Key Takeaways:#

- China's designer toy collectibles market is expected to be worth $8.8 billion by 2023.

- Driven by the popularity of "blind boxes” that keep contents hidden until after purchase, market leader Pop Mart has seen revenue swell over the past half-decade.

- However, there are signs that the company is experiencing growing pains, with slowing revenue growth and share prices sliding over the past six months.

China’s collectibles market has exploded over the past decade, driven by millennial and Gen Z demand for limited-edition toys. According to Research and Markets, the current $5.9 billion market for designer toy collectibles is projected to reach $8.8 billion by 2023.

As noted in Jing Daily’s latest market report,

Chinese Cultural Consumers: The Future of Luxury#

, the collectible toy trend took off in large part thanks to Pop Mart after it introduced its series of "blind box" Molly dolls in 2016. The popularity of blind boxes — limited-edition toys packaged to keep the contents a surprise until opened — has been instrumental in the growth of the collectible toy sector and led to a flourishing market for resale and trade.

Driven by multiple influential trends — the “meng” (cute) wave, nostalgia, and millennial/Gen Z burnout, among others — China’s blind box market is expected to double in size by 2024 to $4.6 billion, according to the Mob Research Institute’s 2020 Blind Box Economic Insight Report. But perhaps the defining driver in the market is the emergence and evolution of the Chinese Cultural Consumer (CCC). Since 2019, China’s per capita gross domestic product has passed the $10,000 mark, a milestone figure that paves the way for more consumption as a leisure activity, rather than just to satisfy basic needs. And now, young and increasingly sophisticated Chinese consumers have more disposable income to spend on items such as collectible toys, many of which derive from beloved IP from popular ACG (Anime, Comics, and Games) content.

Beijing-based Pop Mart has emerged as the market leader for collectible and blind box toys, and its rise fueled HK$5 billion ($643 million) IPO in Hong Kong in December 2020. According to Pop Mart, many buyers will make repeated purchases of blind boxes to try to obtain the rarest and most desired figurines (the repurchase rate can be as high as 58 percent). Opening the box to discover what’s inside offers an experience that can be shared via social media, creating valuable organic traffic for the brand. Whatever the motivation, the attraction of blind boxes is clearly real. Data from Tmall indicates that there are nearly 200,000 consumers who spend over RMB 20,000 ($3,087) per year on blind boxes, with some top spenders shelling out millions. And the opportunity is not limited to China, as Pop Mart kicked off an international retail expansion in Southeast Asia earlier this year.

For the luxury business, this represents a market segment that is increasingly difficult to ignore. For Qixi (Chinese Valentine’s Day) last August, Chinese-owned French luxury house Lanvin launched a blind box lottery via a WeChat Mini Program. For a fee of RMB 500 ($77), participants could join a drawing, with winners redeeming their prizes (Lanvin blind boxes) at offline vending machines and receiving vouchers for silk scarves, sneakers, and even handbags. This initiative proved a hit, attracting 50,000 players within a month, or five times the daily average reading volume of Lanvin’s WeChat articles.

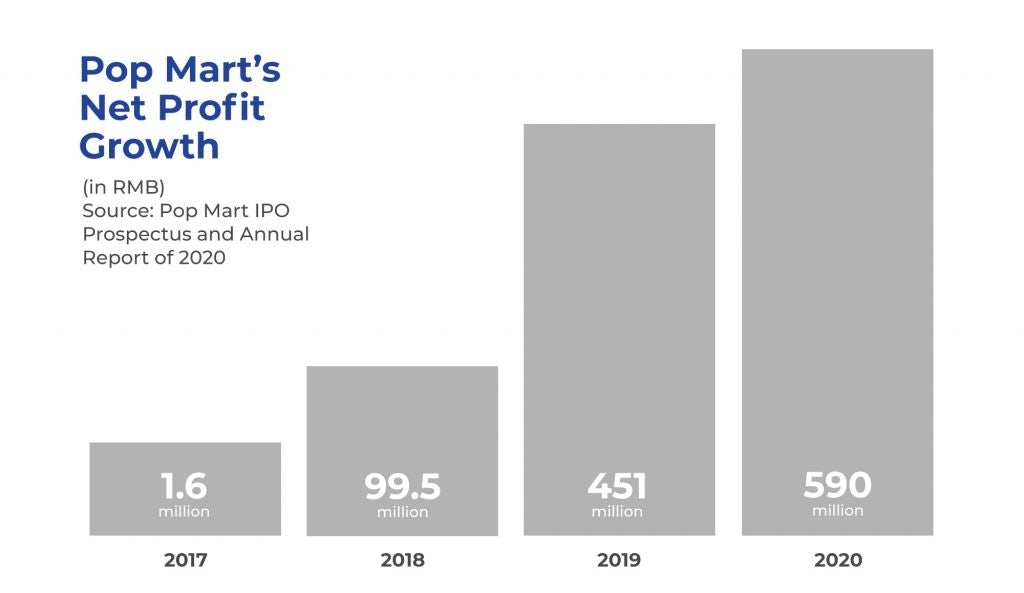

Despite how deeply entrenched blind boxes and collectible toys have become, there are also indications that the gravy train could be slowing for Pop Mart. The company’s most recent earnings report showed that 2020 revenue increased by about 50 percent year-on-year, which, although significant, is a drastic slowdown from the 200 percent growth the company saw in 2018 and 2019. Meanwhile, after a strong showing in the first quarter of 2021, the price of Pop Mart shares has fallen by nearly 50 percent over the past six months, from a high of HK$105 ($13.49) on February 17 to HK$54.70 ($7.03) as of August 16.

While research reports by CITIC Securities and Goldman Sachs have expressed optimism about the company, a survey by iiMedia Consulting found that 30 percent of respondents said the blind box trend is essentially maxed out and that the products themselves are impractical. This is reflected by a large number of collectors reselling their toys on Alibaba's resale platform Idle Fish (Xianyu) at low prices, with one industry insider telling Sina that "only IP with more emotional resonance will promote longer-lasting purchasing behavior."

Download our new report "Chinese Cultural Consumers: The Future of Luxury" on our Reports page

The subtext there is that the novelty of — and dopamine hit from — run-of-the-mill blind boxes is fading quickly, so the pressure is on for Pop Mart and others to launch higher-end or more in-demand products. In addition, Pop Mart must now contend with the pressure and greater scrutiny that comes with being a public company. Last year, Pop Mart was hit by accusations of plagiarism when it was noted that its AYLA animal collection bore a striking resemblance to a well-known 2017 series by DollChateau.

Consumer concerns about Pop Mart’s product quality and after-sales service abound on Sina’s Black Cat Complaint platform, with more than 4,000 reviews decrying everything from product defects to difficulties in returning or exchanging products. Another concern is that Pop Mart may have become overly reliant on its Molly IP, which, unlike evergreen global IP like Harry Potter or Pokémon, is not anchored in popular film or television content.

But perhaps most threatening to Pop Mart is its lack of significant competitive advantage and a surge of investment in toy startups in China. According to Sina Finance, China now boasts more than 800 collectible toy companies, among them ToyCity, which completed a nearly RMB 100 million ($15.4 million) A+ round of financing earlier this month, and 52Toys, which had two rounds of financing worth RMB 100 million in 2018 and "tens of millions of RMB" in 2019. Then there is even stiffer competition from the likes of Guangzhou-based Miniso and Hong Kong’s kkplus, both of which are well-capitalized and able to leverage big-name global IP via licensing deals.

The question now, and one that has major implications for luxury brands considering investing in the space, is whether Pop Mart’s slowing growth is a blip (caused or hastened by the COVID-19 pandemic), the natural result of rising competition, or a sign of “collectible fatigue” among Chinese Cultural Consumers who have simply purchased all the collectibles they need for the moment. If it is indeed the latter, any investment in the blind box trend needs to create that emotional resonance needed to foster long-term affinity and sales.

Purchase Chinese Cultural Consumers: The Future of Luxury HERE.