Chinese luxury shoppers are possibly the most tech-savvy and digitally friendly consumers in the world. In order to cater to the shopping habits of this group, many luxury brands in China have recently developed a digital strategy that includes opening stores on local e-commerce giants like Tmall, JD.com and Secoo, and launching e-shops on WeChat. However, a new report by ContactLab and investment company Exane BNP Paribas suggests there has not been major progress made by luxury brands in China in improving their digital proficiency over the past two years. This failure to advance has impeded brands’ ability to reach out and deliver an optimal digital experience for Chinese online shoppers.

Their report, China Online Boom: Yet to come for Ostrich Luxury Brands, studies the digital strategies of 32 major Western luxury brands in China to understand how they perform online to benefit their businesses. The study evaluates each brand based on a list of criteria, including localization (language, website, display), customer digital engagement (outreach, store finder, product presentation), and cross-channel services (online and offline integration), among others.

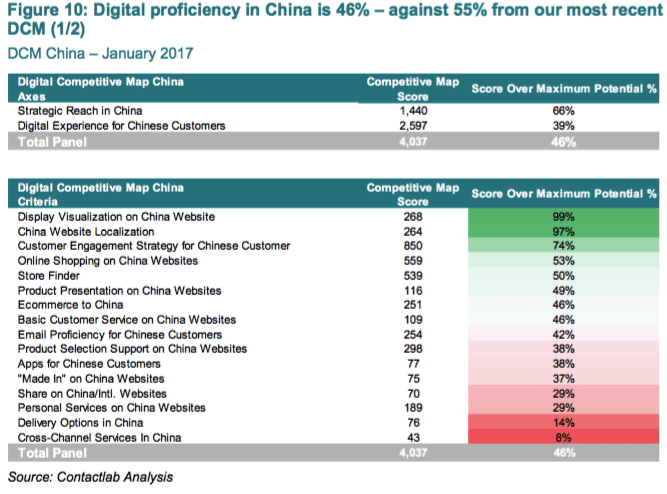

The findings suggest that the pace of digitalization of Western luxury brands in China is slow, as only 21 surveyed brands out of 32 have established e-commerce mono-brand websites in the country, versus 31 out of 32 in the United States and 30 out of 32 in the United Kingdom. Because of this, this year, the report downgrades the digital proficiency of these luxury brands operating in China by 9 percentage points from the previous year’s level to just 46 percent.

The report names the British luxury powerhouse Burberry, followed by the American fashion brand Michael Kors and fine watch and jewelry maker Cartier, as three outperformers. Burberry in China has fully harnessed all types of available digital channels. It has a Chinese official website that is highly localized for Chinese customers. It also has opened stores on Alibaba’s Tmall, as well as launched an online boutique on WeChat. The brand has also made substantial efforts in offering high-quality customer service and style advisory through phone and social media channels, as well as integrating online and offline shopping experiences. Burberry’s wide e-commerce footprint is in contrast with its rivals, such as Gucci, Prada, Hermès and Louis Vuitton, which have not yet established any direct e-commerce.

On the e-commerce front, the study also notes that, in general, Western luxury brands that are willing to sell through this channel tend to go to platforms such as JD.com, Secoo.com and 5lux.com, but keep away from launching flagship stores on Tmall and boutiques via WeChat. One explanation could be that many luxury brands still find it hard to work with Alibaba, as their businesses in China have all, to some extent, suffered from the counterfeit phenomenon on that platform.

When it comes to the level of localization, Coach, Hugo Boss and Ray-Ban are leading, followed by Armani, Burberry, Cartier, Dior and Michael Kors. A high level of localization requires a brand to pay attention to things such as language and currency, and establish official presence on major Chinese sites such as Baidu, WeChat, Weibo, and Youku. Meanwhile, local celebrities and fashion bloggers also play a significant role in helping to localize the brands. For example, Burberry has been working closely with Chinese singer and actor Kris Wu, while Cartier uses singer Lu Han to promote their products.

The availability of “style advisory” is also used as a benchmark to measure brands’ digital performance. Under this category, French fashion house Dior was named as having the best practice via offering an online chat service (in Chinese) to customers with product suggestions. Louis Vuitton offers a similar service via phone and SMS, while Brunello Cucinelli does it via email. Digitally savvy Michael Kors, Cartier and Burberry all provide the service through social media platforms, namely WeChat and Weibo.

In addition, some brands have recognized the importance of mobile payments in the shopping process of Chinese customers. The study discovers that Alipay and cash on delivery have been widely enabled, while European brands, including Ferragamo, Chanel and Dior, also allow customers to pay via WeChat wallet.

The integration of online and offline channels is still in the beginning stages in China, according to the report. To name two pioneers aside from Burberry, Bulgari allows customers to pick up items ordered on WeChat in store, and Coach offers online and in-store product exchange services.

Overall, luxury brands in China still have a long way to go when it comes to fully taking advantage of opportunities in China's digital sphere. The authors of the report said, “It is less than ideal that digital luxury is still dominated by local champions,” as those Western brands who currently have progress to make in their e-commerce presence need to keep in mind that the Chinese consumers they're looking to attract are “young, tech savvy, and eager to embrace change.”

Update: The story has been corrected to show that Burberry has no official e-stores on JD.com, Secoo.com, or 5lux.com.