After a long day, you settle in with your phone in hand, finally at the best part: opening your favorite livestreaming app and tuning into your favorite host as they present beauty products and luxury items galore. The flow of the livestream has become a comforting and recognizable part of Chinese netizens' daily routine. So much so, that livestreaming in China is now a billion-dollar industry that is only skyrocketing in growth, both in the diversity of content and number of viewers.

During repeated lockdowns, consumers are flocking to their screens to see their favorite KOLs — from local micro-influencers to big-name Chinese celebrities — share product reviews and brand recommendations. Accessible to almost anyone with a mobile device, livestreaming e-commerce offers a highly interactive and personable presentation alongside promises of exclusive deals.

From performance art exhibitions, to video games, to one-on-one luxury consultations, more and more companies are tapping into livestreaming’s e-commerce potential. Even platforms like New Oriental, a largely content-driven company featuring educational English, history, and cultural lessons, is turning an eye towards beauty products as part of their e-commerce branch. Outside of China, Amazon, Facebook, and Instagram have also launched their own livestreaming and selling platforms.

As this digital trend continues to boom, social e-commerce may become the new e-commerce. After all, the gross merchandise value (GMV) of the livestreaming e-commerce industry is set to surpass 2.8 trillion RMB (roughly 438 billion USD) in 2022 and a whopping 4.9 trillion yuan (732.8 billion USD) in 2023. With algorithm-driven short-video apps dominating the online advertising space, here’s what luxury brands need to know about the top four livestreaming platforms in China.

Douyin#

Also referred to as TikTok’s Chinese counterpart, Douyin’s livestreaming service pushes the KOL product seeding to sales loop through the app’s interest e-commerce model. From initial interest to final transaction, luxury names such as Louis Vuitton, Gucci, and Dior rely on the social commerce platform to effectively reach consumers stuck at home during ongoing pandemic lockdowns.

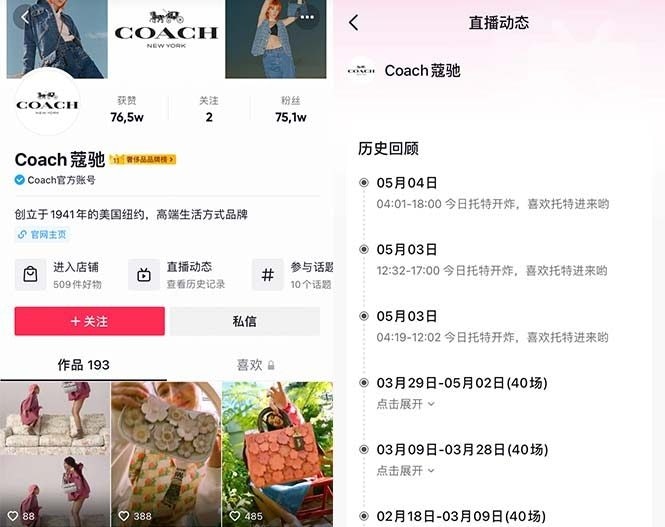

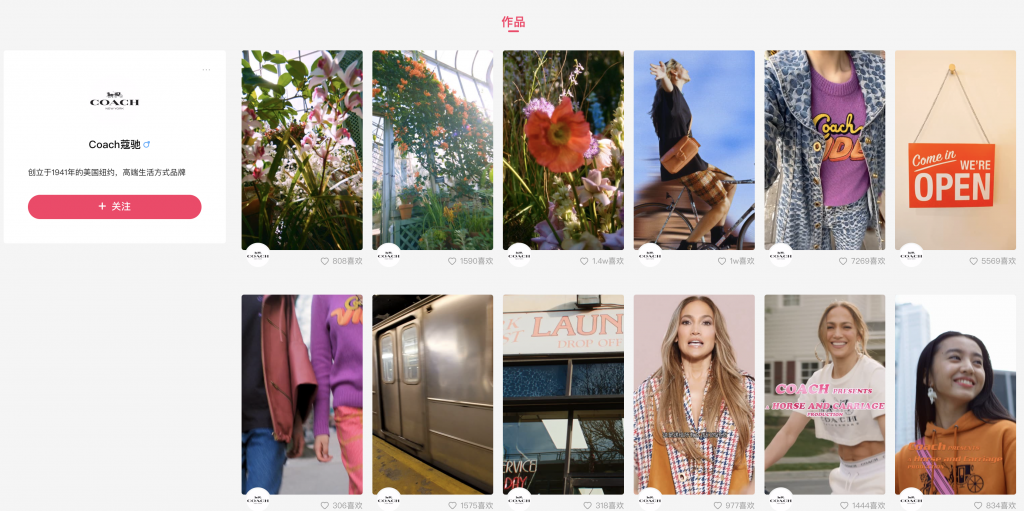

Douyin’s live broadcast feature is particularly popular among young consumers due to its low entry barrier to selling products. Products promoted by popular KOLs can directly translate to sales, as seen by Coach’s collaboration capsule with Bape selling out in a mere 6 hours after a livestreaming event featuring actress Qi Wei. With additional attractive features such as Douyin’s VIP Room, Flagship Store, and Global Choice, the app has successfully established a business model that works simultaneously as a personal and commercial platform.

Kuaishou#

While luxury brands have traditionally focused their attention on apps like Douyin and Bilibili, Tencent-backed Kuaishou’s 578 million MAU and almost 40 billion revenue in the fourth quarter of 2021 is increasingly difficult for major brands to overlook. Coach’s recent livestreaming debut on the app signals an interest from brands in expanding their audience, particularly into lower-tier cities which makeup a large concentration of Kuaishou users. Though it is too early to tell the future of luxury e-commerce on the social platform, the app remains a go-to spot for millions of daily users in purchasing affordable beauty products and food.

YY Live#

YY Live, previously a subsidiary of Chinese livestreaming pioneer company Joyy, was acquired in 2020 by search giant Baidu as a foray into video streaming and a push for advertising dominance in the ultra-competitive Chinese market. Though it doesn’t boast as many MAUs as leading platforms Douyin and Taobao Live, YY Live offers a loyal user group of paying subscribers for a large number of content creators. Hosts of the platform highlight streaming and chat features with virtual currency that is later converted into real cash — positioning the social network as entertainment focused rather than strictly e-commerce. However, strong creator fanbases means user-generated content offers a direct pipeline to sell to communities, rather than just passing-by viewers.

Taobao Live#

Launched in 2016, Alibaba’s short-video platform Taobao has quickly established its place as China’s largest B2C platform. With the largest market share of e-commerce retail platforms in 2021, Taobao clocks in with 840 million monthly active users (MAU), captivating Chinese and international audiences with a mix of entertainment and commerce-related content.

Part of Taobao’s success in the fashion world is attributable to its highly diverse and affordable array of products, which many consumers find as savory alternatives to more expensive versions of trending clothing and lifestyle products. Paired with an ultra-fast supply chain response, Taobao makes it easy for livestreamers to maximize the speed and agility of the number of products they can try on, review, and sell to loyal audiences.

With the ever-increasing importance of brand awareness in China and beyond, livestreamers are often the KOLs that consumers trust and relate to — and therefore turn to for product and service recommendations.