In January, three fiscal quarters after launching its new storefront on Tmall, Farfetch, the luxury e-tailer, unveiled another significant milestone in China, launching Off-White, Ambush, and Palm Angels on the platform. The debut of the three brands, owned by New Guards Group, on Farfetch cements the platform's strategy to empower brands in China. Later the same month, Farfetch announced plans to purchase the US-based beauty retailer Violet Grey, marking its expansion into the cosmetics business. Both moves showcased the luxury e-commerce disruptor’s broader ambition in connecting Chinese shoppers with global brands.

On February 22, the sixth edition of the Luxury Symposium, “All Eyes on China,” is being hosted by the French Chamber in Hong Kong. In advance of the event, Jing Daily spoke to one of its guest speakers, Farfetch’s Vice President of Commercial, Greater China and APAC, Alexis Bonhomme, about the shifting luxury e-commerce landscape and Farfetch’s latest China developments.

Jing Daily: How have Chinese luxury shopping behaviors shifted in the last 12 months, especially during the COVID-19 crisis and China’s zero-COVID policy?#

Alexis Bonhomme:#

“With the pandemic, China gained an ever-increased relevance for the luxury industry. When it comes to observing the share of the online business, it continues to grow strongly with brands and platforms investing in the online field, expecting to reach 30 percent of the China market in 2022 with a growth rate of about 56 percent, according to Bain. More than ever, Farfetch is one of the very few Western platforms succeeding in China, and 2021 was again a very busy year for the 650+ talents we have in Shanghai, Beijing, and Hong Kong offices.

Consumption-wise, the appetite for high-value luxury goods such as leather goods and hard luxury remained strong, and we did break our record with a one million dollar luxury watch sold to one of our private clients. More than ever, our business model (marketplace) allowed us to satisfy the curiosity of our customers, bringing the right balance between inventory and high level of services and localization.

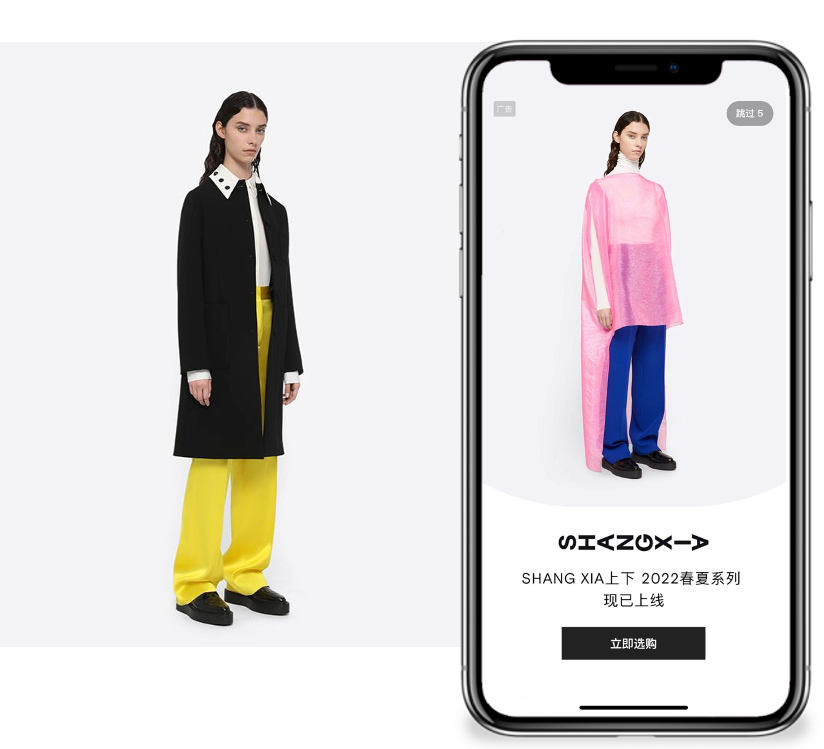

Also, we have been investing in marketing activations and creative content, bringing Farfetch online and offline in Tier-1/2/3 cities and launching our Tmall store almost a year ago, while our local APP’s are our primary traffic and conversion touchpoints. In terms of supply, we put special efforts into helping Chinese brands and boutiques to go global and on boarding names such as Shang Xia, Uma Wang, Canotwait_, Team Wang, or boutiques like Labelhood.”

How have recent digital ecosystem changes in China impacted brand strategies when it comes to engaging luxury consumers?#

“The China digital ecosystem is a concentrated market within a few platforms and all brands are looking for qualified traffic and recruitment opportunities. The downsize is traffic becoming very expansive and finding relevant platforms for engaging with luxury consumers. Hence at Farfetch, we anticipated that trend and decided to build our Media Solution capabilities three years ago, positioning Farfetch not only as a trade platform, but also as a Marketing and Media platform. We combine, within one roof, our Commercial, Marketing, Content Creation, and Private Client resources, offering the best of Farfetch for our partners in terms of content and exposure.

We create relevant content, display it on our local APPs, Mini Programs, and social touch points and amplify it with performance marketing and online-to-offline (O2O) activations. On that last point, engaging our Gold, Platinum, and Private Client customers has been very attractive for our luxury partners, being convinced by the level of sophistication, disposable income, and overall quality of the Farfetch user base in China. From Fashion (Burberry), Beauty (Giorgio Armani), Automotive (Porsche), F&B (Moet Hennessy), 3C’s (Samsung), the industry leaders engaged with us in order to stay relevant to the Gen Z and millennial audience and create a new type of customer engagement.”

What is the most prominent challenge for global brands in China? And how has Farfetch supported their partners in this competitive market?#

“The challenge brands are facing in China are multiple but customer acquisition and remarketing costs are probably one of the strongest at the moment. We do see a certain shift from performance marketing to content marketing and brands investing more heavily on dedicated content for China and creative engagement campaigns.

At Farfetch, we have built our China gateway solution based on two pillars: the B2C offers where Farfetch provides resources to brand partners and the B2B offers via our CuriosityChina division to empower our brand partners on a complete suite of White-Label B2B digital services, from strategy to marketing, content creation or e-commerce operation. We work with international leaders in fashion (Bally, Stone Island), hard luxury (Audemars Piguet, David Yurman) or retail industry (Harrods) and offer them the very best expertise we have acquired since so many years on the China market.”

Farfech acquired the New Guards Group in August 2019. Can you share any of their recent China developments?#

“One of the best recent examples we can share is the 360 degrees work done around the New Guards Group. After opening the range of digital and social platforms for their brands, we launched Off-White, Ambush, Palm Angels Tmall stores early 2022. The three brands are expected to carry out more business growth initiatives in China in the next two years, becoming more vertical and building a true DTC strategy. They also have an amazing collaboration mindset with recent crossovers like Off-White & Nike, Ambush & Moët Hennessy or Palm Angels x Stone Islands.”

What is Farfetch’s next step in China?#

“Our medium-long term outlook is aligned with the potential growth in the region. The consumption scale and level of China's luxury goods continue to increase, and the market shows greater potential.

To capture the strong demand in China, Farfetch has always been committed to a very high level of localization. We have created an all set of local communication and experiences to satisfy our Chinese customers. From localized content around our communities, dedicated IOS, Android APP, Mini Programs, O2O experiences including our VIP customers, and social platforms, including WeChat, Weibo, Douyin, Xiaohongshu, Farfetch China has now become the most localized Western platform in luxury operating in China. Beyond that, we keep building our brand awareness by launching a series of new IPs as well as new categories, such as beauty.”