Hankook's Prouna line blends Asian and Western elements in its luxury chinaware. (Courtesy Photo)

As the producer of luxury dinnerware sets used by royals from the UK to Qatar, Korean chinaware company Hankook has undergone a dramatic “made in Korea” to “designed in Korea” transformation over its more than 70 years in existence. Now, the global company is focusing squarely on Asia for its future growth as Chinese consumers remain fixated on all things Korea.

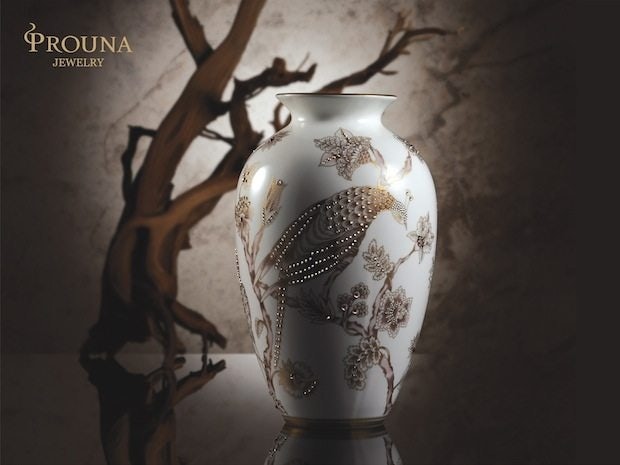

Hankook started out primarily as a an original equipment manufacturer (OEM) for major global chinaware brands like Wedgwood and Lenox, but it later decided to start producing luxury dinnerware with its own unique designs. In 2003, it founded the luxury chinaware brand Prouna, which has gained global prestige with artist and designer collaborations and is sold in top department stores across the world including Harrods, Bloomingdale’s, and Selfridges. With a brand identity featuring a mix of Asian and Western design elements, its dishes have been gifted to Queen Elizabeth by Korea’s first lady and are used by global elites such as the Qatari royal family. While its “Prouna Classic” collection features traditional Asian design elements, the brand has also teamed up with Swarovski to create a crystal-studded “Prouna Jewelry” collection that is popular with Asian consumers.

Like many prestigious Korean brands, Prouna has been seeing significant growth potential with Chinese consumers as it benefits from South Korea’s massive Chinese tourist influx and expands into China. To get more information on the brand’s strategies when it comes to the China market, we sat down with Hankook President Young-Mok Kim for an interview on Chinese customers’ favorite designs, the brand’s China e-commerce strategies, and why its Korean heritage gives it an advantage over Western brands in China.

How does the company’s use of Asian design concepts appeal to Chinese consumers?#

Chinese customers, we are reported, mostly like to have red, gold, and dragons, but in our thought, brands should have their own dignity—their own philosophy [with] colors. It’s a question of “Do we want to adapt to the culture, or [does] the culture select us as [part] of their new culture?” We do not tend to always use the Chinese favorite colors, but we’d like to keep what we feel the trendsetting design and color is—so it’s oriental, but European. Our idea always is a fusion of ancient and future, and East and West, so we are the collaboration of the cultures and time.

The Prouna Classic collection features traditional Asian elements. (Courtesy Photo)

Which patterns are most popular with Chinese buyers?#

Gold—gold-based and Prouna Jewelry. We have two types of categories: one is Prouna Classic—that is with the deer, swans, and sculptural finials on top. But Chinese tend to like more of the gold-based [designs] with the crystals around them.

Are your Chinese customers more likely to buy your products as gifts for others or for themselves?#

Mostly gifts for others. Chinese tend to like to present things to others. I’m still actually learning about Chinese culture at the moment. It’s also a new market for us, but we feel that the Chinese market will be “the” market for everyone with the speed of economic growth and the way they have created themselves as a country.

Many of the people tend to exchange gifts with each other to promote their ideas and their relationship, so Prouna can be the perfect gift for that, because it’s one of a kind. I’ve seen some markets in China where they have hard liquor that costs about US$100,000. I don’t know what they put in it, but they only sell it for gifts—they don’t sell [for] any other [reason]. Because of the price like that, people recognize that product is valuable.

But Prouna is one of a kind. Some people imitate—there are already copies in China. I have seen some copies in China, but the [crystals] all fall off [without] the fusing technology. Having the beautiful product itself is good, but the technology should be there to protect safety and health, because imagine if the beads fall off while you are eating. It’s not Swarovski.

Prouna teamed up with Swarovski for its crystal-studded "Jewelry" collection. (Courtesy Photo)

How important are Chinese customers to your overall global sales now, and how important do you believe they will become in the future?#

I strongly believe China is “the” market. Not only for us; it’s for everybody—whoever gets Chinese attention is the real business success. I recently learned a little bit about the Chinese government and system, and why China has been developed so fast. It’s stable. People talk about many things, but the way they operate, every Communist department—their interest is economic growth. That’s what I learned from some scholars. It’s very difficult to see that they’re Communist. They all look to capitalism and everybody owns their wealth; they spend money freely, and exchange gifts with each other. I don’t know what’s behind that to control it, but that’s not our interest.

Prouna as a company cannot compete with Chinese dinnerware—they make [it] much cheaper. The quality isn't too bad. What we have is the niche technology, and what we have is something different from others, so we have to use that to get their interest.

Do you think the company’s East Asian heritage gives the brand an advantage in China compared to European brands?#

Yeah, I see that it’s very strong. That can be our strength, because somehow Chinese like Korea very much—especially the Korean actors and actresses. We call it “Korea wave” [with regards] to China. Many of the Chinese come to Korea to get plastic surgery. In Korea now, tourism from China is the fastest-growing business. Chinese love Korea. Of course, Chinese love to visit France, Italy, New York, and many places, but we’re nearby and easy to access, and the culture is similar, so they feel much more comfortable. Because of its Korean-based luxury, I’m sure that we have an advantage. Even though [we’re] mixing Western and Eastern, the “Korean-ness” with will appeal much better to Chinese than any other country around us.

Are there any unique ways in which you market your products specifically in China?#

We are studying the tourism and online business sectors. China is very broad, and of course, it’s important to have some offline shops to present our real products to [see] in person, but the network of China is developing so fast and [international] delivery is possible. We cannot ignore Chinese mobility and e-commerce, and I think that probably is the key. That’s actually where we’re focusing very strongly.

You have stores in Shanghai and Beijing. Do you have any China store expansion plans?#

Yes, we do. Our expansion is not invested directly—it is [through] distributors. We like to pick the right partners in the right areas so they’ll be the key player in that region. It’s not only the internet business that matters; there’s always B2B business as well—so offline contacts in as many places as possible.

Asian designs and crystals help Prouna appeal to Chinese buyers. (Courtesy Photo)

Can you talk a bit more about your e-commerce and mobile sales strategies?#

Taobao is big, and Tmall is big. We just recently heard that Tmall.com has been so crowded and they'd like to control that [to be] more specified to the original products. They created Tmall.hk; that probably is the right direction to take. We’re still struggling in that decision—whether we go directly [on] our own or go in groups as a Korean product, but definitely [plan on] online business while showing our identity as a luxury brand.

Are most of your Chinese customers actually buying in China or do you get more business from the Chinese tourist market?#

At the moment we’re getting quite a big profit out of the Chinese tourist market in Korea. We’re not known in China yet, but Chinese come over and they find us as a top brand. They go to department stores and they see that we are displayed as the top-level product, and they instantly recognize the quality product and designs. We have many Chinese tourist customers in Korea. That’s why we have built our confidence that we can do well in China as well.

What are the most common characteristics of your typical Chinese customers?#

[Out of] those who come to Korea, there are two levels of typical Chinese tourists. Some tourists do not have much money, but they want to experience Korea. But some Chinese tourists do not seem to care too much about the price. When they like, they like. We have much experience with the Middle Eastern customers, and we find China [is similar]—the rich are rich. They do not mind about the pricing. They like uncommon products; they like unique products; they like to have a product that not everybody can get. I don't know if it’s all Chinese consumers, but the consumers who tend to like our product come and they do not even ask the price.

This interview was edited and condensed.