What happened

The luxury sector’s bellwether, LVMH Moët Hennessy Louis Vuitton, reported revenue of 10.6 billion euros for the first quarter of 2020 today, down 15 percent compared to the same period in 2019.

Among its five main business sectors, the Fashion & Leather Goods category has proven the most resilient, reporting only a decline of 9 percent in Q1 2020 compared to the same period last year. Major brands like Dior and Louis Vuitton performed well, while others in the sector missed expectations, Bernard Arnault, the Chairman and CEO of LVMH, said in the earnings call. Watches & Jewelry and Selective Retailing, including cosmetics chain Sephora and travel retail leader DFS Group, reporting a 24 percent and a 25 percent decline, respectively, were hit the hardest as a result of store closures and travel restrictions due to the ongoing COVID-19 crisis.

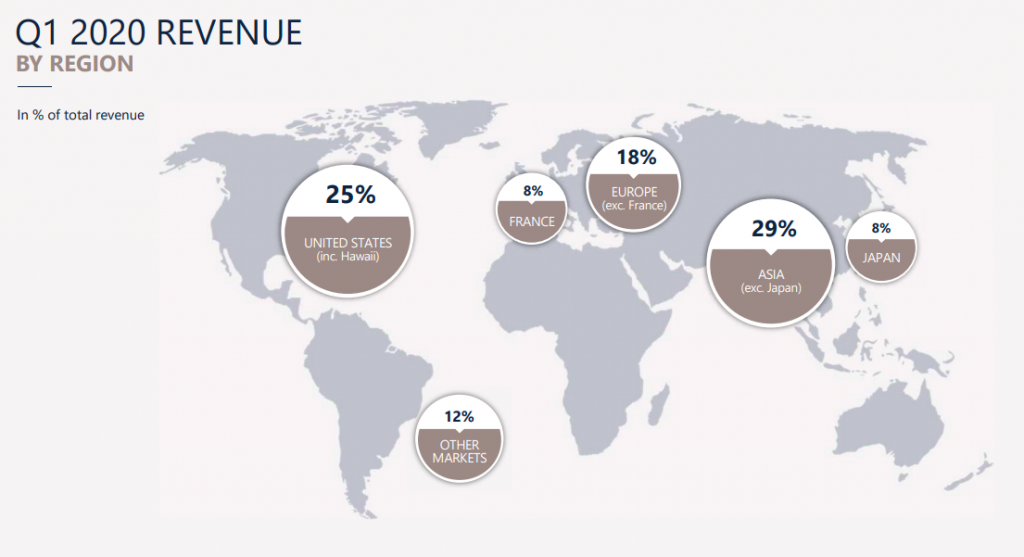

As Asia-Pacific, excluding Japan, remains 29 percent of the group’s revenue and with China showing early signs of recovery, many analysts inquired about mainland China’s outlook during the call. “There is repatriation of part of the business in mainland China,” Arnault answered. “The growth rate in mainland China was higher than our business with mainlanders outside of China. It will amplify in the months to come.” The group also reported improving in-store traffic and sales in China as stores began to reopen in March.

Jing Take:#

As the devastating effects of the COVID-19 pandemic shifts from China to the rest of the world, the luxury industry has been anticipating various luxury players’ financial results to gauge the overall impact. LVMH, for the moment, seems to be doing better than most, at least compared with an overall estimation by RBC Europe, which recently predicted that luxury revenue might drop 20 to 30 percent this year. But how does the rest of 2020 look?

The impact ultimately depends on how long COVID-19 lasts, as Arnault said himself this January when the virus started to impact China: “If it dies out in two months and a half, it’s not terrible. If it takes two years, it will be a totally different matter.” Although the recovery of luxury buying is still uncertain, LVMH has given their guess. “We can only hope that the recovery happens gradually from May or June after a second quarter, in particular in Europe and the US.” Let’s wait and see.

The Jing Take reports on a leading piece of news while presenting our editorial team’s analysis of its key implications for the luxury industry. In this recurring column, we analyze everything from product drops and mergers to heated debates that sprout up on Chinese social media.