It is almost uncontested that China is now taking a lead in the development of the global e-commerce industry. The official government statistics show that the country scored a total of $750 billion worth of online deals in 2016, which was a figure larger than the amount made by the United States and the United Kingdom, combined, which was $598 billion, during the same period.

For quite a long time, the United States has taken a leading position in the global e-commerce market, giving birth to some of the prominent market leaders such as Amazon and Walmart. Around 2010, China’s e-Commerce growth started to explode, in parallel with the massive sales of the world’s largest online retailer, Alibaba. In 2013, China outpaced the leadership of the US in the market, according to the Ministry of Commerce, and has since continued to expand its dominant role.

In a report they co-released titled, "The New Retail: Lessons from China for the West," the global management consulting firm Boston Consulting Group (BCG) and Alibaba Group attempt to look deeper into how China came so far in so little time.

The report, which was released in two parts (the first on May 4 and the second on June 21), offers in-depth analysis of the booming e-commerce industry in China and how it has taken a different evolutionary track from its Western counterparts.

China is not only leading in terms of the sales number, according to the report. Some of the major players such as Alibaba and JD.com have consistently challenged people's imagination about the boundaries of the e-commerce industry through incorporating the latest technologies such as big data analytics and artificial intelligence. The report also recognizes the importance of Chinese consumers in shaping up the country's e-commerce market.

Jing Daily summarizes 10 key differences of the e-commerce landscape between the West and China based on the findings in the report reflecting history, consumer behaviors, the digital marketplace, and technology:

1. Westerners value speed and efficiency#

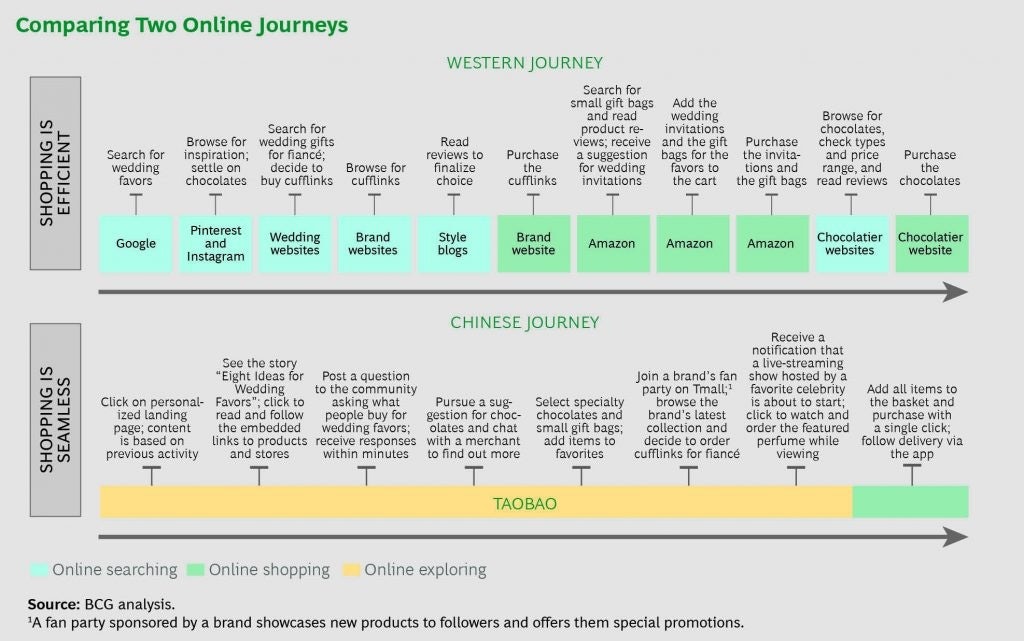

Efficiency is the key driver behind the birth of the e-commerce industry in the West, according to the report. Western consumers go to online stores to place their order, as they value the speed and convenience that this method of shopping can offer. However, efficiency is not that important in China. E-commerce is an extension of traditional shopping. Chinese consumers look to the mobility and universality of the internet to access richer offerings in terms of products and services.

2. E-commerce technology transforms more quickly in China#

There's a vast difference between the foundation that the industry was built on. Before the arrival of online commerce, the offline retail industry in the West was well-developed. Consumers there were used to visiting all kinds of brick-and-mortar stores and boutiques to buy goods. That was a stark contrast from the Chinese shopping experience, which was under-developed in the physical retail realm. The report, thus, noted that one reason why the e-commerce technology transforms faster in China than in the West is that there is less necessity to protect legacy stores.

3. Westerners get to online stores through searching, whereas the Chinese use a variety of channels#

The way that the Western consumers land on the online stores is much simpler than the Chinese counterparts. The BCG report said that the pre-purchase action that is usually taken by foreign customers was searching. Nevertheless, Chinese consumers rarely use searches to direct them to the sites. Rather they get there via a myriad of channels (like key opinion leaders (KOLs), live-streaming events and gamification). It's a process that is quite often seamlessly embedded in other online activities.

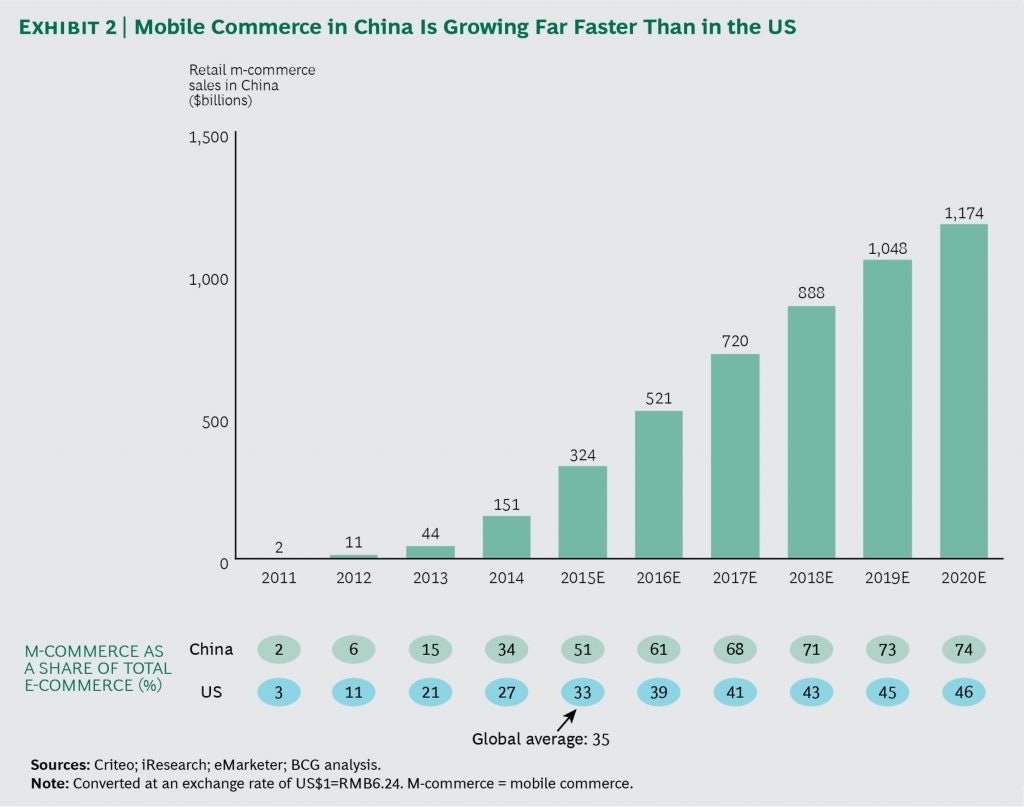

4. The Chinese are more comfortable shopping on mobile#

The study reveals that more than half of Chinese consumers like shopping on their mobile phones whereas only one-third of their Western peers are. The preference for mobile devices has driven the rapid development of the mobile commerce in China. The convenience of smartphones spurs impulse buying.

5. The Chinese want online shopping to be an experience#

Online shopping is more than a simple transaction for the Chinese consumer. Aside from buying the products they need, Chinese shoppers also expect to be entertained, filled with a sense of exploration and discovery, and to engage with friends, celebrities and cyber influencers. The social engagement aspect is especially obvious when consumers purchase luxury items. They look to their high-end consumption as a way to express their lifestyle and social status to their friends and family.

6. Chinese consumers are more brand aware, but less brand loyal#

In comparison to their Western counterparts, Chinese consumers are, in general, more brand aware but less brand loyal. The need to discover and explore new goods and services while shopping online means Chinese buyers are open to brands that they do not know. Retaining consumers and nurturing a sustainable relationship with them becomes the challenge. They're easily attracted by new products and brands that "engage them with innovative offerings and the creative use of multimedia."

7. Merchants in China take advantage of offline events#

Related to Chinese consumers' diverse expectations during the pre-purchase phase of their shopping experience as illustrated in the third point, another major difference that shows how Chinese and Western e-commerce firms market their goods and services toward customers is that Chinese ones usually offer rich experiences in order to lure sales. For example, the report notices that merchants in China take offline events such as fashion shows or game shows and "scale them online to reach a much broader audience.”

8. The Chinese dig deeper into data to understand their customers#

The way providers in the online marketplace use customer's data is also highly different. In the West, BCG said companies give buyers product recommendations based, for the most part, on their searches or buying history. Chinese players, in contrast, capture data beyond that to include types such as location and online activity to better understand their consumers.

9. Western online merchants don't curate the shopping experience as the Chinese sellers do#

The level of personalization that online marketplace providers offer consumers is different in China than in the West. Chinese e-commerce websites tend to provide shoppers with a much better curated shopping experience than that offered by Western sites. Therefore, Chinese consumers can enjoy better-customized and updated online service.

10. In China, there's a higher level of online/offline integration#

All kinds of differences that have been identified above have led to one of the major conclusions of this report: the level of integration between online and offline services is higher in China than it is in the West. Making the natural connection from online to offline can help brands better serve the Chinese consumers who value online shopping more as a social experience.

What are your online shopping habits like? Tell us in the comments section below.