Key Takeaways:#

Fashion and leather goods remained the most resilient business group for LVMH, with an 18-percent growth in Q4 led by Louis Vuitton and Christian Dior.

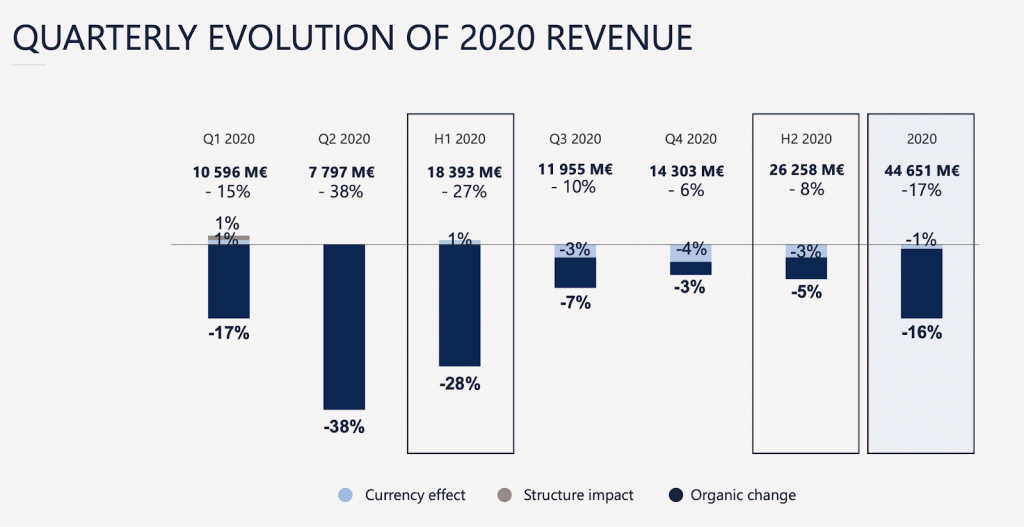

LVMH has witnessed a substantial recovery after a pandemic-ridden Q2, its worst-performing quarter with a 38-percent loss, before recovering to a six-percent group-wide loss in Q4.

The group's priorities for 2021 are to integrate Tiffany and continue its positive trends.

Once again, Louis Vuitton and Christian Dior seemed to have saved the day (or year) for their parent group, LVMH Moët Hennessy Louis Vuitton.

The European luxury giant reported the financial results of its fourth-quarter and full-year earnings on January 26, showing it recorded revenue of 54.31 billion (44.7 billion euros) in the financial year 2020, down 17 percent from 2019.

LVMH has witnessed a substantial rebound after a pandemic-ridden Q2, its worst-performing quarter with a 38-percent loss, before recovering to a six-percent group-wide loss in Q4.

Across the five business groups (BG), fashion and leather goods remain the most resilient, reporting 18-percent growth in Q4. This particular BG includes 17 fashion houses, including Louis Vuitton, Christian Dior, Celine, and Moynat.

“Louis Vuitton and Christian Dior each delivered double-digit organic revenue growth in the last two quarters. That would be a trend at any time, but even more so in 2020,” said the group’s head of investor relations, Chris Hollis, in a conference call with analysts. He added that Louis Vuitton’s recent new product lines, including Pont 9 and the 1854 canvas, were celebrated by customers. Meanwhile, the brand’s in-person shows in Shanghai, Tokyo, and Miami helped generate excitement.

Other positive news came from the jewelry and watches group, which saw the completion of the largest luxury goods deal ever with American jewelry Tiffany on January 7. The transaction took over a year due to jitters over regulatory approvals worldwide and a legal battle with Tiffany itself on the acquisition price. And in mid-January, it was announced that Alexandre Arnault, former CEO of Rimowa and the third son of Bernard Arnault, moved to a senior role in charge of products and communication for the jewelry brand.

Yet, some BGs witnessed fewer signs of recovery. Selective retailing, which includes the cosmetics chain Sephora and the travel retail leader DFS Group, reported a 31-percent decline for FY20. While the DFS Group has been heavily impacted by ongoing travel restrictions, the group said Sephora China’s exclusive livestreamed event Virtual Sephora Day was successful.

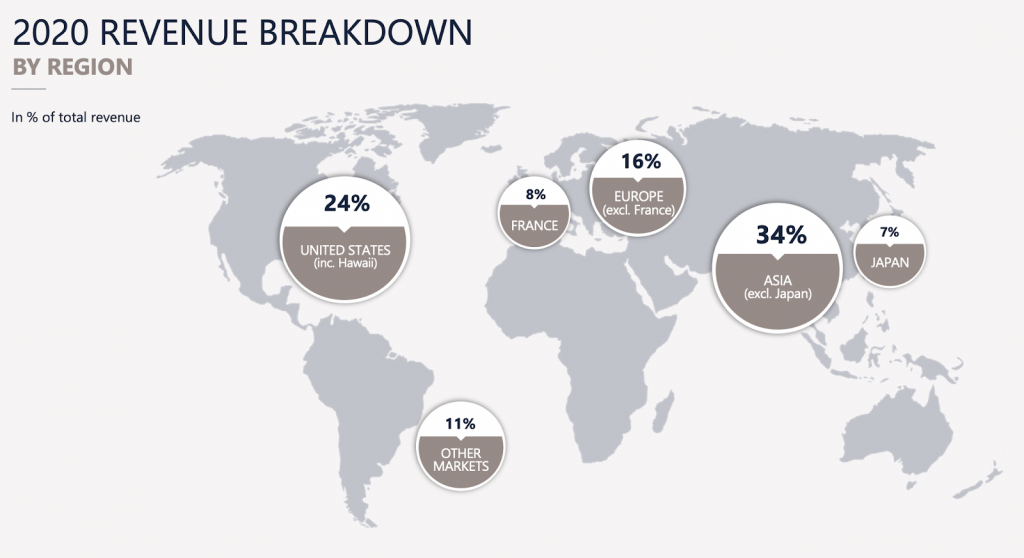

Overall, the group's revenue share from Asia (including Japan) inched upward from 37 percent in 2019 to 41 percent in 2020.

LVMH is readying for a recovery in 2021. “In a context that remains uncertain, even with the hope of vaccination giving us a glimpse of an end to the pandemic, we are confident that LVMH is in an excellent position to build upon the recovery for which the world wishes in 2021,” said Bernard Arnault, chairman & chief executive officer of LVMH, in a statement.

The company’s stock price rose by 3.26 percent to 127 a share at yesterday’s market close in Paris.