From e-commerce to luxury fashion, no sector was safe from the effects of COVID-19. Grappling with ongoing store closures, travel restrictions, and weakening consumer sentiment, global and foreign companies alike reported blows to their bottom lines in August. Which players buckled under the macroeconomic pressures, and which managed to pull ahead of their counterparts?

JD.com#

The Chinese e-commerce giant saw revenue climb 5.4 percent to 40 billion (267.6 billion RMB) in the three months ended June 30. Despite being the slowest year-on-year revenue growth on record for JD.com, this put it ahead of tech rivals Alibaba and Tencent, which posted flat and falling revenue for the first time, respectively.

Generating 36 billion (241 billion RMB), the retail segment drove most of JD.com’s sales thanks to two major commercial events in the second quarter: 520 Valentine’s Day and the 618 Shopping Festival. The platform’s fashion and lifestyle business known as “The J Shop” welcomed double last year’s number of participating merchants for 618 while launching flagship stores for several luxury brands, including Celine, Maison Margiela, and Moose Knuckles. Hitting another milestone, JD Plus, the premium membership program of JD.com, exceeded 30 million registered members in July — pointing to an active consumer base and the resilience of domestic e-commerce.

Backed by a reliable supply chain infrastructure, the Beijing-based e-tailer was “one of the few companies that could still work around challenges and support fulfillment services that many customers and merchants critically needed in an uncertain time,” said CFO Sandy Xu in an earnings call. Going forward, JD.com plans to further develop its supply chain capabilities to improve gross margin and the efficiency of the wider retail industry.

Anta Sports#

“What does not beat you makes you stronger,” wrote chairman Ding Shizhong in the latest interim report. Despite struggling with store closures in first and second-tier cities, Anta posted a record-high revenue of 3.75 billion (26 billion RMB), up 13.8 percent in the six months ended June 30. Anta even outsold Nike for the first time, with the latter generating 3.7 billion (25.7 billion RMB) during the same period.

Anta enjoyed a publicity boost from the Beijing 2022 Olympics and solidified its professional brand image by partnering with elite athletes like Eileen Gu, Wu Dajing, and Zhang Jike. The sportswear giant also benefited from Klay Thompson’s NBA championship win, driving sales of its basketball shoes, as well as its “Shock the Game” basketball tournament which landed in nearly 80 cities in China. While Anta focused on bringing Olympic-level technology to consumer products, Fila was all about creating fashion for the high-end market, releasing crossovers with Y/Project and Maison Mihara Yasuhiro.

Thanks to supportive government policies, Anta remains optimistic about China's sportswear industry. Plus, the recent interest in niche sports like skateboarding and frisbee has given it plenty of room to play and grow.

Capri Holdings#

For the first quarter of fiscal 2023, Capri recorded better-than-anticipated results across all three of its luxury houses — Jimmy Choo, Versace, and Michael Kors — with revenue up 8.5 percent to 1.36 billion (9.4 billion RMB) year-on-year. However, net income fell to 201 million compared to 219 million as revenue in China plummeted mid-30 percent and cut into profits.

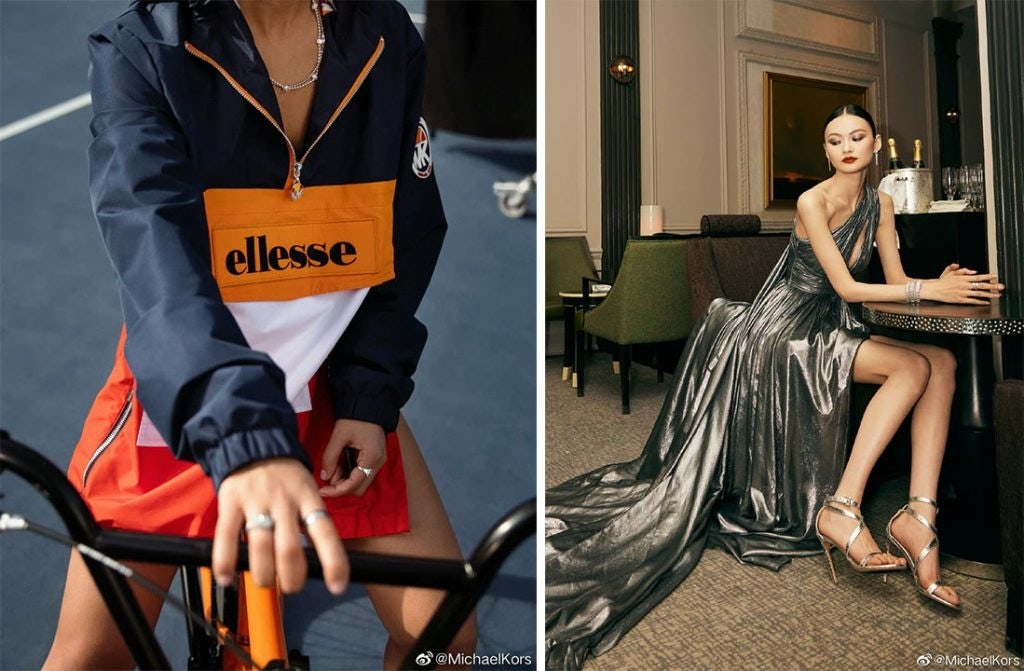

Amid these difficulties, the global luxury line continued to drive consumer engagement in the mainland. In May, Michael Kors launched pop-up installations in Wuhan and Shenzhen to celebrate its retro, sporty collaboration with Italian sportswear label Ellesse. The American apparel maker also wowed global audiences by dressing an extensive cast of celebrities for the Met Gala, including Chinese supermodel He Cong. In the period ended July 2, Michael Kors generated the most revenue (913 million or 6.3 billion RMB) of the three houses.

Still, Capri expects gross margin to be flat for fiscal 2023 as uncertainties abound in the country. Long term, the group has “tremendous faith and confidence” in its growth in the market, noting that “all three of our brands are significantly underdeveloped compared to our competitors.”