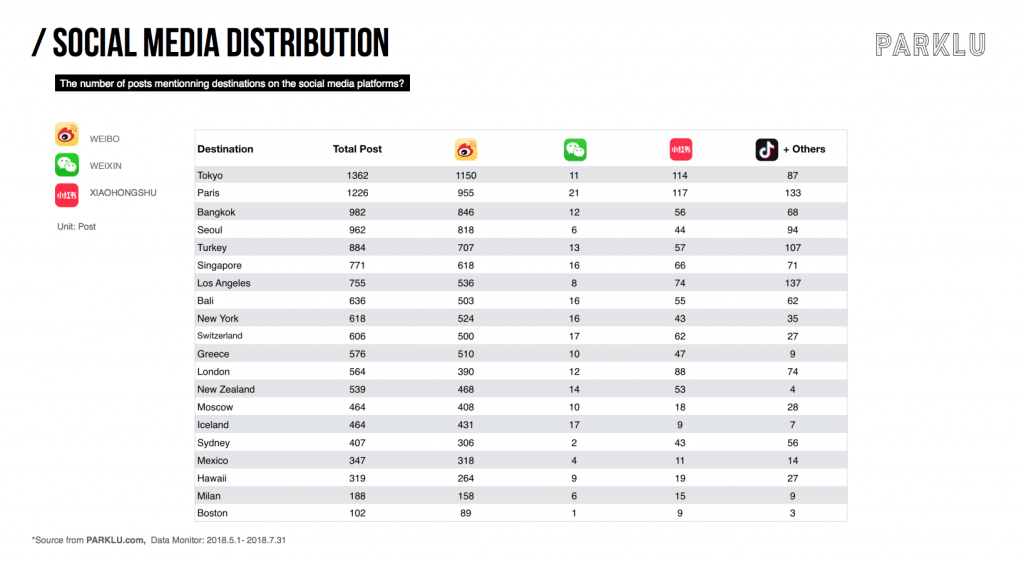

Chinese outbound travelers usually look for destinations that are WeChat-worthy to impress friends, but according to the latest travel influencer marketing report from key opinion leader (KOL) agency ParkLu, that’s changing. Based on social media content distribution from May 1, 2018 to July 31, 2018, covering more than 30,000 influencers, KOLs are favoring Weibo, followed by smaller rivals Little Red Book and Douyin, with WeChat lagging far behind.

Why? While WeChat is a global giant, travelers appeal to be opting for the bells and whistles of its social-media competitors. And with the busy seven-day Golden Week holiday roughly a month away, destinations, travel partners and luxury retailers may have to adjust their influencer strategies accordingly.

Tokyo, Paris and Los Angeles are the top destinations this summer so far, with the generated media value from the KOLs totaling 19.8 million, 13.5 million and 13.27 million (RMB 135.4 million, RMB 92.4 million and RMB 90.8 million) respectively. Based on the number of posts mentioning those destinations, Weibo dominated most conversations, followed by Little Red Book and Douyin, with WeChat ranked at the bottom. According to ParkLu's data, the top five influencers' follower numbers on WeChat are significantly less than those on the other social media, demonstrating a shift in the type of social media platforms used by influencers.

The private nature of WeChat is a double-edged sword. It ensures privacy as all posts from travelers can only be seen by their selected WeChat friends, and search results on WeChat are personally influential as they can be weighted based on friends. But the reach is limited compared to Weibo's public posting option. For travel influencers, the benefit of posting on Weibo is apparent – they can gain greater exposure. For example, a top performing post by a KOL named 呼吸像少年一样的猫 reached 360,000 people and gained 6,000 engagements. In the post, she illustrated in detail how to use OPPO's phone to document her trip through Turkey, Japan and Xiamen. In contrast, a top-performing travel post on WeChat reached a little over 100,000 users.

Little Red Book and Douyin beat WeChat for their highly-visual and searchable user-generated content. For example, Little Red Book, born as a mix of Instagram and Yelp, started as a tool for consumers to access overseas products through first-hand pictures, recommendations and reviews; it now has more outbound travel destination recommendations – a natural progression from its pure luxury product content. While users rely on Little Red Book for trusted content, Douyin is a space to show off creativity. The short-video app allows users to put their own spin on the destination they've visited by creating 15-second music videos. The content appears much more attractive than a picture on WeChat Moments.

In terms of location, the top searched destinations on Baidu are Iceland, Bali and Singapore, while Singapore, Bali and Paris rank at the top on WeChat search. Bali is the biggest winner – there's a lot of organic content from KOLs promoting this destination – as it went viral across social media with Little Red Book and Douyin picking up on the trend and pushing related user-generated content.

Another interesting observation is that despite the huge fan base of top-tier KOLs, the mentions of destinations are mostly contributed by micro influencers. So, instead of spending a large budget on the top influencers, brands can consider incentivizing smaller KOLs in their social media strategy. Besides working with KOLs, they can also consider partnering with online travel and house-booking agencies for relevant promotions; the top mentioned this summer are Mafengwo, Ctrip and Airbnb.