Haute couture houses suffered during the first and second world wars from fabric limitations and financial instability. They lost their wealthiest American clients due to the Wall Street Crash in 1929. All those tragic events, combined with the ready-to-wear revolution, led to the disappearance of many famous names such as House of Worth, Paul Poiret, Jean Patou, Madeleine Vionnet, Molyneux, Schiaparelli, Rochas, Doucet and Nina Ricci.

Ailing, once glamorous fashion houses that require an injection of cash from a wealthy entrepreneur to save them from bankruptcy and oblivion are often referred to as “sleeping beauty” brands.

The late Karl Lagerfeld provided the best example of how to revive one of fashion’s “sleeping beauties” when he saved Chanel from oblivion in 1983 and turned it into a legendary luxury brand with revenues of US9.62 billion for 2017.

Lagerfeld, who led the brand for 36 years, recalled, “Everybody said, ‘Don’t touch it, it’s dead, it will never come back.’ But I thought it was a challenge. Thirty-five years ago, old labels were old labels. Now everybody wants to revive a label.”

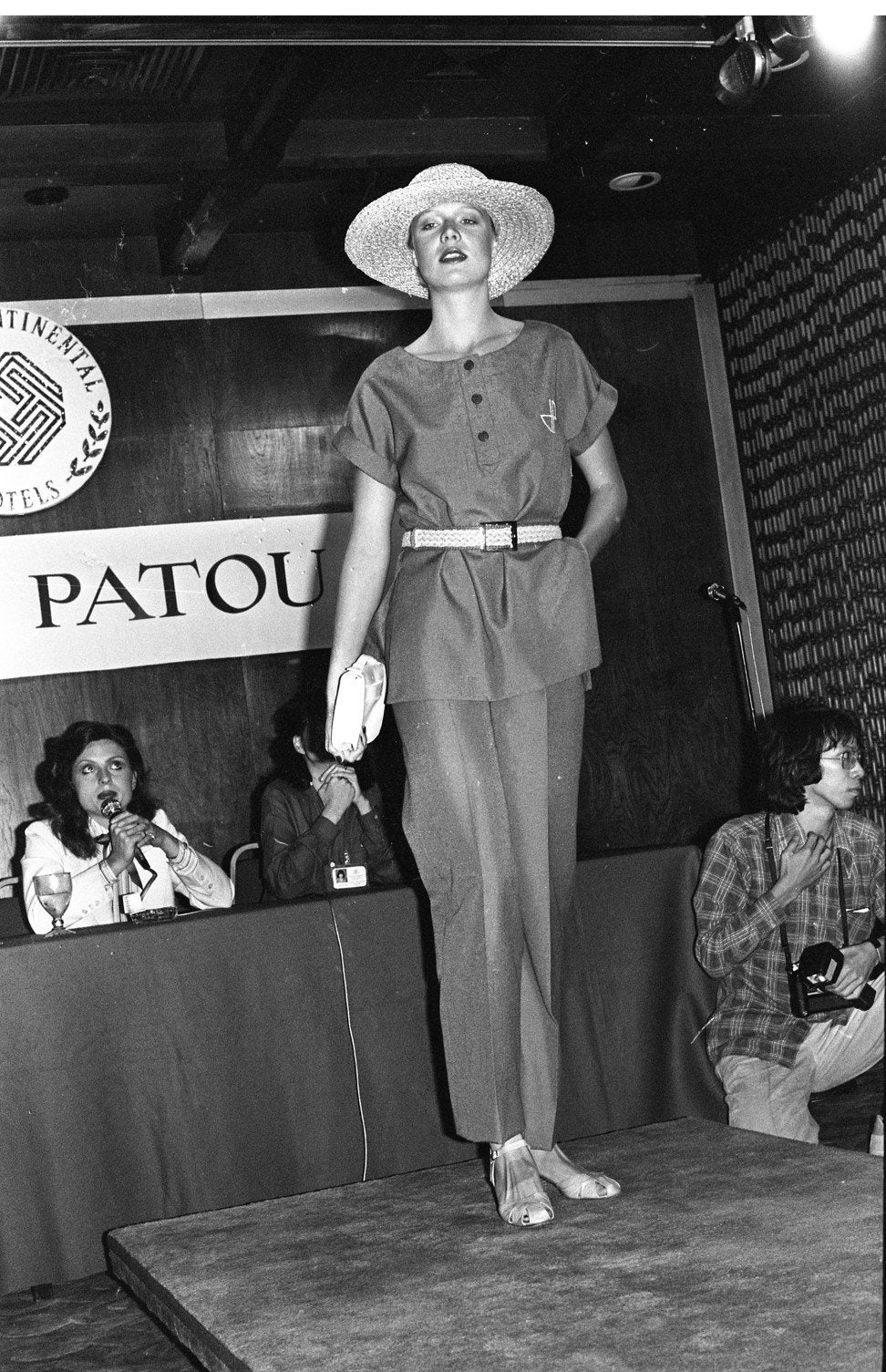

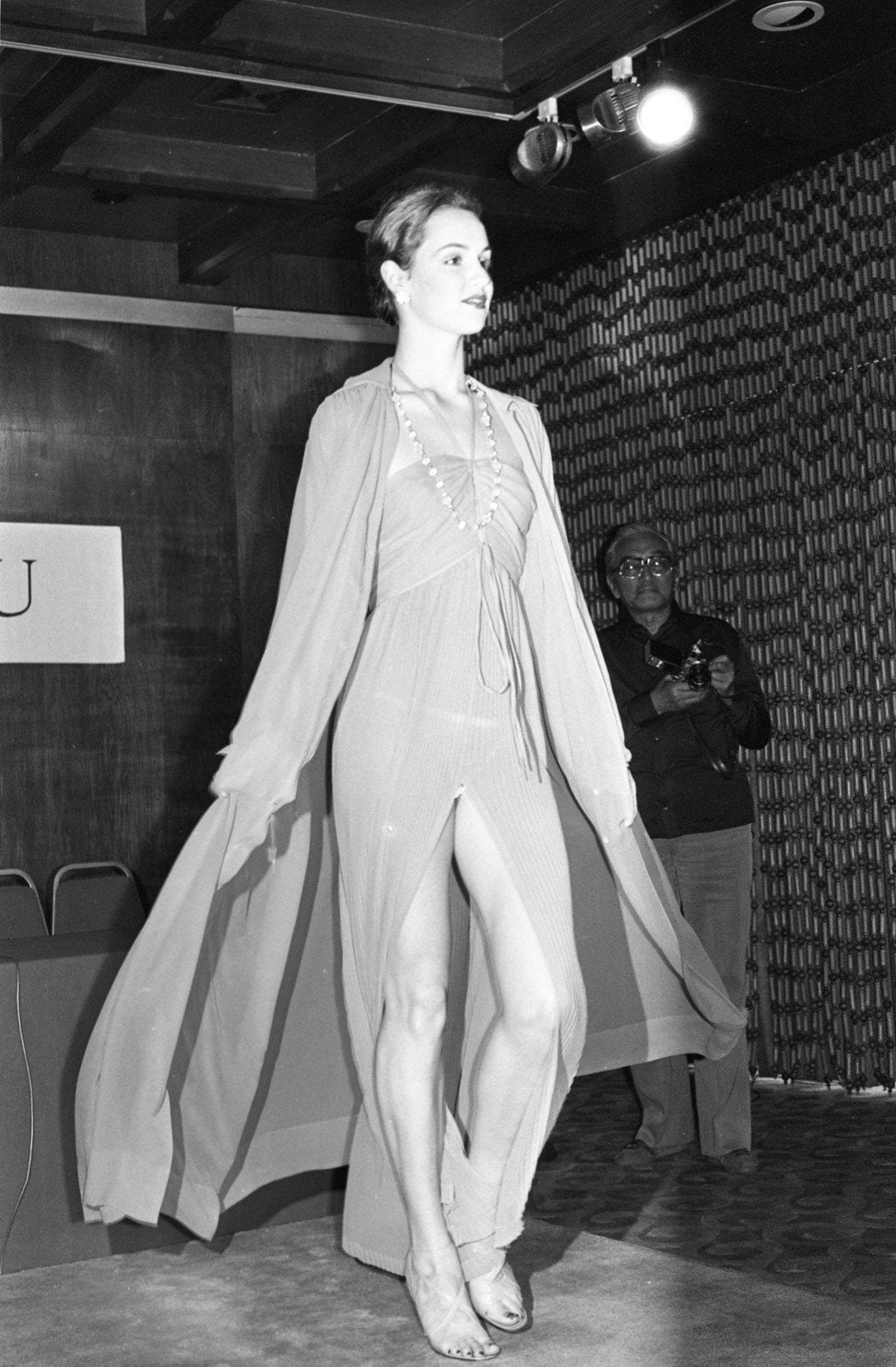

In September 2018, the LVMH group announced plans to relaunch the couture house Jean Patou, Chanel’s biggest rival after the first world war. Founded in the 1910s, Jean Patou was once a household name in fashion, popular for his chic silhouettes with comfortable style. The French couturier was also considered the godfather of sportswear. In 1921, French tennis diva Suzanne Lenglen caused a stir by wearing Jean Patou’s daring outfit at Wimbledon. Showing a brilliant business sense, Jean Patou also applied his own “JP” monogram to his sportswear designs that would become the first visible designer label in the world.

In 1929, the Frenchman also launched the perfume “Joy”, regarded as one of the greatest perfumes ever created and a landmark example of the floral genre in perfumery. Despite its expensive price and the depressed economic environment, it became a hit and was voted “Scent of the Century” by the public at the Fragrance Foundation FiFi Awards in 2000, beating its rival, Chanel No. 5. The house was closed in 1987.

In relaunching the brand, LVMH appointed Guillaume Henry as the creative director.

Investing in a young fashion designer is sometimes a high-risk, high-reward endeavor. In a fragile fashion landscape, are luxury groups shifting their investment strategies to heritage names?

“With a dormant fashion house, you have an inexhaustible reserve of storytelling to match, yet it comes with no liability, negative connotation or skeletons in the cupboard. There is no restructuring to be done and you can position the brand however you wish in terms of creativity, price points, and distribution channels. It is basically ‘carte blanche’ to devise a modern business model that comes with the benefits of aura and heritage”, says Pierre Mallevays, managing partner of Savigny Partners LLP, who is dubbed the “Grand Wizard” of M&A in the fashion and luxury industry.

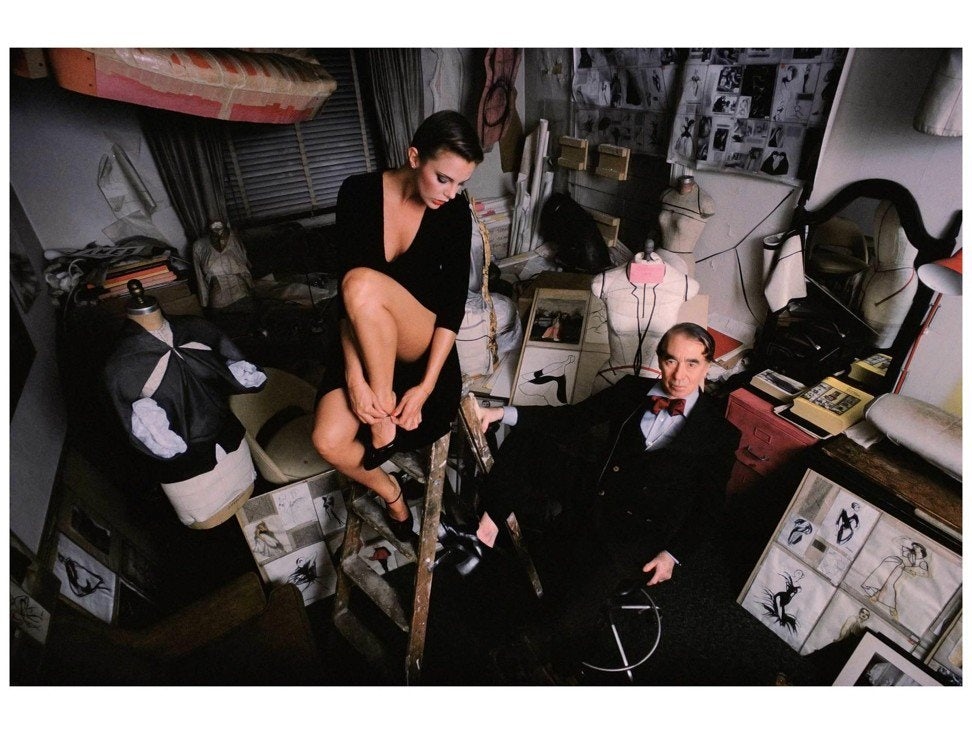

Anglo-American couturier Charles James was acknowledged as the best dressmaker in the world by Cristóbal Balenciaga. Christian Dior called him the “greatest talent of my generation”. James’ greatest achievements included “The Swan”, a puffer jacket made in 1938, which was described by artist Salvador Dalí as “the first soft sculpture”.

In 2014, the now-disgraced movie tycoon Harvey Weinstein announced that The Weinstein Company would relaunch the iconic house. However, Weinstein’s revival plans were halted by Luvanis, a Luxembourg-based investment company that owned trademark rights in various jurisdictions. At the end of 2018, the investment company discreetly put Charles James up for sale.

Arnaud de Lummen, managing director of Luvanis, tells us, “Charles James is not only a household name in museums and fashion history books – it is a wonderful vehicle to create an old-new luxury brand, a fresh name carrying heritage. It offers a canvas for a quintessential luxury brand with the opportunity to build on the Swan jacket to create an alternative to Moncler or to rely on James’ rebellious punk attitude to bridge with streetwear.”

In 2011, Weinstein failed to revive the famous American fashion designer Halston’s brand.

Creativity is a key element in building brand equity. Regardless of the prestige of the name, investment requires knowledge of the fashion industry, which is difficult for a single entrepreneur – even one with deep pockets.

But, it is a straightforward exercise for international fashion groups.

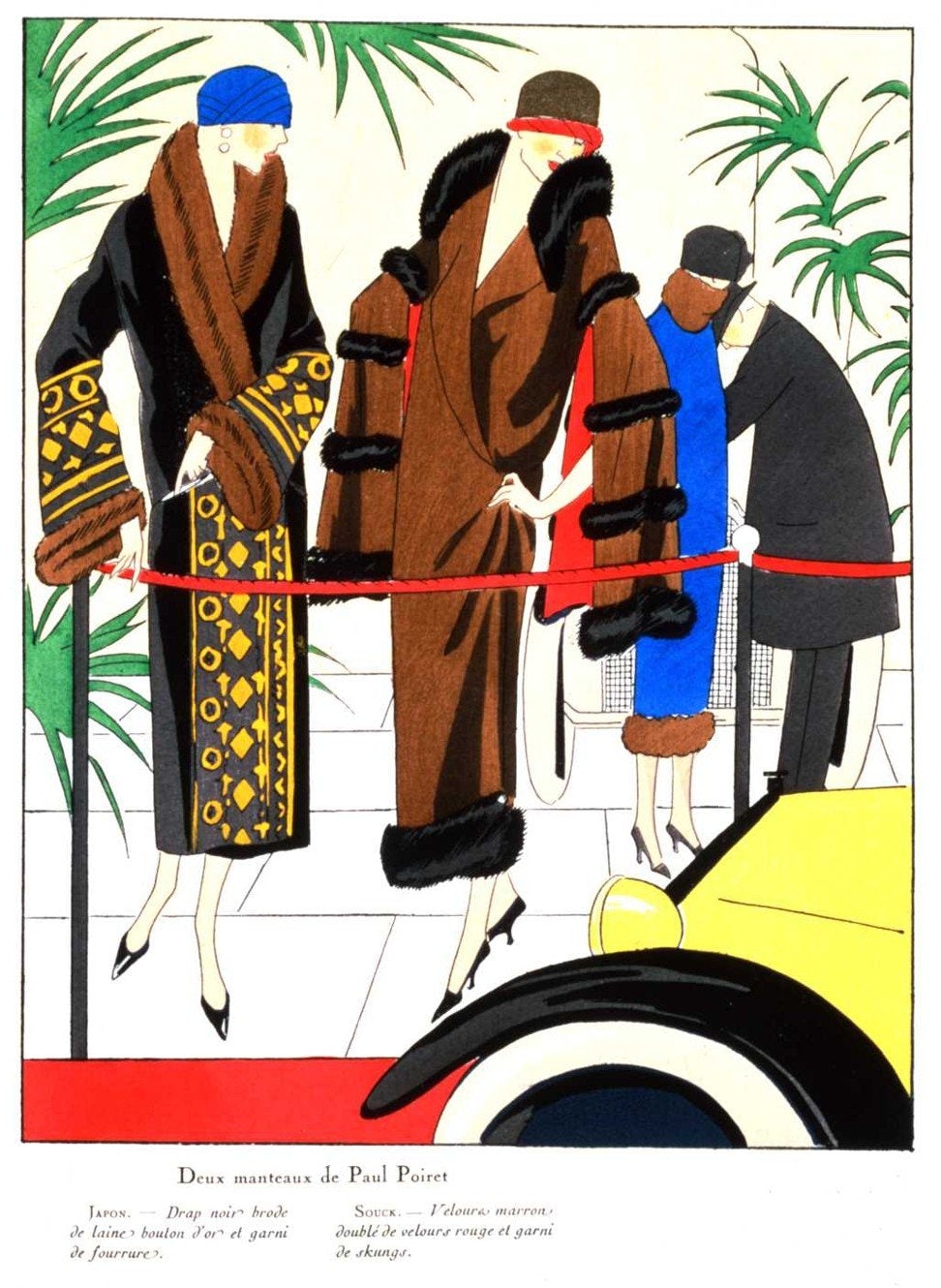

In 2015, South Korean fashion group Shinsegae acquired one of the most important haute couture houses, Paul Poiret. In 2018, Chung Yoo-kyung, CEO of Shinsegae, appointed Belgian businesswoman Anne Chapelle as CEO of Paul Poiret. Chapelle was behind the rise of Ann Demeulemeester and Haider Ackermann.

After a 90-year hiatus, Chinese couturiere Yiqing Yin unveiled the new vision of Poiret in March 2018. Thanks to its heritage, Poiret successfully secured a good spot during the busy fashion week. Both collections of Poiret were warmly received by the international press. Last December, Poiret announced the departure of the Beijing-born Yin after just two seasons.

“Brands with an authentic heritage are important assets. The challenge is to revive them and make them relevant to today’s consumers,” says Luca Solca, managing director, Luxury Goods at Sanford C. Bernstein Schweiz.

The fashion industry is sometimes based on a dichotomy. A brand has to create sustainable value for the long term while taking creativity and cultural factors – which fluctuate every season – into account.

Chinese conglomerate Shandong Ruyi, acquired 51 percent of the Hong Kong company Trinity Ltd, which operates menswear brands Gieves & Hawkes, Cerruti 1881, Kent & Curwen and D’Urban, in 2017.

Over the years, the 200-year-old British tailoring house Gieves & Hawkes has evolved into a global menswear brand. In 2018, sales were boosted by Chinese shoppers in London during Golden Week. The Chinese market will account for half of the luxury sales by 2025, according to a new study by Bain & Company.

Chinese companies are aggressively acquiring European independent houses, boosting economic growth globally. Glamorous exhibitions of old fashion brands are on show in the world’s biggest museums. For wealthy private investors, injecting funds into a fashion house is like revamping a living masterpiece which might one day make a great return. Major luxury groups that acquire a fashion brand can estimate the risk of the investment, and they minimize the risk by strategically appointing a young, talented designer at the creative helm.

A successful renaissance of a label quite often calls for management knowledge, a unique business strategy, creativity, and cultural momentum.

“It requires vision and special abilities, including an uncommon sense for style. Independent entrepreneurs, conglomerates and Chinese groups could all fit the bill,” Solca says.

“Yet, fashion conglomerates have additional [leverage] such as established distribution networks, media buying, and media management skills, retail and consumer insight.”

This post originally appeared on South China Morning Post Style Magazine, our content partner.