Mini-programs, essentially apps within WeChat, have been one of the biggest disruptors in China’s social media and e-commerce industries over the past year. Because they are built inside of WeChat’s massive ecosystem they offer convenience to consumers, who are able to access and use mini-programs without leaving the main WeChat application.

For luxury brands selling to China, mini-programs offer the potential to monetize on WeChat, and numerous luxury brands including Longchamp, Gucci, Michael Kors and Fendi have already released mini-programs.

To many, mini-programs have already cemented their place in China’s online ecosystem, but others may be surprised by just how fast they are growing. A new report released by mini-program research agency ALD revealed that as of June 2018, there are now a total of over one million mini-programs, nearly doubling from 580 thousand in January. On top of that, the number of daily active users has reached 280 million.

Upon hearing these incredible numbers, brands might feel rushed to build a mini-program. However, it is important to first understand their fundamental traits and trends in order to accurately determine if building a mini-program will benefit your brand.

Based on the ALD report, Jing Daily has summarized three key mini-program trends, and what they mean for luxury brands:

1. Sharing is the number one way that people enter and discover mini-programs#

Because WeChat is a closed ecosystem, just as it is difficult for people to discover Official Accounts, it can be difficult to draw users to your mini-program. To help alleviate this problem, WeChat has been continuously adding new gateways for users to discover and access mini-programs.

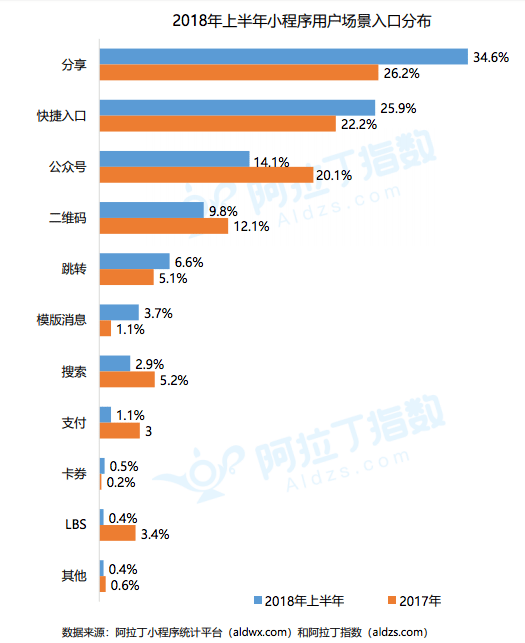

Yet despite all these options, from January to June 2018, the most common way to enter a mini-program was through a mini-program card shared in a chat group or on WeChat moments - with 34.6 percent of users accessing them in this manner. This is a significant increase from only 26.2 percent in 2017.

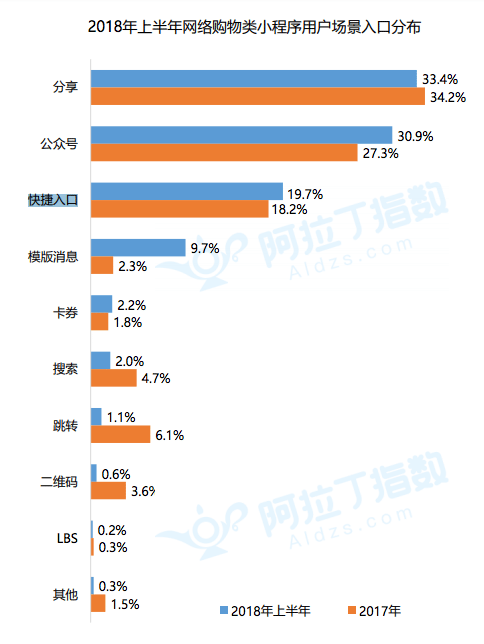

For e-commerce mini-programs specifically, the top three ways users entered them were through sharing (33.4 percent), official accounts (30.9 percent), and through the quick access pull-down at the top of the WeChat app homepage (19.7 percent).

Official accounts are one of the most popular entry points because a large number of e-commerce mini-programs are operated by brands, WeChat KOLs, and Wemedia - whose Official Accounts have a large existing follower base which they can use to drive traffic to their mini-program shops.

Key takeaways:#

- Unlike games and social networking, users are not naturally inclined to share e-commerce mini-programs. But with sharing being the most common way people discover and enter mini-programs, it is key for brands to incorporate incentives for sharing.

- Besides sharing, having a large Official Account following plays a huge role in a brand’s ability to drive traffic to their mini-program. Brands with a smaller following will need to focus heavily on “shareability” and user retention.

2. Retention rates are increasing#

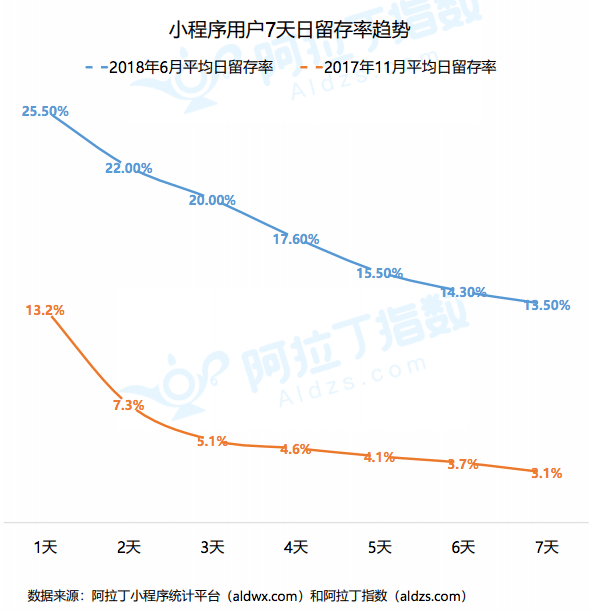

Once users have discovered your mini-program, you need to keep them coming back, and unfortunately, that’s not easy to do. Good news is that as of June 2018, average user retention rates were significantly higher than in 2017, with next day retention rates increasing from 13.2 percent to 25.5 percent, and seven-day retention rates increasing from 3.1 percent to 13.5 percent.

Key takeaway:#

- While retention rates are rising, they are still quite low. For e-commerce mini-programs, brands need to find ways to keep users coming back, including loyalty programs, limited edition pieces sold exclusively on mini-programs, as well as simply consistently updating and adding new merchandise.

3. E-commerce mini-program users are predominantly female#

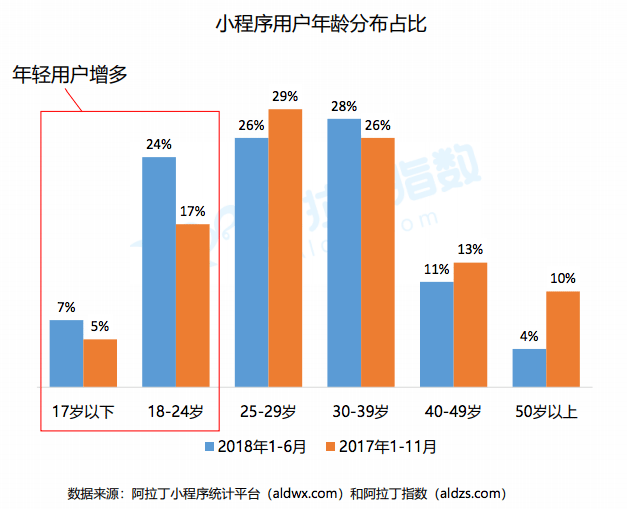

The ALD report found that as of June 2018, the average age of a mini-program user was 29 years old. However, it may not stay that way for long, as the greatest change between 2017 and 2018 was the increase in users between the ages of 18 to 24 from 17 percent to 24 percent. Conversely, while still one of the largest age groups, the number of users between the ages of 25 to 19 decreased from 29 to 26 percent.

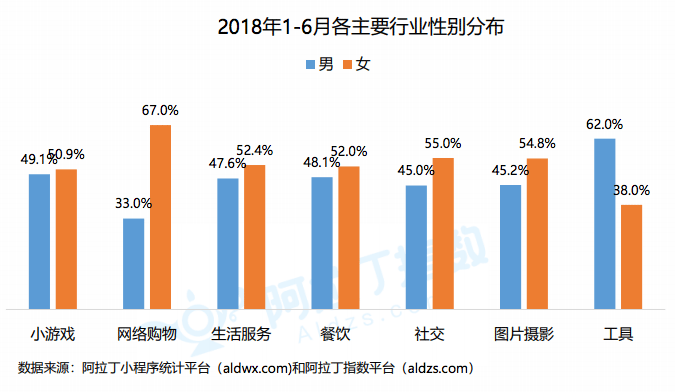

For total mini-program usage, the male to female ratio is nearly even at 47 percent to 53 percent respectively. However, for specific types of mini-programs, the gender ratio is significantly skewed. Importantly for brands, e-commerce mini-program users are predominantly female at 67 percent.

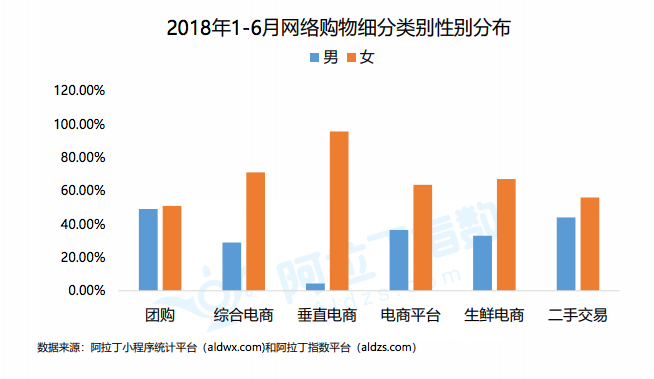

When e-commerce mini-program gender ratios are broken down even further by specific types of retailers, the most dramatic imbalance occurs for vertical retailers – brands selling their own products - whose mini-program users are 95 percent female, and only 5 percent male.

While the report does not include average user salaries, it does share that 68 percent of mini-program users have a bachelor’s degree or higher.

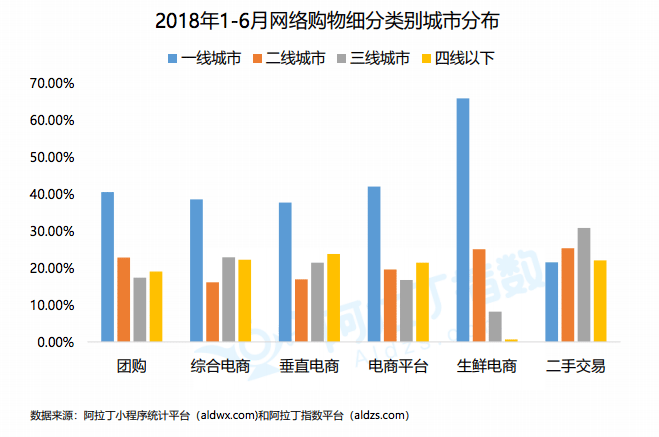

The top five cities with the most mini-program users are: 1. Guangzhou, 2. Beijing, 3. Shanghai, 4. Shenzhen, 5. Chengdu. For all types of e-commerce mini-programs, the percentage of users from first-tier cities is the highest.

Key takeaways:#

- At an average age of 29, with a high education level, living in 1st tier cities, mini-program user demographics are currently an excellent fit for luxury brands. However, this may change as the number of younger users increases

- For e-commerce mini-programs, brands targeting female consumers will see more success

In addition to revealing the latest mini-program data, the ALD report gives several predictions for the growth of mini-programs in the second half of 2018. Among them:

- By the end of 2018, there will be three million mini-programs

- The number of daily active users will reach 400 million

- Retention rates will continue to increase

- Tencent will continue making it easier for people for find and access mini-programs

- Mini-program stores will become the new standard for e-commerce