The rise of mobile use has propelled China to its “golden age” in entertainment, according to Mary Meeker’s Internet Trends report, and that's likely to create a window of opportunity for brands. The former Wall Street analyst and partner at Kleiner Perkins Caufield & Byers highlighted China's growing adoption of mobile payment systems and gaming in a presentation of her 2017 report on Wednesday.

Mobile use in China has skyrocked to more than 700 million users, and the growth rate of usage has outpaced that of users, according to research done in accordance with investment management group Hillhouse Capital. One of the driving factors of revenue on mobile in China is gaming—China is the number one mobile gaming market in the world—a factor that helped push Tencent into a record-breaking first quarter.

But while most of the revenue drivers are in actual interactive games, gaming culture tends to bleed into other industries as well.

“There is gamification across a bunch of different categories,” writes Lauren Sherman for Business of Fashion. “Advertising on Snapchat is gamified, dating apps are gamified, and food points programs are gamified—but there are more opportunities for fashion brands to apply tenets of gamification to the shopping experience, whether through loyalty programs, digital-to-physical activations and messaging bots.”

These “opportunities” are already being applied by many luxury brands, especially on WeChat, where gamification marketing is a common strategy for international fashion houses with their eyes on China.

Most recently, Cartier released a campaign on WeChat for 520 Day, China's take on Valentine's Day. The campaign featured a Pac-Man-like game where users had to solve five mazes that each led to an item of jewelry in the Cartier collection. Other brands have adopted augmented reality technology, allowing WeChat followers to go on scavenger hunts in shopping malls to discover discounts right in front of them. Even more simply, quiz games mean brands can encourage social interaction by asking users to share their quiz results or leave a comment on the page in exchange for the chance to win free gifts.

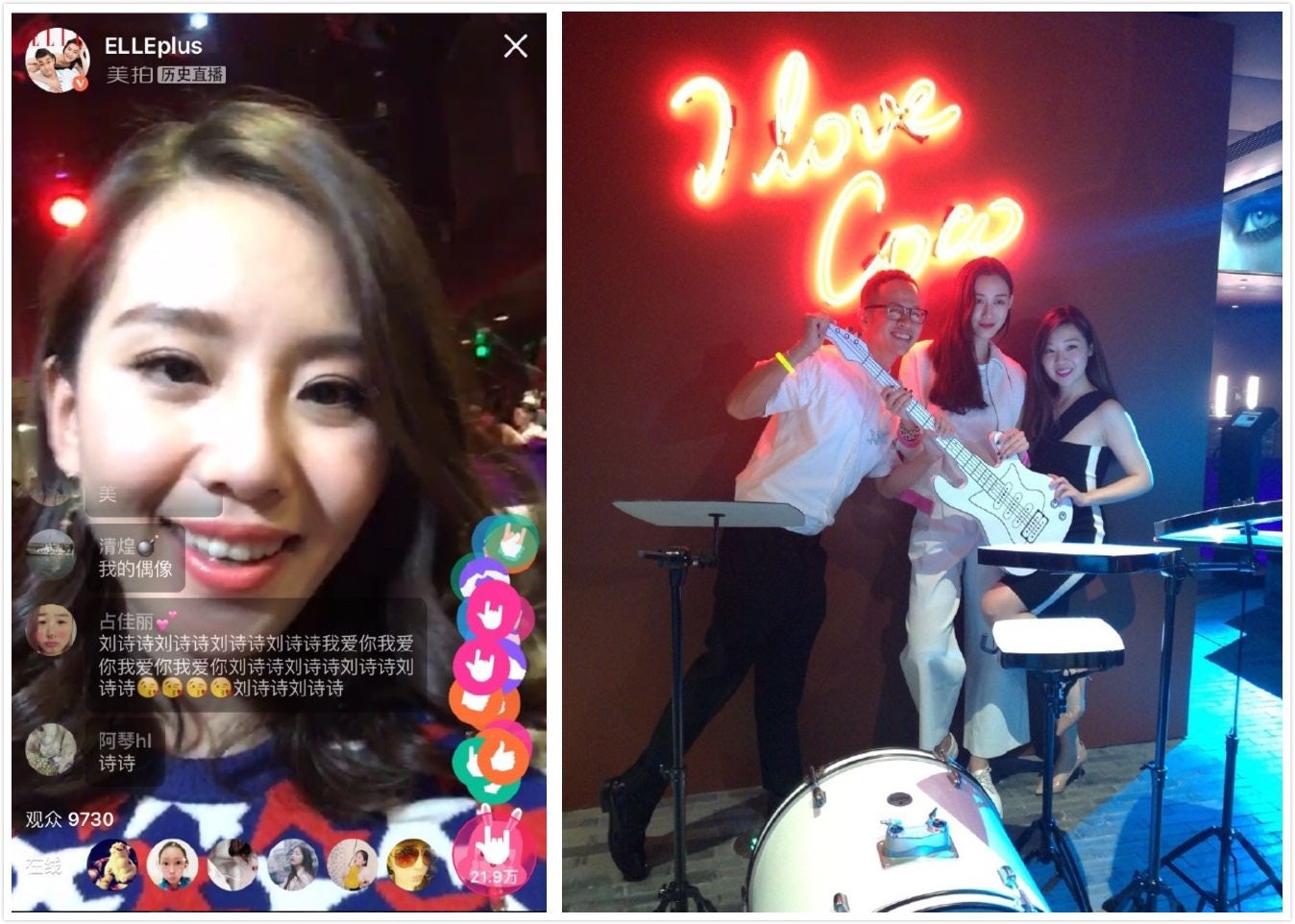

Other major factors driving China's mobile use, according to the report, are live-streaming and video. Setting it apart from the United States, China boasts consumers who are willing to pay for live-streaming entertainment and use mobile payment systems to “tip” live-streamers with money or virtual gifts. Brands have already started to take advantage of Chinese consumers' penchant for live-streaming by either working with KOLs who have a healthy social media following, or by live-streaming their own events, such as fashion shows or tours through their overseas stores. The trajectory of live-streaming revenue growth in China suggests that there may be more potential on this front for brands, as long as they curate their strategy to reach their target consumer.

The report also highlighted China's burgeoning mobile payment scene, which is fueling live-streaming and gaming revenue, but is also key for cross-border online shoppers as industry giants like WeChat Pay and Alipay set sights abroad. The year 2016 saw a 71 percent year-on-year growth of merchandise value for m-commerce in China, but only a small portion of mobile payment users are spending big—most users spend less than 15 per transaction. Still, some luxury brands are beginning to utilize mobile payment apps for their convenience factor to target outbound Chinese travelers with deals and promotions.