Even amid tanking confidence in crypto, minimal NFT trading volumes, and low token prices, collectors’ thirst for luxury spirits NFTs seems impossible to quench.

Just last week, Dewar’s, Hennessy, and Orientalist Spirits dropped new NFTs, joining the likes of Karuizawa, Johnnie Walker, and Patrón, which in recent months launched NFTs during a market stagnation following the spring crypto crash. So why are luxury drinks brands keen to adopt this new technology?

“NFTs have become a way to build strong communities around brands through experiences, which includes access to rare spirits, making this a compelling channel for brands to connect with their audiences,” explains Layal Baaklini, Global Managing Director for Disruptive Innovation at Bacardi Group, which owns Patron, Dewar’s and Grey Goose.

Indeed, in the past few months there has been a shift in the NFT market, with interest in pixelated JPEGs dying and investment in utility-based tokens growing by the day. And with metaverse and NFT projects predicted to be worth 50 billion (360 billion RMB) for the luxury industry by 2030, fine spirits businesses are now realizing that NFTs can be effective in three key areas of brand building for a new era: creating communities, fostering trust, and expanding reach.

Creating communities invested in the brand#

Luxury houses have long known that online communities (as shown through social media) can be just as valuable as IRL ones, and this belief is now spreading to the rarified world of fine spirits, too.

“If there are exciting, new ways of engaging with people digitally then we want to be there — experiencing whisky at home in a fun immersive way or enabling people to visit our spaces online,” says Joao Matos, Johnnie Walker’s Global Marketing Director.

The Diageo-owned whisky brand has released no less than four NFT drops over the past year, from limited editions, 1 of 75 Blue Label Ghost bottles, to the even rarer Master of Flavour whiskies aged at least 48 years. The latter also came with exclusive tastings and a 35,000 price tag.

The investment that NFTs represent resonates well with collectors of luxury spirits, who are often used to pouring resources into reserves of bottles, built up over the years.

“Through NFTs, we can offer consumers more autonomy over their assets, allowing them to hold on to the NFT, gift it, trade it, or redeem it for the exclusive physical bottle,” adds Bacardi’s Baaklini.

For example, earlier in the year, Bacardi’s Patrón teamed up with NFT platform BlockBar to launch its first-ever tequila NFT, which granted access to 150 individual bottles of limited-edition Patrón Chairman's Reserve, each priced at around 4,000. Buyers could choose to redeem their token right away for the physical bottle or have BlockBar store it for them in a secure location. They could also sell their NFT to other collectors.

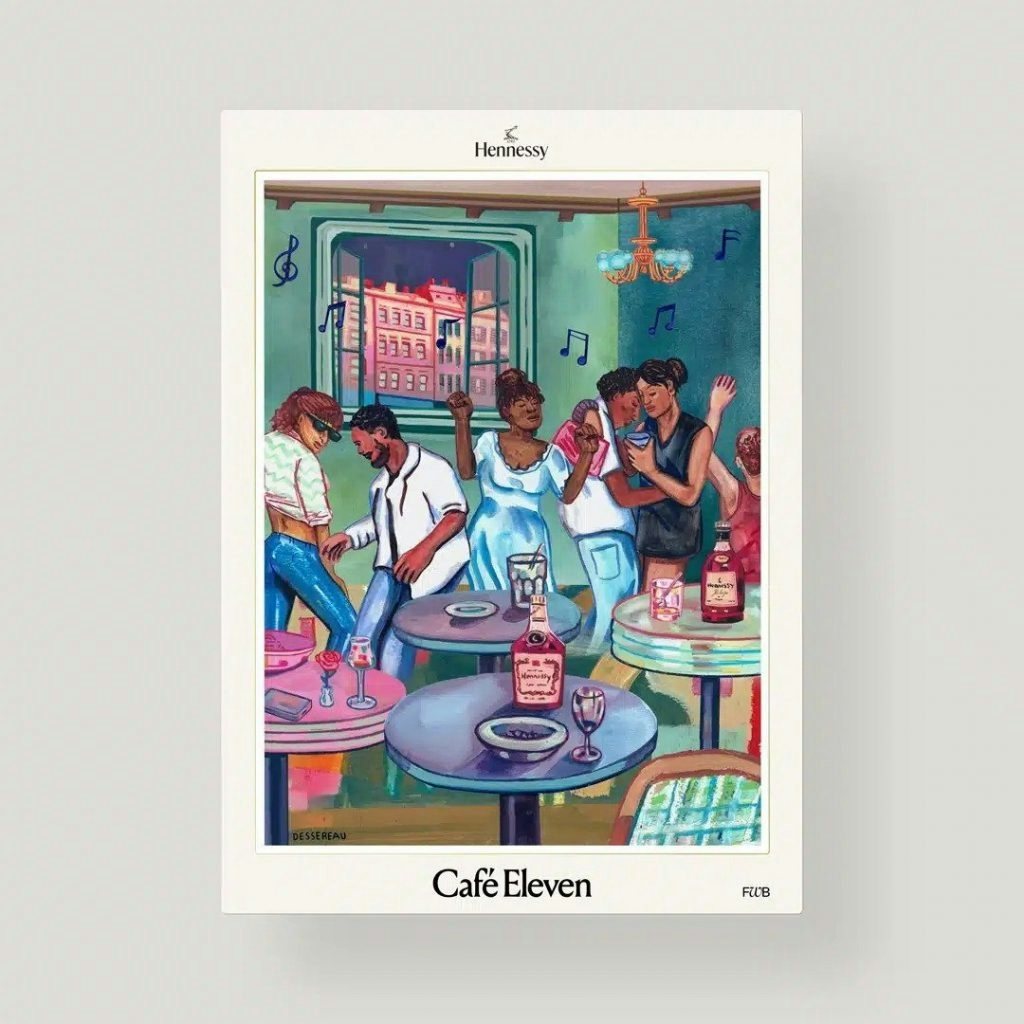

Some like Hennessy are going further with the Web3 community with a Decentralised Autonomous Organisation (DAO). Danielle Barich, Hennessy’s Web3 Development Director explains that the brand “just launched a cultural membership with the Friends with Benefits DAO called Café 11. We are using NFTs as proof of membership to exclusive events and experiences, but most importantly access to a community that we will co-create future Web3 projects with.”

The LVMH-owned Cognac brand made a splash in January when it released an NFT of the first and last bottles (1 and 250, respectively) of Hennessy 8, a rare, limited-edition series. The NFT was sold via BlockBar for a staggering 221,000.

For spirits groups tapping into a loyal audience, the appeal of NFTs is clear: they create a permanent link between company and customer, etched onto the blockchain. As Bacardi’s Baaklini observes, “the data we derive allows us the opportunity to engage and educate influential consumers with invitations to exclusive private tastings, brand home visits, or hospitality at key events.”

Building more trust with HNWIs while tackling counterfeits#

As in many other strands of the luxury market, counterfeiting runs rampant among luxury spirits. According to one study by the East Kilbride-based Scottish Universities Environmental Research Centre, one in three rare Scotch whiskies was found either to be fake or distilled in a different year from that declared. In recent years, some distillers have started turning to blockchain technology to prove authenticity from farm to bottle.

In this respect, NFTs have turned out to be rather effective at building trust and loyalty among fine spirit connoisseurs, as they can offer proof of authenticity that previously required imperfect like-to-like comparisons or expensive carbon dating sampling.

One of the driving forces behind the creation of BlockBar was helping assuage collectors’ fears around authentication. “Offering NFTs is the best way to show transparency and guarantee authenticity to all buyers,” remarks Blockbar CMO Charlotte Shaw.

Transactions are recorded on the Ethereum blockchain and buyers can trace ownership all the way back to each brand’s distillery itself. The company works directly with spirit labels like Johnnie Walker, Hennessy, and Glenfiddich to source unique bottles, and has so far facilitated more than 70 drops.

Tapping into more audiences — and younger ones, too#

Luxury spirits are often seen as the preserve of older, more affluent collectors. But NFTs could be set to change that, as a cohort of newly rich, tech-and-crypto-savvy buyers grows accustomed to seeing digital goods as valuable — sometimes even more valuable — than physical ones.

“The NFT market has gathered a group from the young generation, Gen Z, that might become our potential clients,” notes whisky brand Karuizawa owner Eric Huang. “Moreover, trading with digital tokens has somehow avoided the uncertainty and risks when shipping the exact whisky bottles across different countries.”

The Japanese distiller made available on BlockBar just one of 211 remaining 50-year old bottles from its shuttered distillery, which has become somewhat of a cult product among aficionados. It sold for approximately 79,000.

Luxury wine and spirits NFTs also might start to look particularly appealing as stocks and crypto tokens drop in value amid a looming worldwide recession. The Liv-ex Fine Wine 1000 investment benchmark, for example, has outperformed the Samp;P 500 index of the biggest U.S. companies so far this year.

But buying whole bottles isn’t the only way to invest in fine spirits. Savvy young collectors, who might be familiar with fractionalized stocks introduced by digital brokers like Robinhood, have also been enticed by fractional ownership of casks through services like BlockBar and Metacask. The latter was behind the record-breaking 2.3 million (16.7 million RMB) sale of a rare 1991 Macallan cask last October.

NFTs are meant to be… savored?#

While the heady highs that NFTs reached in 2021 have faded, the buzz surrounding their arrival in the fine spirits world can sometimes make brands and collectors forget about an important maxim: the physical experience of savoring a rare, high-quality bottle of whiskey, rum, or tequila can never be replaced by a digital token.

“So much of whisky’s value and appeal is bound up in the physical, sensorial aspects: the heft of the bottle in hand, the wonderful noise as you uncork it, the fantastic aroma, the amber spirit glinting in the light, and the incredible taste,” enthuses Rod Gillies, Brand Director at The Dalmore. The label’s first NFT drop last year, came with a four-piece set containing single malt whiskies from four different decades, sold out in minutes for around 137,000.

“As with rare whisky sold at auction, I’d always hope that at some point the lucky owner would actually open the bottle and enjoy it,” Gillies continues. “Our focus will remain on [NFTs] enhancing or accompanying a real-life sensorial experience, not replacing it.”