Buying a car used to be about going to the dealership and speaking with a salesman in person, but in China, with a growing market of digital native millennials, e-commerce is everything.

The latest report by digital intelligence firm L2, “China: Luxury Auto,” says that more than half of Chinese consumers are “willing to purchase a car online,” and car companies are beginning to listen. Accessible luxury car makers, like Mercedes-Benz, Audi, and BMW, are leading the way in functionality of their e-commerce websites, according to the study, which looked at 18 luxury car brands in China.

However, when it comes to ultra-luxury car brands, automakers have some catching up to do. While 10 out of 18 of the luxury and ultra-luxury brands in the study had a shop on Tmall, in the ultra-luxury category, only one car brand, Maserati, hosts a site on Tmall. “Ultra-luxury brands are worried about seeming too mass market, and they're wary of any kind of use of digital technology, marketing, or e-commerce having an effect on their brand history and heritage,” Liz Flora, editor of Asia-Pacific research for L2, said. “In China, that's creating a huge differentiation between the availability of certain information and e-commerce among the brands.”

Alibaba has already been working to boost the legitimacy of its online shop to car consumers through its Singles' Day (November 11) campaigns. Last year, Tmall and Taobao sold 100,000 vehicles over the course of the day, and while Maserati didn't sell actual cars, it sold 50,000 RMB ($7,290) vouchers that buyers could bring into the dealership to go towards the purchase of its Levante SUV.

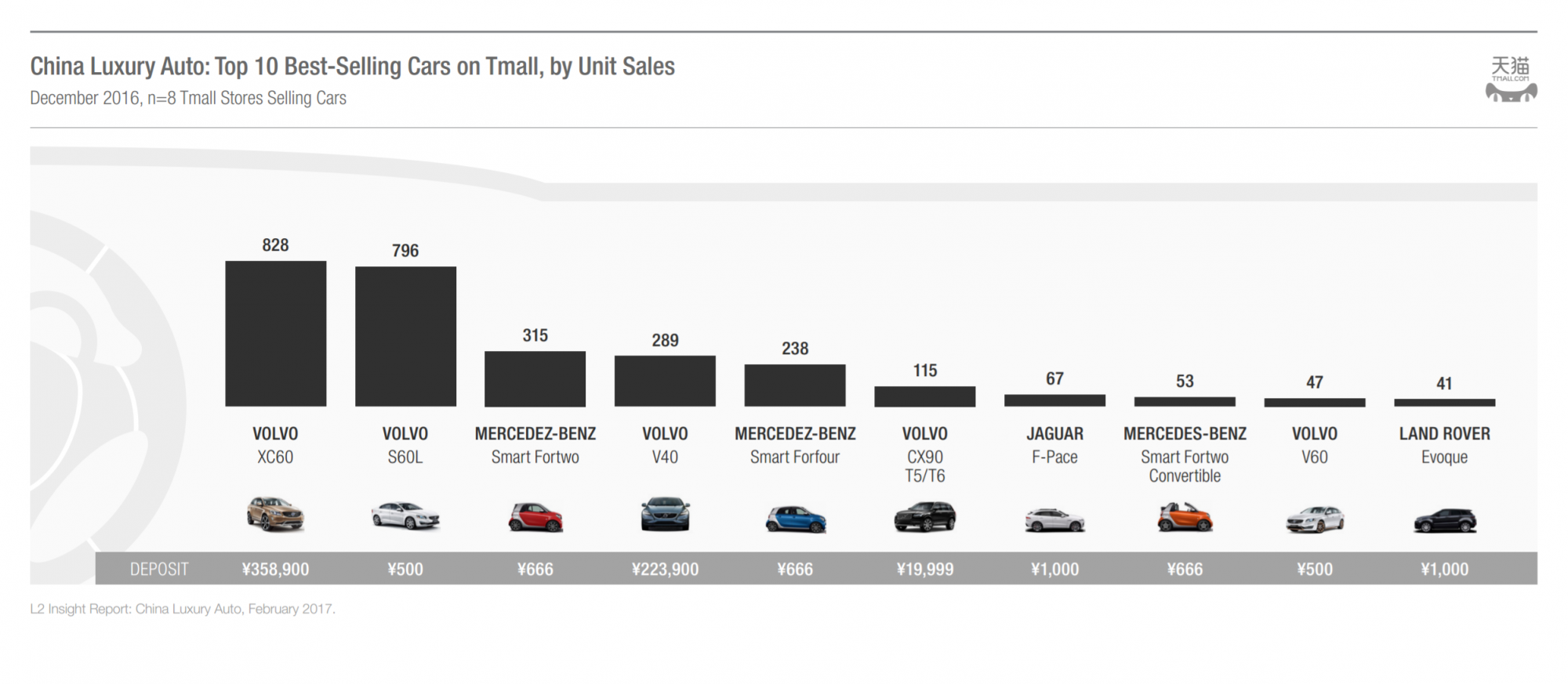

About 77 percent of Chinese consumers said they would be willing to buy a new car online, and offering this option can be especially useful for car brands wanting to sell to consumers in cities in China without dealerships present. On Tmall, the Volvo XC60 is the best-selling model, and its success is hardly surprising—the carmaker's Chinese parent company Geely was the first automaker to have a flagship shop on Tmall five years ago, according to the report.

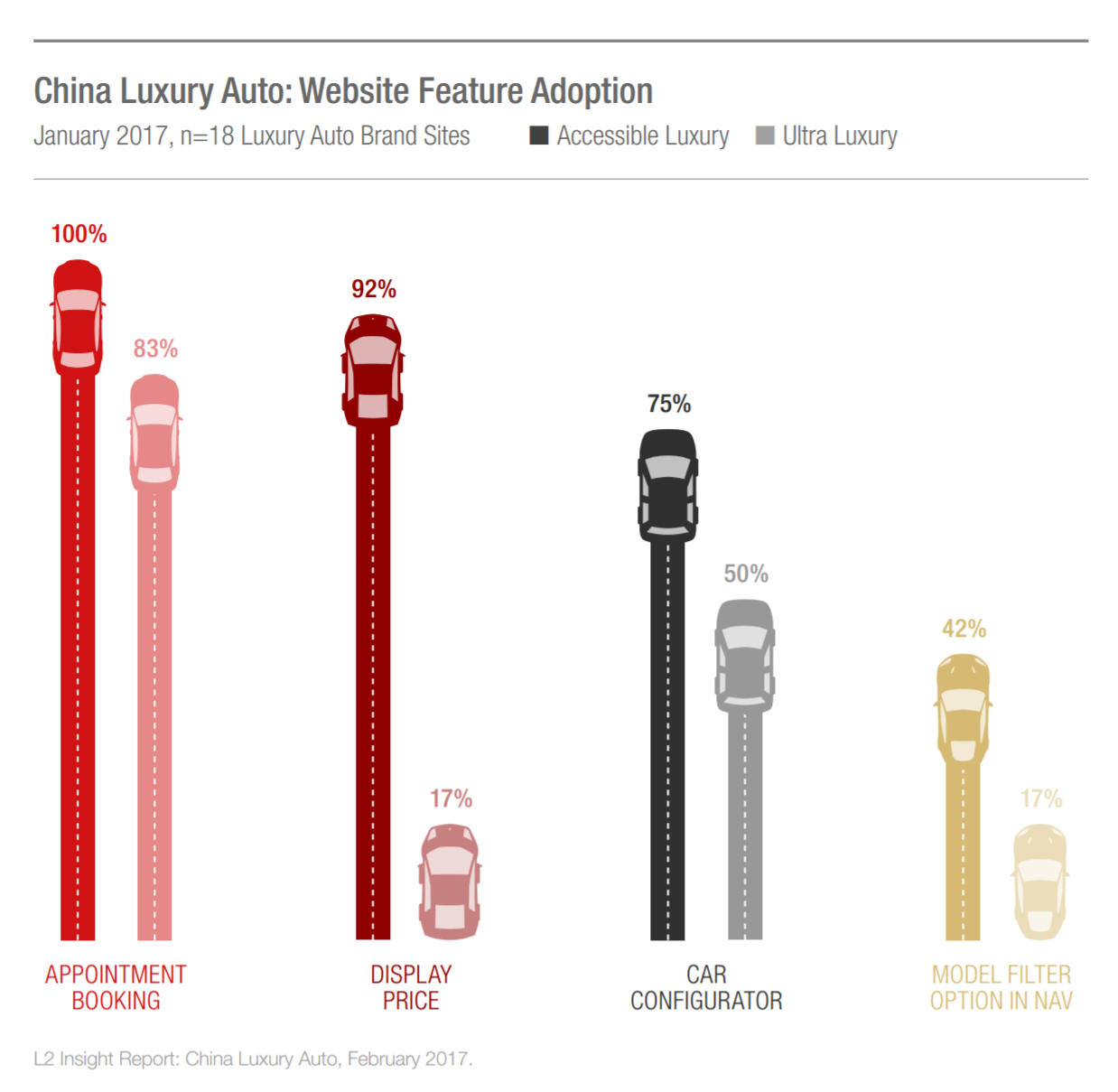

But many auto brands only have mass models available online, so it's particularly important that they offer online-to-offline features on their websites to bring customers into the dealership. L2's study suggests carmakers are not meeting their potential in this respect. For example, while all of the accessible luxury car brands with e-commerce sites in China offer online booking, only 83 percent of ultra-luxury ones do.

There is plenty of room for luxury auto companies' e-commerce presence to grow overall, according to L2. “They're much further behind in their website capabilities than they are on their English language sites, even thought it's much more important to have this digital development in China,” Flora said. This is clear in the numbers: about 98 percent of the brands feature car configurators on their English-language websites, compared to just 67 percent of luxury car brands' Chinese sites and 50 percent of ultra-luxury carmakers.

Having just a car configurator is not enough, according to L2, as car brands ideally would offer a “call to action” feature, such as offering the potential buyer a chance to sign up for a test drive, providing them links to dealerships, or giving them a code that saves their customized car information that they can bring into the dealership. Each one of these features is utilized by less than 22 percent of the 18 car brands reviewed. In one shining example, Audi offers a configurator that provides the consumer a code once they finish creating their customized car model on its website. The German automaker will then make dealership suggestions based on the availability of the specific features the consumer wanted.

“Chinese consumers are doing a lot of their auto research online before they ever go into the dealership, so the brands that are ahead technologically with their website features are the ones that will be ahead of the curve in terms of attracting those consumers,” Flora said. “The brands that really stand out right now in terms of their website functionality are the ones that are able to use their websites to drive the consumers further down the path to purchase.”

As automakers compete for new consumer segments in China, some brands are making efforts to take their presence even further into the digital sphere. Last year, for example, Mercedes-Benz opened an experience center in Beijing to woo a younger generation of aspiring luxury consumers through social media and offline events. L2's study emphasizes that it pays to capitalize on digital technology in a market that's increasingly leaving brick-and-mortar sales behind.