Four years and three designers later, Lanvin, the 130-year-old French fashion brand, has finally returned with new blood. The team now is headed by CEO Jean-Philippe Hecquet, shaped by emerging 31-year-old designer Bruno Sialelli, and backed by Chinese conglomerate Fosun International. But will this be the management formula that finally works for the much-maligned heritage brand?

Lanvin’s official debut in China was hosted last week inside the expansive Fosun Foundation building in Shanghai. Visitors were welcomed with the opening of an exhibition titled Dialogues, which commemorated the brand’s past while also heralding its future, as well as a new flagship store in the Bund Financial Center just across from the foundation building. The show expresses just how much Lanvin — with its uniquely Chinese DNA — is counting on China’s consumers, who it estimates will account for roughly 50 percent of its revenue over the next 3-4 years.

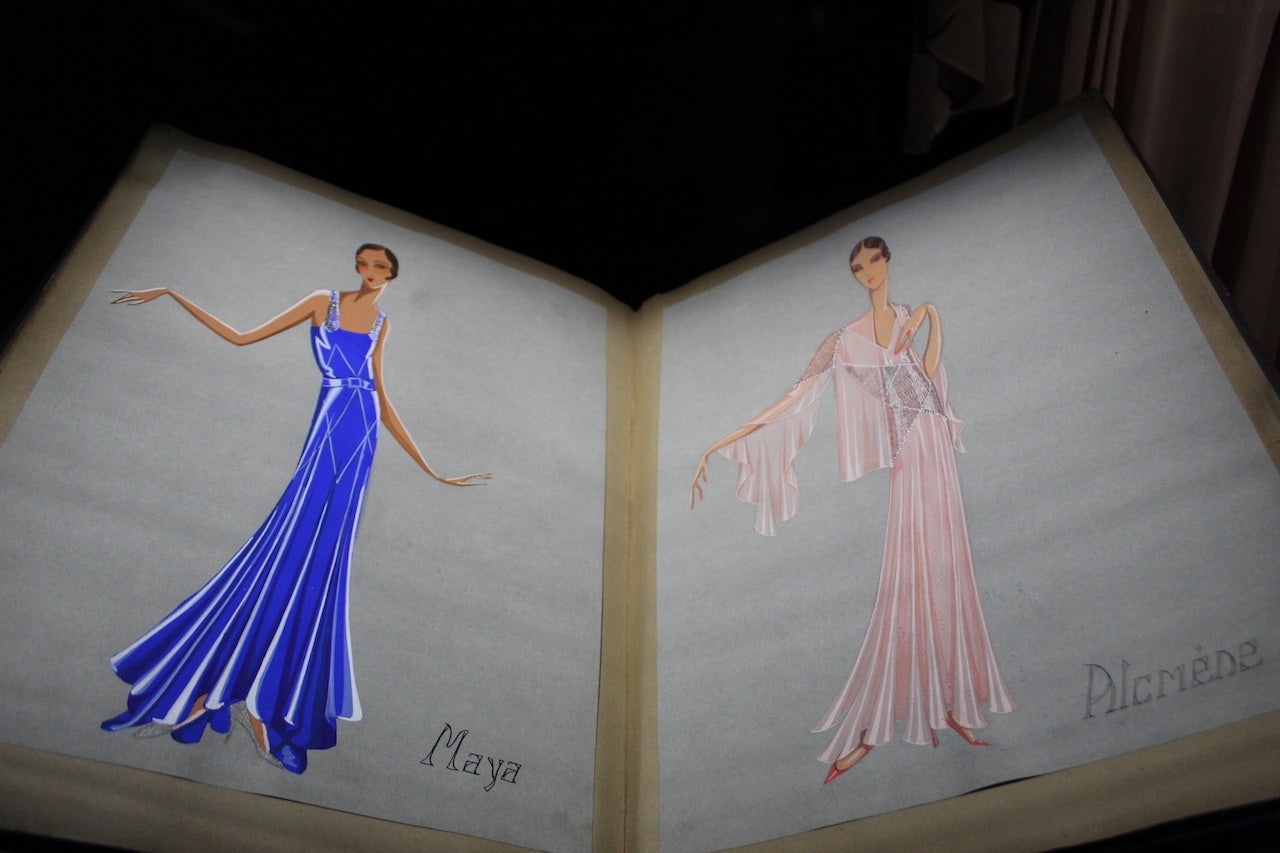

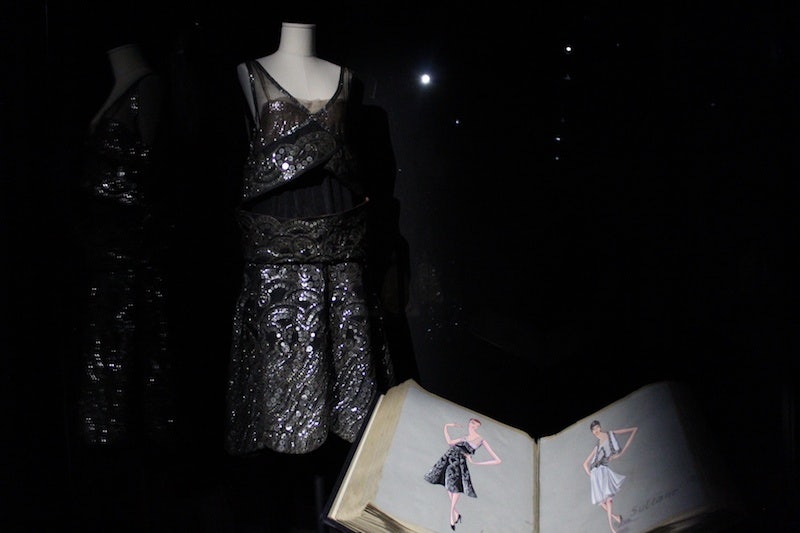

Inside the exhibition, visitors are immersed in a Lanvin-Blue-colored world that features 75 pieces from the house archive dating back to 1889. Guests can see a mother-daughter sculpture representing the brand’s origins (the label was created by founder Jeanne Lanvin specifically for her daughter) and a slice of early-19th-century French history, thanks to Lanvin’s obsession with period theatre and film. These elements might seem foreign to Chinese consumers who are used to exhibitions with red lanterns and Chinese calligraphy, but this was done for a reason.

“We intentionally didn’t design [the show] for Chinese consumers,” stated the well-known curator and exhibition designer Judith Clark to Jing Daily, saying that the production was meant to refresh the brand for a global audience. It’s certainly not an easy job to pack over 100 years of Lanvin history into one exhibition, but Clark worked tirelessly alongside new designer Bruno Sialelli to help wake the sleeping beauty Lanvin.

“I investigated a great deal into [Lanvin’s] past by using the archive as a physical tool,'' said Sialelli about his quest to learn about the house’s original designer during a panel hosted after the opening. “[I didn’t] literally interpret what Jeanne Lanvin had done, but her obsession turned into mine.” Sialelli has stints working at Acne Studios, Paco Rabanne, Balenciaga, and Loewe under his belt, but the Lanvin job is much bigger in scope. He has been tasked with revamping the women, men, and accessories lines — a first for an age-old brand that has traditionally used separate designers for different product lines.

Yet it was Lanvin’s storied past that drew the eye of Fosun, the Chinese conglomerate who also owns brands like Wolford and Caruso and snapped up Lanvin last February for 100 million euro. “When I first visited the office, I was struck by the rich history preserved in the place,” Joann Cheng, president of Fosun Fashion Group recalled excitedly. “The over 100-year-old desk of [founder] Jeanne Lanvin was perfectly preserved, which was very impressive.”

But the key to revamping a brand like Lanvin isn’t simply a wealthy and patient Chinese owner; it’s a seasoned CEO who can meditate between the money and the talent. That CEO is Hecquet, who previously served as the head of Sandro, another Chinese-owned French luxury brand. In an exclusive interview with Jing Daily, Hecquet spoke about Lanvin’s future focus, the challenges of “pace” in the China market, and how it should take two-to-three years for the brand to fully recover. Below are some of the highlights:

In 2018, Lanvin was acquired by the Fosun fashion group as its first major luxury acquisition, and half a year later you were appointed as the CEO. Was it a smooth transition for the brand?#

It was very busy, but it’s a beautiful challenge, rebooting the oldest fashion house. The first mission was to bring Bruno on board because the relation between Creative Director and CEO is very important. We have the same vision, and the idea was really to bring in somebody who would be able to understand the past but treat it in a modern way. His vision is men and women and accessories.

We had to bring consistency to the brand and having a designer who’s able to embrace the whole product category with a clear vision is very important because then there’s consistency everywhere. That’s the first element because people looking at the brand want to understand the brand.

In a recent interview, you mentioned that the company is seeing a return of growth, and you are largely betting on China for that recovery. What will that recovery period look like and how long will it take?#

Our idea is to do things right and well, so we want to focus on the key markets, which are China, the U.S., France, the U.K., and Italy. So, over the next three to four years, we will mainly focus on those five markets. China is probably the most strategic one, and in those markets, we are seeing a good reaction so far.

At the end of the day, it’s all about the products. So, the customer will react. If they feel good about the product — I would say, even more in China — then there’s a connection with it.

How do you see the Chinese market reacting to Lanvin’s different products? Is there a specific category that you’re counting on?#

The accessories category is big. I come from the accessories world. Lanvin’s history is fashion, mostly ready-to-wear but also accessories, and I think we have built a team to develop this category.

Bruno’s approach is a full look every time. There’s never a look without a pair of shoes or a bag or jewelry. We have a full business dedicated to accessories and in the future, you’ll see that we’re investing heavily in city bags and shoes. We want the accessories part of our business to reach 50 percent of the business in three to four years. Product-wise, we’re investing a lot in accessories and ready-to-wear, which is the heart of our DNA.

Lanvin recently opened its Asia flagship store in the Bund Finance Center in Shanghai. Do you have an online-to-offline retail strategy in place for China?#

Of course, we’re going to use both. Digital is at the heart of our strategy, especially in China where everything is digital. We’re going to leverage different digital tools in China, but we still need flagships so customers can fully experience the brand. We will open in K11 in Hong Kong, and then we have a lot of projects in China in other main areas and cities.

How do you reconcile building a more casual fashion line while still retaining the brand's high-end appeal?#

Everybody’s mixing brands and products today. The fashion industry has evolved, and Lanvin’s approach is appropriate for this new trend. But we must stay genuine to our history. So, we aren’t going to follow a certain type of product just because it’s very popular. We want to keep the same vision while stretching the brand in our unique way. It’s also about addressing different types of clients.

Luxury consumers in top-tier Chinese cities are experiencing market saturation. Do you have any plans to invest in lower-tier cities in China?#

We could over the next three years. I think it’s more a question of doing things gradually. We’d love to tell our story everywhere in China, but we’d focus on tier-one cities first, while still having an eye on the tier-two cities. And sometimes, you find a good project with a great partner or a mall, so we don’t close doors, but the focus is tier-one cities first.

The last fashion brand you worked for, SMCP, is also backed by a Chinese company, what do you think is the key to navigate the culture? How do you balance the freedom and restriction of working with Chinese investors?#

I think we have the same values in terms of resource focus, respecting brand DNA, and bringing everybody along at the same pace. I think one important element is pace. Because the pace is very fast in China, but the French pace is different. So, you need to understand the China pace, meaning you need to accelerate things that you can accelerate while giving time to some other elements.