While many luxury brands in China have been hesitant about diving headlong into the country's e-commerce market due to concerns over infrastructure, quality, and distribution issues, a new report argues that companies who aren't getting into the market now are missing out on a massive opportunity.

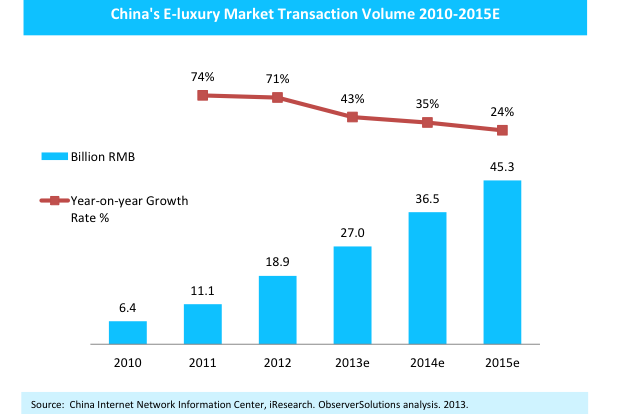

We’ve seen many new statistics and reports on e-commerce in China lately as it grows at rapid numbers, and a study by China business advisory firm Observer Solutions focuses specifically on this market as it relates to luxury. China’s e-luxury market “has exploded since 2011,” rising by 71 percent to 18.9 billion RMB in 2012, according to the report. By 2015, the company believes that this number will expand to 45.3 billion RMB, creating “an unprecedented opportunity awaiting the company that comes out with a winning business model first.”

The report is clear in arguing that luxury brands shouldn't hesitate to get into the market for several reasons. First of all, if you don’t get your brand online, someone else is certainly going to be selling it on a consumer-to-consumer (C2C) platform like Taobao, says report author and company founder Julia Zhu. “China's e-luxury market started from C2C online marketplaces and C2C still accounts for over half of the e-luxury transactions in China now,” she told Jing Daily via email. According to her, C2C dominates the luxury market because of “huge unmet demand” for luxury from online consumers, and luxury brands need to “go online now” in order to “win this part of the market back from the unauthorized channels.”

However, brands can’t just expect to jump online and see immediate profits, but must rather understand their customer base in China and come up with smart strategies including having a relevant product offering, tailored customer service, proactive customer communication and engagement, and localized business operations.

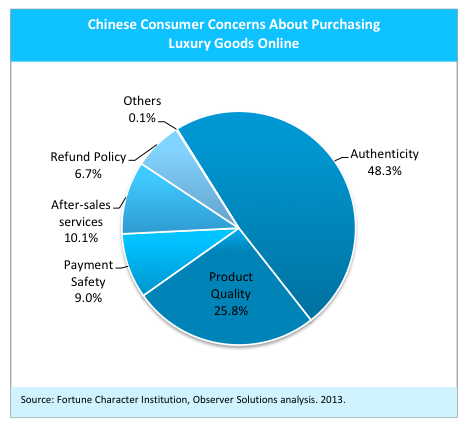

Of these issues, one main concern is the fact that 48.3 percent of Chinese consumers are worried about purchasing inauthentic goods online, according to the report. Zhu notes that e-tailers must “provide tailored service to mitigate customer concerns about product authenticity and quality." These efforts must include informative and high-quality product presentations as well as concern-mitigating customer services including third-party payment, cash-on-delivery options, and easy returns. Customers should also be well aware of the brand's heritage before they click to make their purchase, as a proactive branding strategy also helps “to raise recognition and trust,” says Zhu.

Elaborating on the importance of a brand’s online presentation to authenticity perceptions, Zhu states, “Because of the issue of quality and authenticity concerns, website design is actually an essential part to communicate to new customers and tell them how reliable an e-tailor is.”

The report also features several case studies of “existing players,” including Marks & Spencer, Neiman Marcus, VIPShop, and Nihao Media. Regarding Neiman Marcus, which recently downsized its China operations, Zhu states, “Neiman Marcus could do a better job on marketing and branding itself on both traditional media and new media such as Weibo. Take its Weibo account for example, it only has 17,144 followers so far. even though it is a well-known brand in the United States, while another case mentioned in the report, Nihao Media, attracted 983,897 followers within the same period of time.” The retailer may be shaping up, however. “I think its latest discount/price guessing campaign on Weibo is a good one,” says Zhu, “since it sparked significant discussions and retweets.”

The report is available for download online, and Tech in Asia has compiled a compelling infographic featuring its data that's worth checking out.