What happened

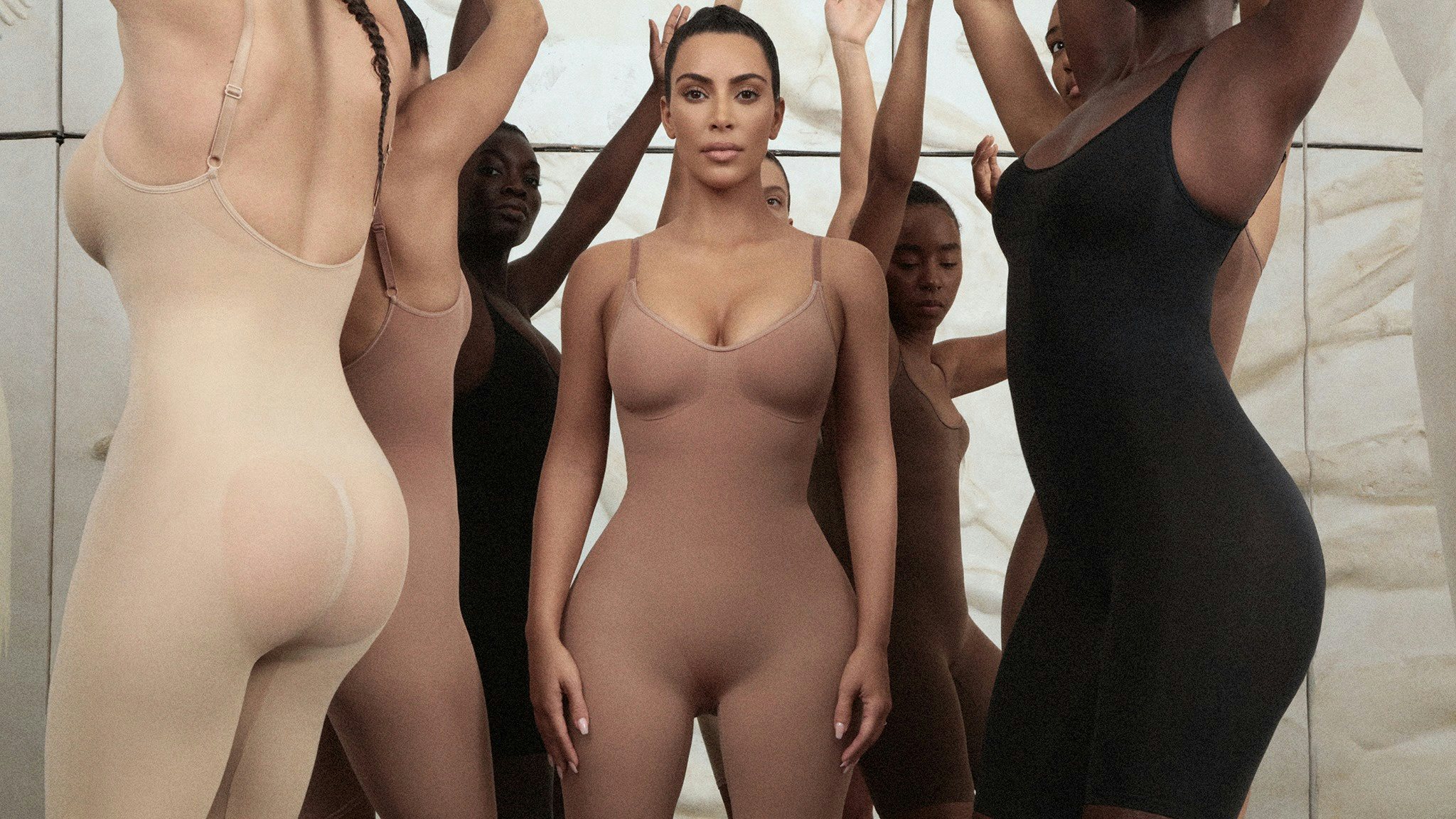

Internet mogul Kim Kardashian just revealed big ambitions for her shapewear brand, SKIMS, to her 266 million Instagram followers — to go global. And her first stop is China, with two stores opening in Shanghai and Hong Kong through the department store Lane Crawford. At these sites, she will sell over 100 assorted products personally curated by the entrepreneur herself.

SKIMS currently has a value of $1.6 billion. And thanks to the brand’s success, Kim Kardashian has entered into the exclusive billionaire club, following the footsteps of her younger sister Kylie Jenner. But will her expansion into the Chinese market eventually grow the billionaire entrepreneur's empire?

The Jing Take

Sales of Kardashian's capsule collection collaboration with the Italian luxury house Fendi seem promising thus far. And according to Fashion Business News, the collaboration products, priced between $150 to $350, immediately sold out on a WeChat Mini Program. Given Fendi’s popularity in the local market, the partnership has helped the celebrity brand, raising its awareness among Chinese consumers and positioning it in a more luxury sphere.

But can the underwear label still attract local shoppers without Fendi’s aura? Kim Kardashian’s combined following on domestic social platforms (Weibo, Xiaohongshu) only stands at 2 percent of her Instagram following — a drastically reduced influence.

Therefore, to guarantee exposure in China, the entrepreneur may have to run up huge marketing costs by paying for more influential local celebrities and KOLs to promote products. Additionally, SKIMS’ 12 shapes of nude color underwear may be less relevant in China. So the brand might need to find a more unique selling point in order to take market shares away from established underwear brands like NEIWAI, Ubras, Uniqlo, and Victoria's Secret.

With these potential challenges, it will be interesting to see if Kardashian can adapt her strategies to fit local needs. If so, her chances of harvesting Chinese consumer pockets will increase. But if not, she might become one in the long lists of names to withdraw from China.

The Jing Take reports on a piece of the leading news and presents our editorial team’s analysis of the key implications for the luxury industry. In the recurring column, we analyze everything from product drops and mergers to heated debate sprouting on Chinese social media.