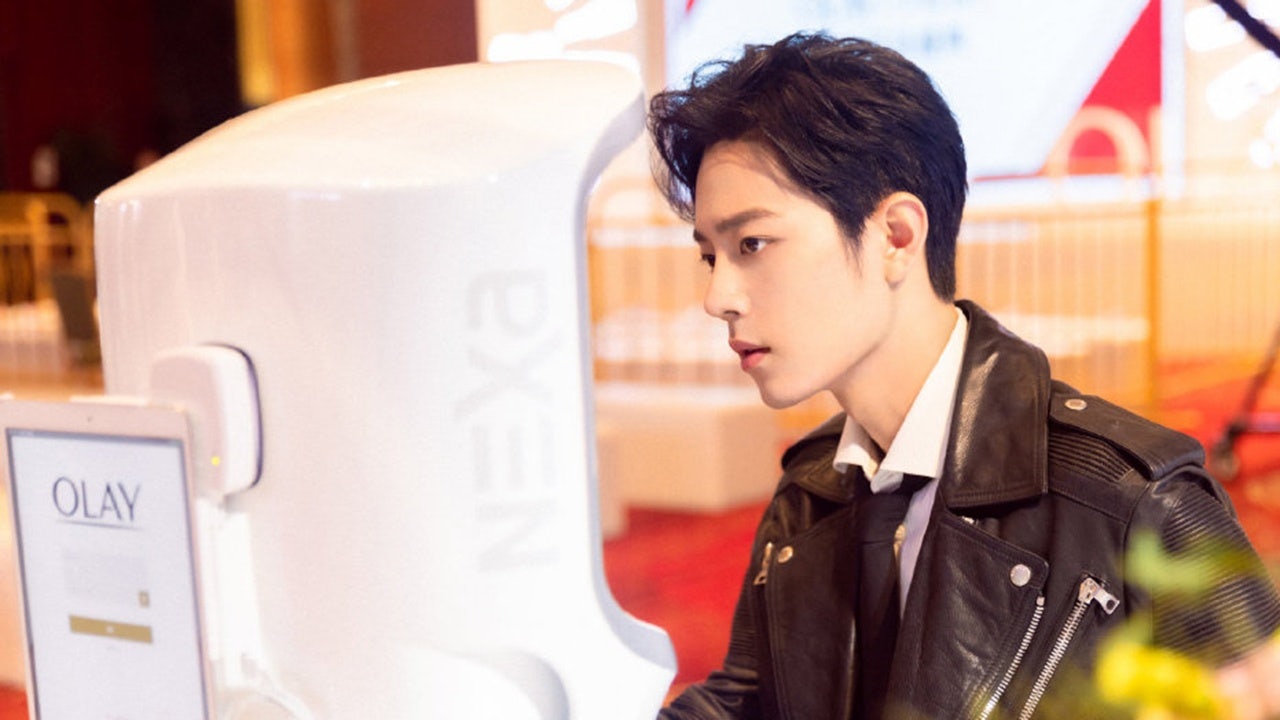

The controversy over the irrational fans of Chinese pop idol Xiao Zhan has escalated to the government level. What started as an online quarrel in between Xiao’s fans and the publishing platforms of homoerotic fan fiction, featuring Xiao, has quickly backlashed on their idol. Netizens started boycotting brands such as Estée Lauder, Piaget, Cartier and P&G’s Olay, which all have Xiao as an ambassador. They are also unhappy about Olay’s silence amid the controversy and reported the company to China Consumers Association and local tax authorities for not having receipts from their purchases on Olay’s Tmall store (it’s common for retailers not to offer receipts). The tax authority is evaluating the complaints and in talks with Olay’s representatives, NDB wrote.

Brands Taste Initial Success Over Livestreaming via WeChat Mini Programs — Tencent Tech#

WeChat may only have launched a livestreaming feature through its Mini Program this year but given the super app’s large user base (1.1 billion), it has recently demonstrated great potential for brands. Thousands of retail brands in China, including the Austrian jewelry brand Swarovski and the Hong Kong shoemaker STACCATO, turned to livestreaming over the past International Women’s Day and has had initial success, WeChat’s official data shows. With average users spending eight minutes on livestreaming this past Women's Day, the average transaction value, for example, on Nanjing-based retailer Jinying’s channel, reached 5300 yuan ($756).

Taikoo Li Owner, Swire Properties, Reports 55% Decrease in 2019 Group Profit —#

House.China.com#

Swire Properties, the Hong Kong-based developer with multiple high-end shopping complexes in mainland China like Beijing’s Taikoo Li Sanlitun and Shanghai’s Taikoo Hui, have reported a 1% decrease to HK$14.2 billion ($1.8 billion) and a 55% decrease in group-wide profit for the 2019 financial year.

Hong Kong protests have heavily affected Swire’s retail business in its home base, but the mainland sector stayed strong last year. As of 2019, Swire’s malls in mainland China have seen a 10% growth in revenue, with almost a 100% occupancy rate, while revenue from Hong Kong’s retail sector was down by 12% compared with 2018. The group’s management also showed concerns over the COVID-19 pandemic in the report.

Emily Fu contributed research.