The following is an excerpt from the recent Wunderman Thompson Intelligence + Jing Daily report,

Transcendent Retail: APAC | Lessons From China’s Trend-Setting Commerce Market#

, available for download on our Reports page.

Among other things, 2020 will go down as the year that Chinese brands finally made it on the world stage. Surprisingly, it was neither an Alibaba e-commerce platform nor a Tencent-owned social app that gained traction overseas, but two younger upstarts that managed to win the respective attention and wallets of global Gen Z: TikTok and the ultrafast-fashion brand Shein.

TikTok Takes Over the World#

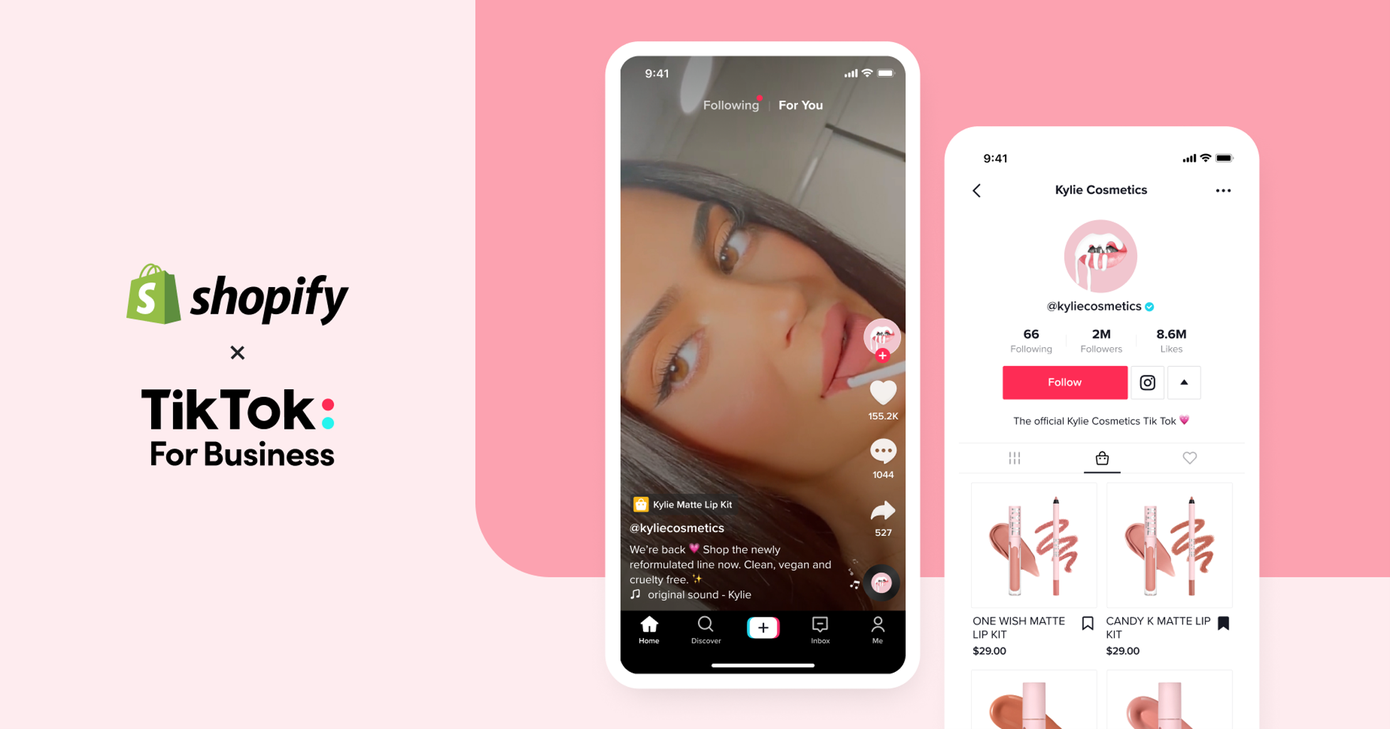

As short-video platform TikTok dangles the promise of e-commerce -- announcing an expanded partnership with Shopify and a pilot test of TikTok Shopping in August 2021 -- its Chinese sibling Douyin is already offering it. Over the course of 2020, the short-video platform TikTok became one of the world’s most popular apps, peaking with 112 million global downloads in May 2020. Its parent, Beijing-based tech giant Bytedance, operates a counterpart in mainland China called Douyin, which hints at the future of global e-commerce fueled by content.

A relative latecomer to e-commerce in China, Bytedance, through Douyin, is taking on established players such as Alibaba and JD.com. In late 2020, it barred links to third-party e-commerce platforms from livestreams hosted on Douyin, directing users to Douyin online stores instead. In March 2021, Douyin introduced flagship stores for brands with official accounts on the platform and began building centers for logistics and product quality inspection around China, as well as cross-border warehousing for goods imported from Southeast Asia and the United Kingdom. To top it all, the platform also introduced its own digital payment system, Douyin Pay, in early 2021.

Douyin’s e-commerce business has grown rapidly over the past year, achieving a reported gross merchandise value of RMB 500 billion ($76 billion) in 2020, but it has a long way to go before it approaches the levels of Alibaba (RMB 7 trillion in 2020), JD.com (RMB 2.6 trillion), and Pinduoduo (RMB 1.7 trillion), and its conversion rate reportedly lags that of the established players.

Douyin has been publicly downplaying the importance of e-commerce sales numbers, emphasizing its ability to offer a high-quality experience for both buyers and sellers, and its ultimate bet is that it can leverage the power of its 600 million-plus daily active users and the content they create and consume into a compelling driver for a new form of e-commerce.

To that end, Douyin’s head of e-commerce, Kang Zeyu, recently outlined a vision of “interest-based e-commerce,” which he described as “helping people to discover their potential needs.” This would presumably use Bytedance’s AI prowess to satisfy users’ desires to upgrade their lives and tap into their shopping preferences via an understanding of their video consumption habits.

Shein and the Race to Rule Ultra-Fast Fashion#

Chinese designers have been making waves in the world’s fashion capitals. Angel Chen starred in Netflix’s Next in Fashion competition last year and collaborated with Adidas and H&M. The 2021 Spring/Summer Paris Fashion Week featured collections from Masha Ma, Uma Wang and Sandriver, whose founder, Guo Xiuling, supplied wool to international luxury brands such as Hermès.

But despite these inroads into high-end fashion, the biggest Chinese fashion brand today comes the other end of the spectrum — ultra-fast fashion. Most Gen Zers active on social media are familiar with Chinese fast-fashion brand Shein, which has leveraged China’s manufacturing supply chain to release hundreds of new ultra-cheap clothing products a day, all for distribution on a global scale.

Founded around 2008 by entrepreneur Xu Yangtian (also known as Chris Xu) in Nanjing as Sheinside.com, the somewhat secretive company initially specialized in

selling inexpensive wedding dresses, and only pivoted to broader retail in 2015. Since then, it has been on a path to internet virality via global social media. As a DTC retailer of apparel, home goods, pet supplies, and just about everything else, Shein has doubled its sales for eight consecutive years. Recent reports have valued the company at $30 billion, placing it in ranks that include H&M ($38 billion) and Zara ($21 billion).

Shein’s success is not premised on low prices alone. The brand relies largely on social media marketing, inviting fans around the world to join its affiliate program, through which up-and-coming influencers can receive commissions for promoting the brand with posts of their outfits. As a result, Shein’s Instagram accounts include content from paid partnerships with mega-influencers like American TikToker Addison Rae (38.4 million followers as of June 2021) alongside reposts from lesser-known creators with follower numbers in the 2,000 to 50,000 range.

The brand’s defining strength is a social media presence based on user-generated content. The label is perhaps best known for appearing in thousands of review videos or “clothing hauls”—in which creators model recent purchases and share their opinions—across TikTok and YouTube. Of the 10 most-watched Shein try-on videos on YouTube, only two were sponsored by the brand.

Now the race is on to find the next Shein, with venture capital funds targeting investments at potential Chinese contenders such as Cider, which recently secured $22 million from Andreessen Horowitz and DST Global. However, Shein’s ability to churn out endless versions of cheap clothing every day is not without its downsides, chief among them the environmental costs associated with low-cost manufacturing and clothing meant to be cast aside almost as quickly as it can be made.