What happened

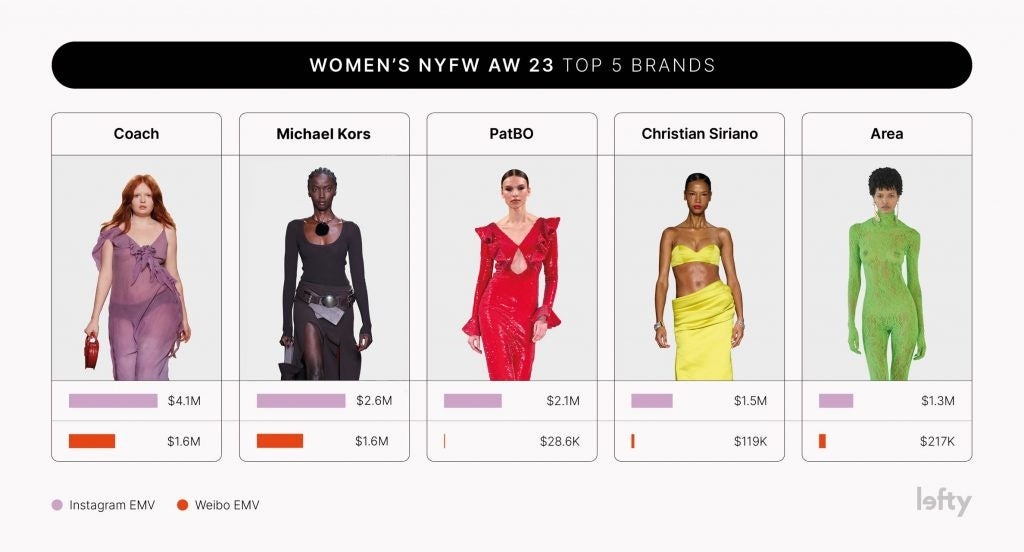

Fashion month kicked off in New York, with American editors and celebrities flocking to the front rows of their favorite stateside designers. Social media agency Lefty has ranked the top five New York shows in terms of Earned Media Value (EMV), and the results may come as a surprise.

Big American stalwarts Marc Jacobs (4.2 million Instagram EMV) and Coach (3.2 million Instagram EMV) came in first and second place, respectively, on Instagram. CFDA newcomer Brazilian designer PatBO (2.1 million Instagram EMV) entered as a surprise third but barely registered on Chinese social media channels. Meanwhile, US celebrity favorite Christian Siriano earned 1.5 million Instagram EMV, ranking fourth, and recent hot ticket Area took fifth position with 1.3 million Instagram EMV. On Chinese socials however, both ran relatively under the radar.

The Jing Take

On Weibo, it was a different story. It was both Michael Kors and Coach that hit the high note with 1.6 million each in Weibo EMV, according to Lefty. This comes as Coach deepens its investments in China and expands beyond first-tier cities through greater retail diversification and localization efforts, casting its net far and wide. Alongside its digital artist and metaverse activations, the brand’s goal of capturing younger fans across the globe seems to be working so far.

Likewise, Michael Kors is a popular brand for Chinese fashion fans cornering that affordable luxury market, and continuously invests in online and offline retail in the country as well as engaging with native KOLs. Earning 565,000 in Weibo EMV, Marc Jacobs has also made considerable inroads in China. It was followed by splashy Gen Z favorite Area (217,000 Weibo EMV), whose headline grabbing outfits veer towards stage fashion, red carpet and costume, rather than regular ready-to-wear.

Many American labels still mostly sell in the Americas, with entry into the Asian and Chinese markets low. The metrics show just how differently Chinese social media reacts to fashion week compared to global platforms like Instagram. Even celebrity-heavy front rows don’t necessarily make a difference in EMV unless they are filled with celebrities favored and known in China.

Localization with influencers and celebrities is key for each market. Moreover, China’s fashionistas seem to focus on American brands who’ve been around for over 10 years. As such, the likes of Michael Kors, Coach, Tory Burch, Marc Jacobs, Thom Browne and Ralph Lauren still trump newer, flashier designers whose styles and brand values are not yet well established in the Chinese fashion consumer psyche.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.