The

Jing Daily Fashion Week Score#

evaluates a range of parameters to assess how a brand’s collection resonates with Chinese audiences. Shows have become a powerful tool for brands to speak directly to their fans, bypassing the filter once held by editors. This means fashion week now presents a major opportunity for brands to connect with the Chinese community and set the tone for the success of their collections.

For Milan Fashion Week Spring 2020, Jing Daily looks at brands who have a stake in the Chinese market and a few who stand to gain from heightened efforts. Several brands this season like Prada and Gucci are stepping up their game when it comes to connecting with Chinese audiences. The continued silence around Versace and Dolce & Gabbana, meanwhile, brings into question whether these brands will ever be able to come back from their recent blunders.

The

Jing Daily Fashion Week Score#

is based on the following parameters:

- Model representation: evaluates representation of Chinese models on the runway.

- Digital impact: evaluates Chinese netizen reception and engagement on leading social media platforms including Weibo, WeChat, and Little Red Book.

- KOL & celebrity visibility: considers star power associated with the brand through strategic KOL and celebrity partnerships.

- Special brand efforts: considers special programs or efforts on a brand’s part to speak to the Chinese audience.

- Design context: a qualitative assessment of how the brand’s collection will speak to the Chinese audience based on current trends and preferences.

- Brand history: considers existing brand history in China, including overall presence, social reach, number of stores, earning trends and brand missteps.

PRADA

#

This season, Prada leveraged the star power of its Chinese ambassadors: actress Xiaotong Guan and singer Xukun Cai. The on the ground presence of Vogue China's s editor in chief Angelica Cheung also had a positive impact on the show's reception. Social media support from these three show attendees alone resulted in over 570k engagements from their combined 60 million followers. Prada's marketing and communication efforts also stood out among the rest thanks to the brand's WeChat Mini Program. This marks the second time Prada has leveraged a Mini Program for its runway show, allowing consumers to better engage with its fashion week event. The Mini Program created an interactive environment that allows users to play the runway video, take closer looks at each look, and save the look into the users own profile. It also provides a breakdown of celebrity presence and features a video where users can follow Xukun Cai around Milan. The Mini Program received positive feedback even outside of WeChat and sparked discussion on Weibo, where netizens cited its diverse functions and high-quality images of the runway, celebrities, and the scene.

GUCCI#

Gucci's Spring 2020 show has proven that the brand continues on an upward trajectory, set in motion by creative director Alessandro Michele in 2015. With over 1.83 million followers on Weibo, the brand posted 16 times pegged to its Spring 2020 show and gained over 2.6 million engagements. The brand leveraged strong celebrity relationships, inviting Chinese idol turned actor Zhan Xiao to the show. With over 18 million followers on Weibo, his single post about the show received over 1 million engagements. The Gucci camera bag he carried to the event has also received a new name shortly after the show as "The bag that Zhan Xiao carried to the show" ("肖战同款"). The crowd-sourced nicknaming of product is a phenomenon that occurs in China, and often translates into extremely high sales, signaling a slam dunk for the brand. Gucci's runway show was also live-streamed through Weibo, which allows replay, and the video content received over 26 million views in total. Gucci did not promote the SS2020 runway through its WeChat official account. However, the brand's boutique in WeChat includes the SS2020 runway video at the center of the landing page and also the close-up shots of each look.

BOTTEGA VENETA#

Chinese audiences received Bottega Veneta's Spring 2020 show positively. The brand posted only 7 times to its official Weibo account but employed a heavier load on WeChat compared to other brands, with a total of 3 posts for the show. Bottega Veneta's official channel performance on Weibo was flat and resulted in very low netizen engagement. However, the brand selected its Chinese guests wisely. Faye Yu, the 48-year-old Chinese celebrity was widely praised on Chinese social media for representing Bottega Veneta's image elegantly. The careful curation of a brand ambassador who represents the brand, as opposed to choosing a celebrity-based only on their following, paid off for Bottega. Elsewhere, one single post by one of the top 10 influential entertainment bloggers on Weibo featuring Faye Yu at the show received over 118k engagements. In addition, the brand received a lot of coverage from Chinese fashion bloggers, who were not present at the show. Such posts generated much wider exposure for the brand than its official posts and from the posts of the invited celebrities, unlike most other brands where celebrity posts served a major traffic booster. Given its recent gains in popularity in China, Bottega Veneta stands to have an even wider impact with a more direct strategy targeted at Chinese audiences.

TOD'S#

For Spring 2020, Tod's live-streamed its runway show through both Weibo and Tmall, which linked directly to the Tmall shop, creating a one-stop experience for the audience. The Tmall shop did not feature the Spring 2020 collection and the brand could have further capitalized on its live streams with a limited edition, "see now, buy now" drop. Tod's official Weibo account performance was also successful, especially when it came to posts featuring runway looks and detail shots. In addition, Tod's leveraged brand ambassador Shuying Jiang's star power, gaining over 8k engagements from Shuying Jiang's post featuring Tod's. The brand also invited influencers like Mr. Bags, Jing Li, and Xinxin Zhang, whose posts all generated great exposure for the brand. Tod's show also featured high representation, with close to 20% of models on the runway being Chinese.

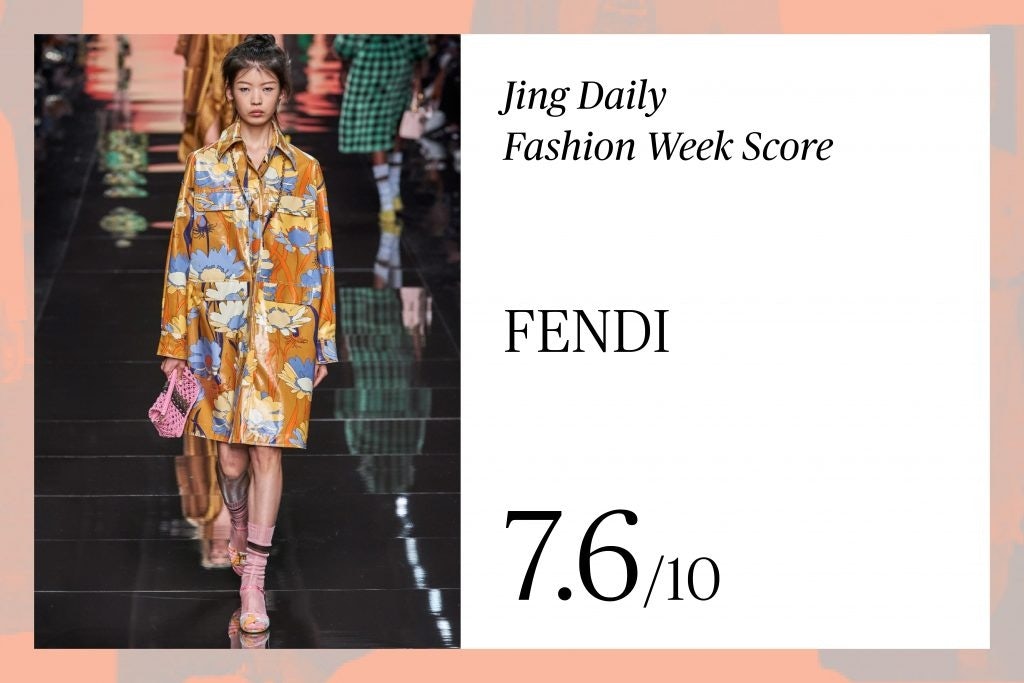

FENDI#

Fendi's investment in extremely high profile Chinese celebrity partnerships translated into strong return at this season's Spring 2020 show. One single post from the brand's ambassador singer Meiqi received over 1 million engagements on Weibo. Fendi also took on a very active social media strategy on Weibo, sharing over 20 posts on the brand's Spring 2020 runway show. The posts include everything from runway recaps to photos of celebrities and KOLs, providing Chinese audiences a clear window to the show. However, Fendi lacked behind other brands in terms of an interactive experience with its audiences and can benefit from innovating with its digital strategy. Chinese model representation from Fendi's runway was likewise lacking, featuring only 1 Chinese model in the entire runway show. While the brand is apparently willing to make monetary investments to speak to the market, proper representation must also be kept front of mind to connect with the Chinese community.

ANGEL CHEN#

Angel Chen is a hot name right now in China, but the runway show did not necessarily result in high engagement. The brand took on a fairly active social media strategy to try to promote the show through its official channel, posting starting three days ahead of the show, but netizen reaction was low, totaling to less than 100 engagements on Weibo. Angel Chen also did not livestream the show, unlike the debuting collection with H&M which was live-streamed through Taobao. The Chinese model representation was also average. Instead, Angel Chen's hot discussion point this week was more on her debut collection with H&M on Tmall's super brand event, which received a lot of media coverage. Chinese celebrity Yixing Zhang's presence at the event received massive Chinese netizen's engagement, which totals more than 43k engagements on Weibo with one single post.

FERRAGAMO#

Salvatore Ferragamo made clear efforts to leverage the impact of Chinese social media to promote its Spring 2020 show on Weibo. However, the efforts did not translate into a high return. With a total of 16 posts on Weibo speaking to its 356k followers, the posts received less than 200 engagements total. Neither of the two celebrities invited by Ferragamo to the show really generated any heat for the brand. The brand did also not utilize WeChat at all in promoting its latest runway show. In addition, Ferragamo shared a few videos featuring interviews with other foreign celebrities at the show, which did not speak to the Chinese audience. Even Mr. Bag's post at Ferragamo's show turned out to be flat in terms of netizen reaction compared with his posts for other brands this season in Milan. Ferragamo's Chinese model representation was also lacking, featuring only three Chinese models for the entire show with over 60 looks. While Ferragamo currently has an established brand presence in China, the label is in need of re-invigoration to compete with other players.

VERSACE#

Versace's T-Shirt scandal back in August this year had a major impact on reception for the brand's Spring 2020 runway show. At this season's show, no major Chinese celebrities or KOLs made appearances and the absence of the brand's past ambassador, Yang Mi, was certainly felt. The one event that did break through to Chinese audiences was the iconic resurgence of Jennifer Lopez on the runway, which sparked conversation. Like Coach earlier this season, the brand is in a difficult situation when it comes to social media strategy. Brands who have made missteps in China have to weigh re-building their brand presence with respecting the market. Since the brand's T-Shirt scandal, Versace had only posted twice to its Weibo account, but has now posted 7 times following the show. However, the netizen reaction was low, considering the lingering impact of the recent scandal.

DOLCE & GABBANA#

While Dolce & Gabbana still has a following of 902k on Weibo, the brand's posts about the Spring 2020 show gained less than 200 engagements. With no clear presence of Chinese celebrities or KOLs in attendance at the show, the brand continues to hurt from its major cultural misstep in the market last year. The brand's official WeChat account has been abandoned for the past 9 months with no posts at all since the scandal last November. The brand also did not promote the runway show on WeChat. The show did gain some organic exposure from netizens who shared runway looks, but the engagement with these posts was generally low. Now almost a full year away from the incident, the future of the brand in China seems limited.