The eyes of Silicon Valley were firmly fixed on Mary Meeker yesterday, as the prolific figure gave her latest report on emerging internet trends. Meeker is a former Morgan Stanley internet analyst, now a partner at venture-capital fund Kleiner Perkins Caufield & Byers, and has led successful investment on high-growth internet companies such as JD. com, Facebook and Airbnb. Each spring Meeker publishes a report of over 200 pages, detailing the internet trends that will carve the direction for hundreds of tech investors.

By tracing back to trends that first emerged in 2013, this year’s report highlighted China’s jaw-dropping speed of digital development in comparison to other countries. China is quickly becoming the global center for many of the world’s biggest internet companies, having gone from owning two high-market-value public tech companies in 2013, to nine in 2018. Innovation at these internet companies has dramatically altered consumer behaviors, and company strategies in relation to China.

The China portion of the report is compiled by investment management firm Hillhouse Capital Group. Jing Daily has selected the top five takeaways most relevant to luxury brands. Here we explain how they can help to shape the digital strategies of brands in China.

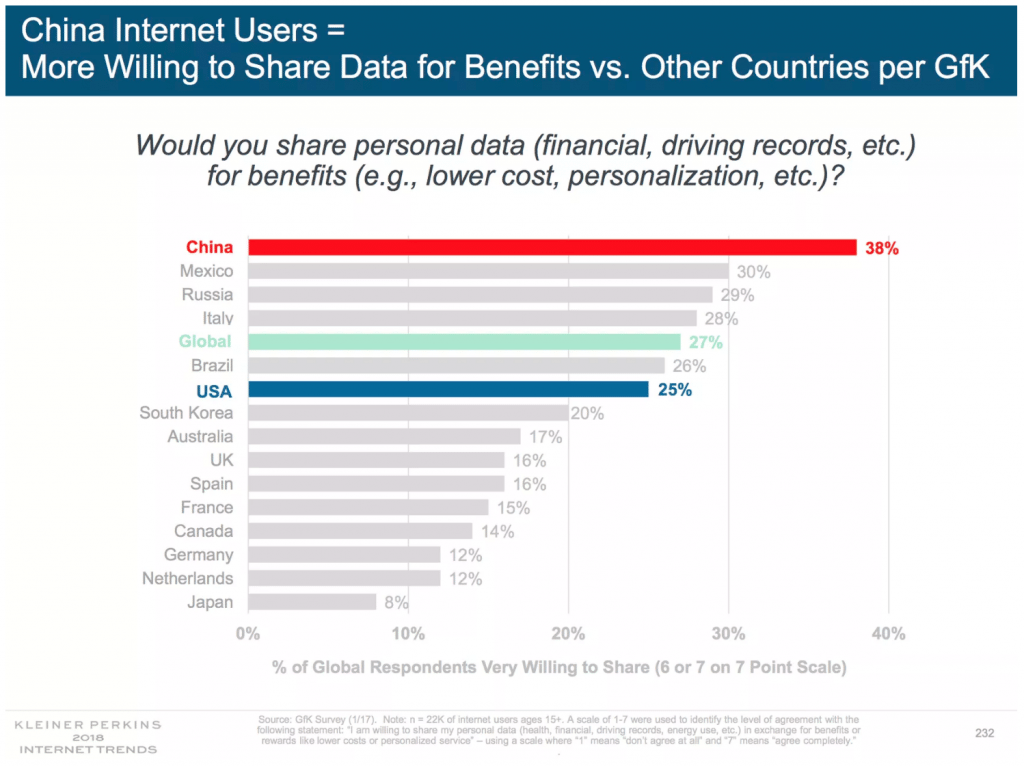

1. Chinese Less Sensitive About Internet Security#

Mary Meeker highlighted that personalization can unlock the full potential of data in order to improve user experiences and drive growth. But, as Facebook remains under strict scrutiny after the data firm Cambridge Analytica gained access to the private information of 50 million users, the general public has become increasingly aware of their online privacy. This has called into question just how much personal data consumers are willing to give away, in exchange for a better service. The report shows that 38 percent of internet users in China are willing to share personal data in exchange for benefits such as lower costs and personalization. In comparison, only 25 percent of US users feel the same. For luxury brands, this personal touch can aid in finding the balance between a standard and premium service. Meeker's findings suggest China remains the land of opportunity for brands to experiment with personalization.

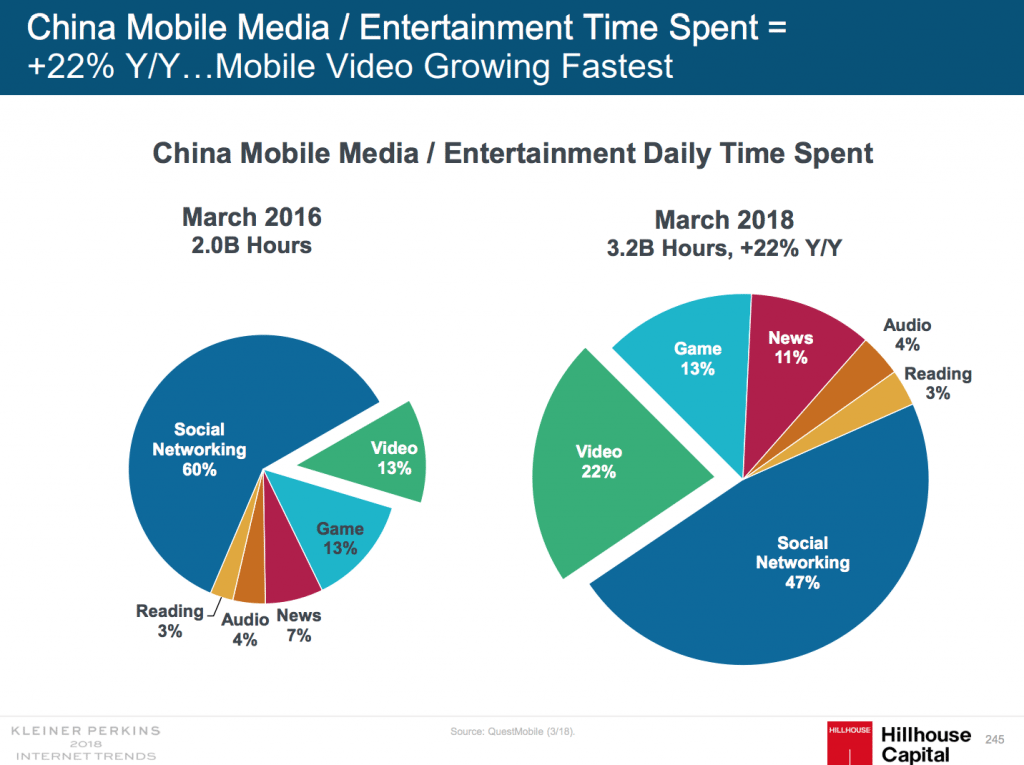

2. Chinese Internet Users Sucked in by Videos#

In today’s attention economy, it’s important to know where users spend most of their time so that brands can distribute advertising budgets accordingly. Meeker's report shows that in 2018, 47 percent of China's mobile media or entertainment time is spent on social networking, followed by 22 percent on video. Although social networks are still dominating users' online time, in 2016 only 13 percent of users spent time watching videos, demonstrating an obvious shift. On mobile devices, user spend on average 52 minutes a day on short video platforms such as Douyin and Kuaishou.

Michael Kors was the first luxury brand to work with Douyin, and the platform has proved its worth attracting new luxury consumers. 85 percent of users on Douyin are millennials under 24 years old, with the majority hailing from first-tier and second-tier cities. Douyin also allows influencers to include shopping links to e-commerce sites Taobao and Tmall, enabling brands to monetize on users’ time.

3. Mobile Payment Booms by Over 200 Percent#

According to the report, mobile continues to be the place where Chinese consumers live, breathe and shop - with mobile accounting for 73 percent of the e-commerce industry's gross merchandise value. China’s mobile payment market saw a 209 percent growth in the last year, reaching almost 16 trillion dollars in payment volume. WeChat Pay and Alipay collectively hold 92 percent of the mobile payment share in China. Luxury retailers continue to learn to implement mobile payment systems online and in store, as vendors battle to boost and sustain sales by Chinese customers.

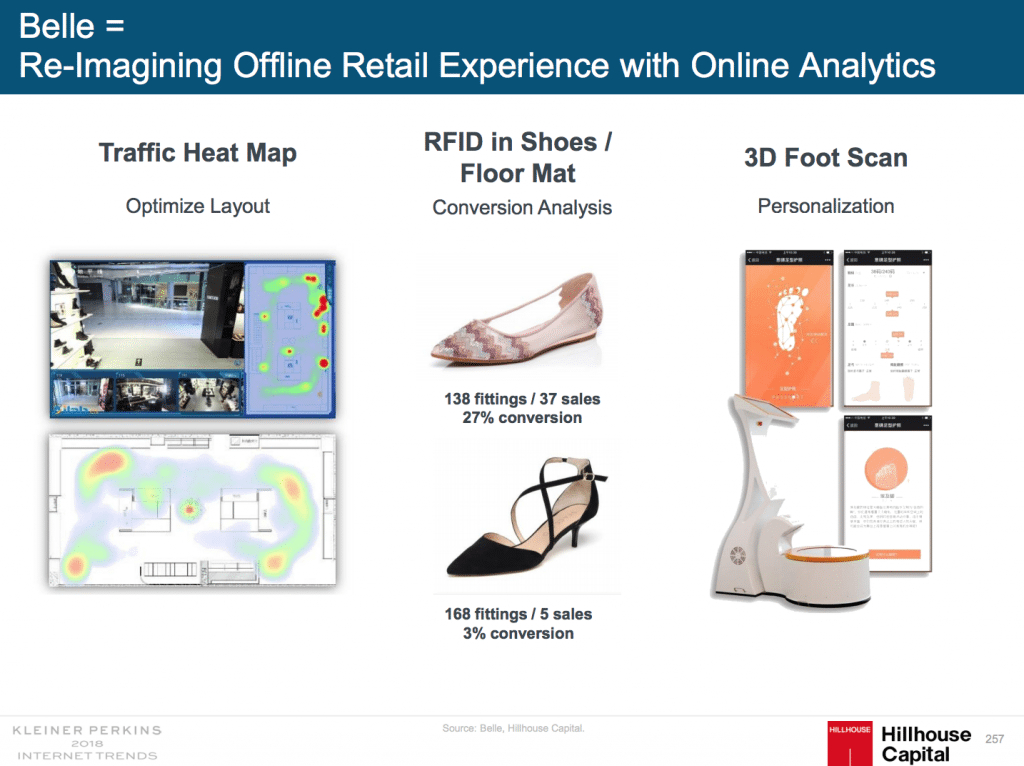

4. China Leads Innovation Building Omni-channel Stores#

In China, e-commerce accounts for 20 percent of retail sales, and is the highest and fastest growing sector in the world - followed by South Korea and Britain. Meeker gave examples of how the line between traditional offline and online has become blurred, and how China is leading the way in building omnichannel stores.

For instance, Alibaba’s interactive grocery store Hema recently showcased a new retail strategy. Having both an online and offline presence, its sales method involves online purchasers placing an order online and picking it up from the store. Another shoe store, Bell, has attempted to empower its own traditional stores with the use of technology. Bell places sensors on the floor and RFID chips in its shoes, so that they are able to gather a heatmap of store traffic and data, including the percentage of shoppers trying on shoes vs. purchasing. Although as of yet there is no specific data on whether this technology has had an impact on sales, luxury brands should be aware of investment on in-store technology, in addition to how this data can empower human services.

5. Chinese Consumers are Now Shopping at Home#

In 2018, 62 percent of China's GDP growth was from domestic consumption, a number nearly doubled from 35 percent back in 2003. Being technologically advanced has fueled consumers at-home spending, and China's consumer confidence index has seen a boost in positivity since 2017. As local spending continues to strengthen, consumers look for brands representing Chinese heritage, leading many local luxury designers to pose as a threat to traditional western brands.